Weekly Market Roundup

MG News | April 03, 2022 at 05:33 PM GMT+05:00

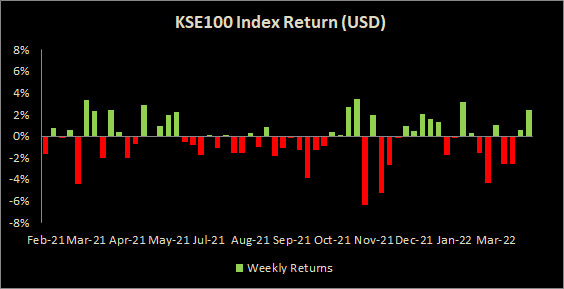

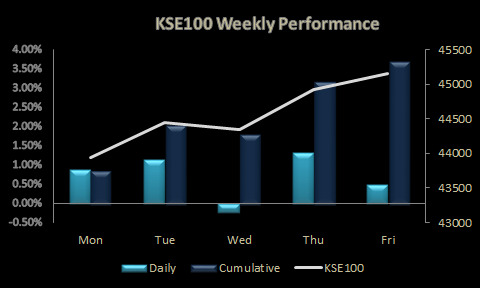

April 3, 2022 (MLN): Recovery momentum in the previous week continued into this week as the equity market gained 3.7% or 1,600 points, WoW, to settle at the 45,152 points level. This was the highest weekly return since July 31, 2020.

The market witnessed an eventful week as both, the incumbent government and the opposition tried to gather allies amid a vote of no-confidence motion against PM Khan in the National Assembly.

“We believe the market has largely digested the aforementioned which, coupled with the decline in international oil and coal prices (which garnered interest in the cement sector) brought back the bulls, as concerns over inflation have ceded,” a closing note by Arif Habib Limited said.

Although some shuffling in support by minority parties in the mid-week added pressure, it added.

During the week, the bourse witnessed 4 sessions in favour of bull while 1 session ended in the favor of bear. Participation also improved during the week, with average volumes at 310.1mn shares – the highest in 11W.

Sector-wise positive contributions came from Cement (266pts), Commercial Banks (241pts), Technology & Communication (182pts), Fertilizer (152pts), and Power Generation and Distribution (111pts). Whereas, sectors which contributed negatively were Leather & Tanneries (9pts) and Leasing Companies (1pts).

Scrip-wise positive contributors were SYS (129pts), LUCK (129pts), MTL (69pts), HUBC (68pts) and ENGRO (57pts). Meanwhile, scrip-wise negative contribution came from COLG (16pts), SRVI (9pts) and

EFERT (6pts).

Meanwhile, the KSE All Share market cap increased by Rs241.5 billion or 3.28% over the week, being recorded at Rs7.6 trillion as compared to a market cap of Rs7.3tr recorded last week.

Flow-wise, foreigners were the net sellers during the week, offloading stocks worth $15.5mn compared to a net sale of $4.1mn last week, largely backed by foreign corporations amounting to $15.37mn. Sector-wise, major selling was witnessed in Banks ($15.7mn) and Fertilizers ($0.6mn).

On the local side, the majority of the buying was reported by Banks, Individuals and Organizations amounting to $15.7mn, $7.5mn, and $1.4mn, respectively. However, Mutual Funds and Insurance Companies stood on the other side with net selling of $5.2mn and $2.2mn respectively.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 139,984.68 132.66M | 1.14% 1572.43 |

| ALLSHR | 86,701.50 271.51M | 1.17% 998.54 |

| KSE30 | 42,786.80 71.96M | 1.26% 531.96 |

| KMI30 | 197,375.38 75.87M | 1.68% 3265.78 |

| KMIALLSHR | 57,564.14 138.34M | 1.50% 850.47 |

| BKTi | 38,154.89 8.58M | 0.86% 323.56 |

| OGTi | 28,451.56 33.46M | 3.68% 1010.93 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 119,675.00 | 119,785.00 117,905.00 | 2055.00 1.75% |

| BRENT CRUDE | 72.39 | 72.82 72.16 | -0.85 -1.16% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 70.02 | 70.41 69.80 | 0.02 0.03% |

| SUGAR #11 WORLD | 16.46 | 16.58 16.37 | -0.13 -0.78% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Consumer Confidence Survey

Consumer Confidence Survey