VIS reaffirms CGR of Pak Kuwait Investment at CGR-9 on sound financial transparency

MG News | January 15, 2020 at 04:47 PM GMT+05:00

January 15, 2020: VIS Credit Rating Co. Ltd. has reaffirmed the Corporate Governance Rating of Pakistan Kuwait Investment Company (Private) Limited (PKIC) at ‘CGR-9’. The rating signifies a very high level of corporate governance. The previous rating action was announced on January 25, 2019.

Corporate governance ratings are based on evaluation of key governance areas of the rated institution including regulatory compliance; ownership structure; composition and operations of the Board of directors (BoD) and executive management; self-regulation; financial transparency and relationship with stakeholders.

PKIC has been established under a joint venture arrangement between the Government of Pakistan (GoP) and the Government of Kuwait (GoK). Given the joint venture structure, PKIC is exempted from provisions of the Code of Corporate Governance applicable on DFIs, in accordance with the circular issued by the regulator. Nonetheless, the company has taken measures to adhere to governance best practices and protect the interests of various stakeholders.

The assigned rating incorporates the sound governance structure of PKIC supplemented by strong financial transparency and effectively functioning board and management level committees. Frequency of board and committee meetings, high attendance record and comprehensive discussion on various aspects of the company during the meetings demonstrates a high level of engagement of Board members.

Overall control environment of the institution is considered strong. All information related to the company is disseminated in electronic form through the official website in addition to periodic financial statements. Disclosures available in the public are adequate and made in a timely manner.

During 2019, changes were witnessed at senior management level which included new appointments including the position of Managing Director. Stability in the management team is considered essential from a rating perspective. The company has a well-defined organizational structure with each functional area overseen by a separate qualified and experienced senior resource. Internal controls and compliance framework are also considered sound. The company is focusing on improving its IT infrastructure; developments of the same are expected to materialize over time.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 135,939.87 307.74M |

-0.41% -562.67 |

| ALLSHR | 84,600.38 877.08M |

-0.56% -479.52 |

| KSE30 | 41,373.68 101.15M |

-0.43% -178.94 |

| KMI30 | 191,069.98 82.45M |

-1.17% -2260.79 |

| KMIALLSHR | 55,738.07 422.01M |

-1.03% -577.24 |

| BKTi | 38,489.75 45.79M |

-0.02% -8.33 |

| OGTi | 27,788.15 6.87M |

-1.24% -350.24 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 116,950.00 | 120,695.00 116,090.00 |

-3285.00 -2.73% |

| BRENT CRUDE | 68.81 | 69.41 68.60 |

-0.40 -0.58% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 96.50 96.50 |

0.50 0.52% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.25 |

-2.05 -1.92% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.68 | 67.13 66.22 |

-0.30 -0.45% |

| SUGAR #11 WORLD | 16.56 | 16.61 16.25 |

0.26 1.60% |

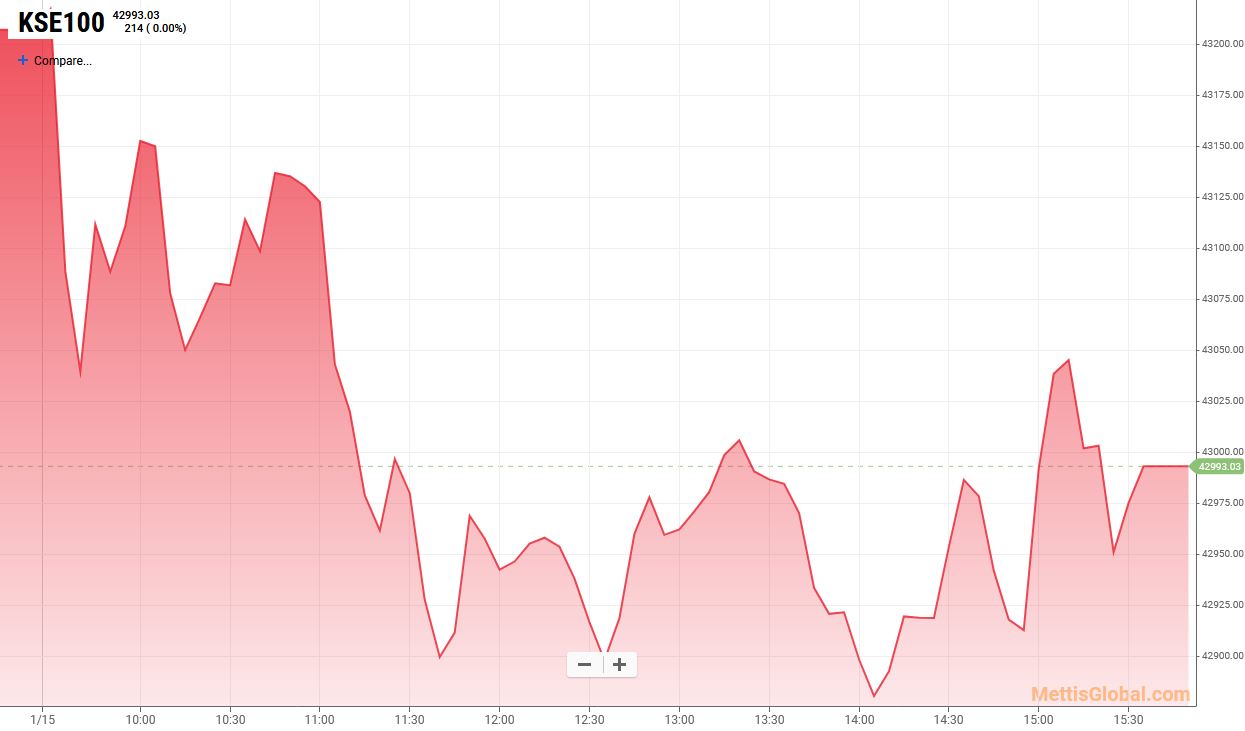

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|