US Fed opens final 2019 meeting; no rate move expected

By MG News | December 11, 2019 at 03:45 AM GMT+05:00

Dec 10, 2019: The Federal Reserve on Tuesday opened its final policy meeting of 2019, with markets overwhelmingly expecting the central bank to leave interest rates untouched.

After cutting rates three times in the summer and fall, policymakers have said they are now pausing to watch how the world's largest economy performs.

With robust job growth and steady consumer spending, central bankers believe the United States has proved "resilient" in the face of a slowing world economy and a trade war with China, both of which have helped send American manufacturing into decline.

The Fed is due to announce its latest decision, along with a new set of economic forecasts, at 1900 GMT on Wednesday, followed by a news conference by Fed Chairman Jerome Powell shortly afterward.

Job creation shot well past expectations last month, according to official data released Friday, wiping away fears that employers' demand for labor has begun to fade.

"This just leaves the Fed very comfortably on the sidelines for 2020, or at least as we enter the new year," Diane Swonk, chief economist at Grant Thornton, told AFP.

Futures markets as of Tuesday predict the Fed will be on hold until September of next year.

Consumer spending and confidence are strong. The housing market has picked up. Unemployment is still very low as hiring continues. GDP growth slowed in the third quarter but was still better than feared.

If Washington and Beijing manage to seal a partial trade deal and at least cease hostilities, an end to uncertainty could give businesses a sharp boost.

However, economists say the Fed could soon begin to feel pressure to resume cutting rates.

Even amid more positive data, dark spots in the economy have mostly persisted. Adjusted for inflation, consumer spending in October was the weakest since February.

Should GDP growth fall below two percent in the final quarter of this year and the first quarter of 2020, the Fed could be compelled to add stimulus to the economy, according to Rubeela Farooqi of High Frequency Economics.

"They might be forced to move by the end of the first quarter," she told

AFP/APP

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 125,627.31 258.99M |

1.00% 1248.25 |

| ALLSHR | 78,584.71 1,142.41M |

1.16% 904.89 |

| KSE30 | 38,153.79 69.25M |

0.63% 238.06 |

| KMI30 | 184,886.50 91.38M |

0.01% 13.72 |

| KMIALLSHR | 53,763.81 554.57M |

0.54% 290.61 |

| BKTi | 31,921.68 33.15M |

1.78% 557.94 |

| OGTi | 27,773.98 9.65M |

-0.40% -112.21 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,055.00 | 109,565.00 107,195.00 |

570.00 0.53% |

| BRENT CRUDE | 66.64 | 67.20 65.92 |

-0.16 -0.24% |

| RICHARDS BAY COAL MONTHLY | 97.00 | 97.00 97.00 |

1.05 1.09% |

| ROTTERDAM COAL MONTHLY | 107.65 | 107.65 105.85 |

1.25 1.17% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 64.97 | 65.82 64.50 |

-0.55 -0.84% |

| SUGAR #11 WORLD | 16.19 | 16.74 16.14 |

-0.52 -3.11% |

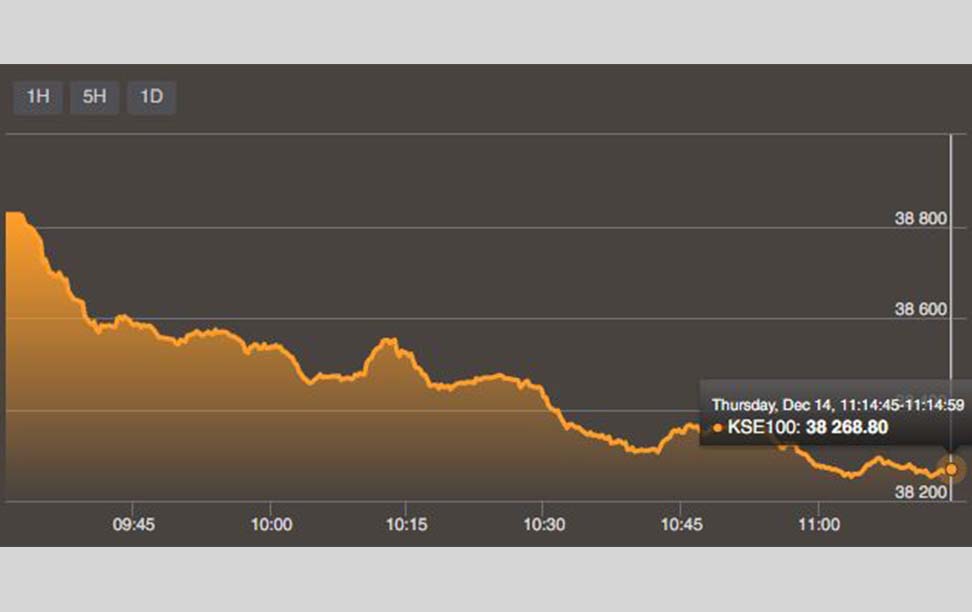

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.jpg)