U.S Fed increases holdings of Treasury securities

By MG News | September 27, 2019 at 04:41 PM GMT+05:00

September 27, 2019: Data from the U.S. Federal Reserve (Fed) showed on Thursday that the central bank has increased its holdings of U.S. Treasury securities.

For the week ending Sept. 25, the average daily figure of Fed holdings of U.S. Treasury securities rose by 5,315 million U.S. dollars to 2,107,405 million dollars.

The majority of U.S. Treasury securities that the Fed holds were longer term securities issued by the U.S. government like Treasury notes and Treasury bonds, which totaled 1,958,948 million dollars, according to the Fed.

The Fed purchased government-issued securities and other securities like mortgage-backed securities (MBS) from the market in order to boost the money supply and encourage lending and investment after the 2008 financial crisis.

Commonly known as "Quantitative Easing," the unconventional monetary policy left the central bank with a massive holding of securities and MBS, providing more liquidity to the U.S. financial market to counter headwinds.

Meanwhile, the data also showed that the central bank lowered its holding of MBS. The average daily figure of MBS holdings decreased 10,454 million dollars to 1,478,238 million dollars, for the week ending Sept. 25.

XINHUA/APP

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 120,023.24 136.80M |

0.02% 20.65 |

| ALLSHR | 74,956.95 415.25M |

0.09% 64.82 |

| KSE30 | 36,533.23 44.37M |

0.25% 91.50 |

| KMI30 | 177,648.07 53.46M |

0.48% 854.02 |

| KMIALLSHR | 51,412.96 224.87M |

0.22% 113.15 |

| BKTi | 30,161.85 6.28M |

0.10% 29.54 |

| OGTi | 27,008.50 5.66M |

0.59% 157.59 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 103,730.00 | 106,725.00 102,425.00 |

-235.00 -0.23% |

| BRENT CRUDE | 77.32 | 77.67 75.51 |

-1.53 -1.94% |

| RICHARDS BAY COAL MONTHLY | 88.00 | 0.00 0.00 |

-3.70 -4.03% |

| ROTTERDAM COAL MONTHLY | 103.85 | 0.00 0.00 |

0.35 0.34% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 74.04 | 75.74 72.32 |

0.54 0.73% |

| SUGAR #11 WORLD | 16.53 | 16.73 16.44 |

0.22 1.35% |

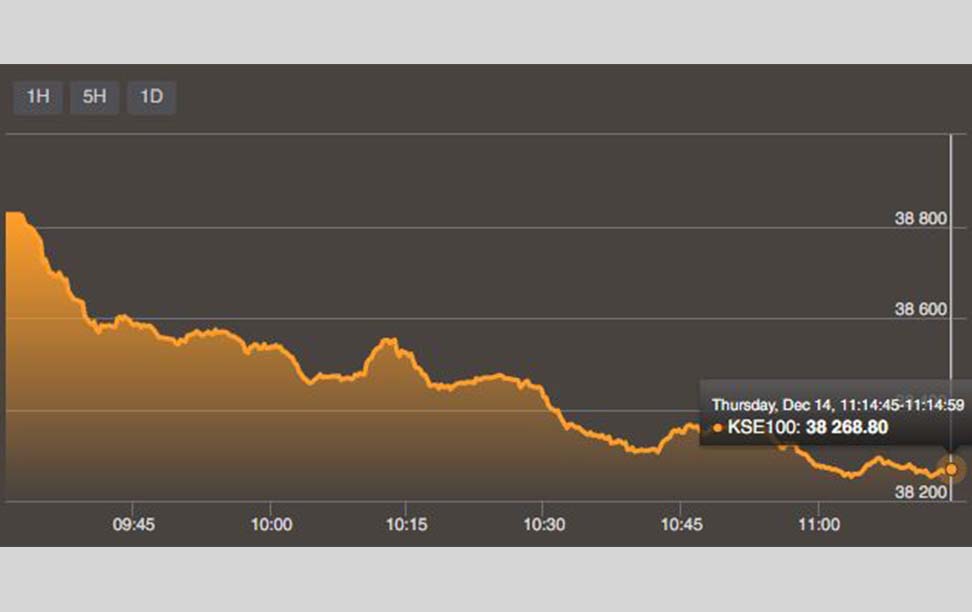

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Summary of Foreign Investment in Pakistan

Summary of Foreign Investment in Pakistan