Tech Beat: Crucial week ahead as KSE-100 nears psychological barrier

By Abdur Rahman | November 27, 2023 at 12:53 AM GMT+05:00

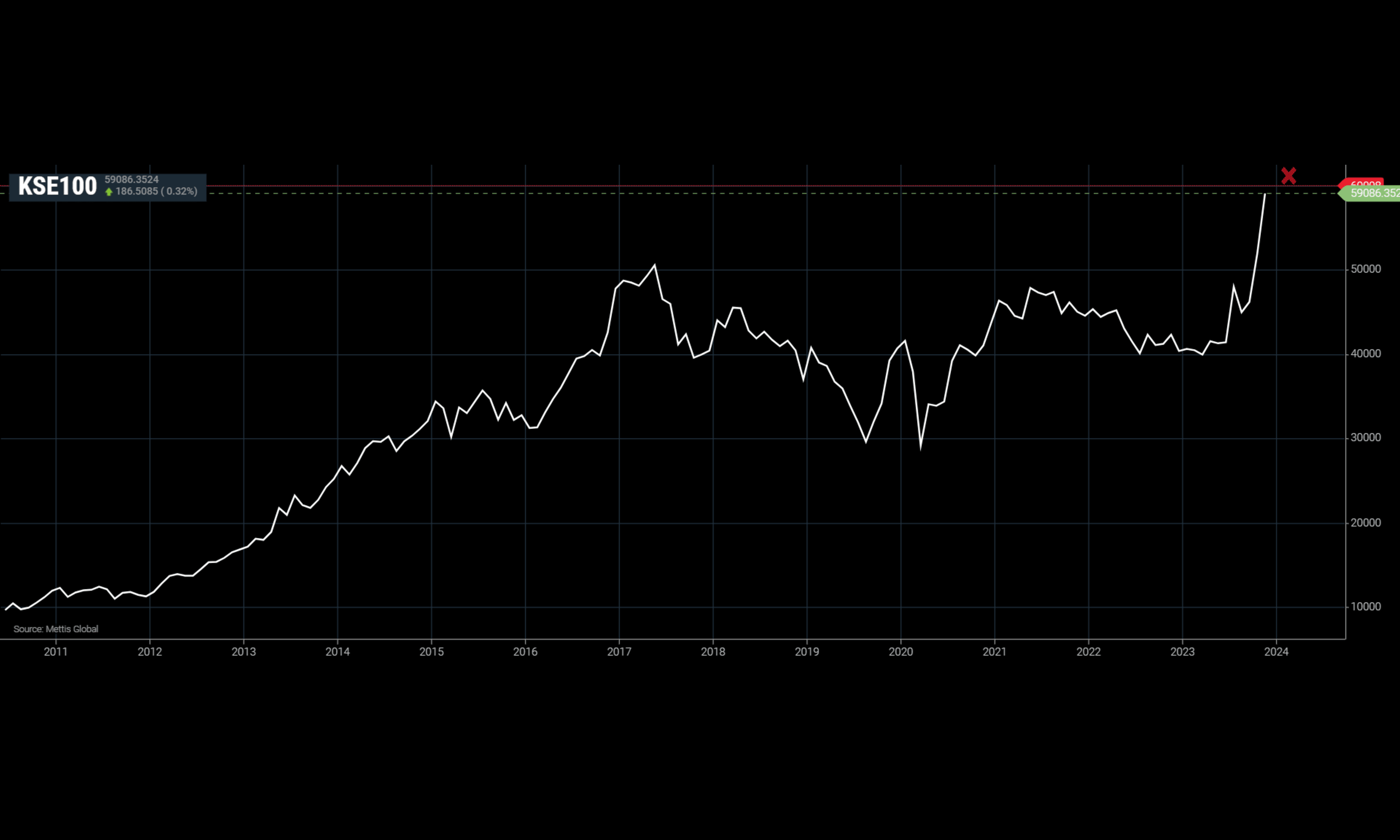

November 27, 2023 (MLN): The benchmark KSE-100 index is approaching the key psychological level of 60,000; a cautious approach should be taken now.

Just over a month ago, when the index was trading at 49,400, a 60,000 target was given, which the index has successfully achieved.

The next week will be crucial as the index closed just below the key psychological level on Friday, and profit-taking can be anticipated as it closes in toward this level, which can lead to a sharp decline. The direction will be determined by the price action around 60,000.

| Support Levels | ||

|---|---|---|

| 57,950 | 57,300 | 56,850 |

| S1 | S2 | S3 |

| Resistance Levels | ||

|---|---|---|

| 59,500 | 60,000 | 64,000 |

| R1 | R2 | R3 |

KSE-100 Daily time-frame chart

The 14-day RSI is at 91.91, while the Stochastic RSI is at 96.58.

The near-term support would be at the 57,500-57,300 area in case of a fall.

Scrips to Monitor

OGDC

OGDC had convincingly broken above its resistance of 109.6; however, on the retest of this area, it failed to hold, indicating weakness.

For further upside, it must quickly reclaim this level; otherwise, the next support is at 104.4.

HUBC

The KSE-100 rally has been led by HUBC, contributing the most points. It has also closed the week around a good area.

In case of a market-wide sell-off, there is potential for a retest of 105, presenting an opportunity for long positions.

If it fails to hold this level (although unlikely), it may open the way towards 93. Either way, it looks likely that HUBC will make new all-time highs soon.

MEBL

MEBL is one of the very few names that have broken its all-time high, and as it enters price discovery mode, more upside can be expected.

Immediate support lies at 153, while in case of a deeper pullback, the 138 area would serve as a strong support zone.

Disclaimer: The views and analysis in this article are the opinions of the author and are for informational purposes only. It is not intended to be financial or investment advice and should not be the basis for making financial decisions.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 125,627.31 258.99M |

1.00% 1248.25 |

| ALLSHR | 78,584.71 1,142.41M |

1.16% 904.89 |

| KSE30 | 38,153.79 69.25M |

0.63% 238.06 |

| KMI30 | 184,886.50 91.38M |

0.01% 13.72 |

| KMIALLSHR | 53,763.81 554.57M |

0.54% 290.61 |

| BKTi | 31,921.68 33.15M |

1.78% 557.94 |

| OGTi | 27,773.98 9.65M |

-0.40% -112.21 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 107,650.00 | 108,105.00 107,505.00 |

-585.00 -0.54% |

| BRENT CRUDE | 66.45 | 66.63 66.34 |

-0.29 -0.43% |

| RICHARDS BAY COAL MONTHLY | 97.00 | 97.00 97.00 |

1.05 1.09% |

| ROTTERDAM COAL MONTHLY | 107.65 | 107.65 105.85 |

1.25 1.17% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 64.80 | 65.02 64.67 |

-0.31 -0.48% |

| SUGAR #11 WORLD | 16.19 | 16.74 16.14 |

-0.52 -3.11% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.jpg)