Steel Q2 Preview: Strong demand to drive earnings

By MG News | January 20, 2021 at 10:22 AM GMT+05:00

January 20, 2021 (MLN): Increase in sales led by a broad-based surge in demand from the construction space, 2/3 wheelers and other segments have made market participants optimistic about an upswing in the profitability of the steel sector during 2QFY21.

The steel sector is likely to grow by 83% YoY to post a cumulative 2QFY21 net profit after tax of PKR1,873 million.

After the resumption of economic activities, market sources are buoyant that metal prices will remain strong in the near term amid a significant rise in rebar prices and other several price hikes in the second half of FY21.

According to a preview report by Intermarket Securities, the profitability of ISL is likely to jump more than 9- folds to PKR1.12 million (EPS: PKR 2.58) during 2QFY21 when compared to net profits of PKR118 million during the same period last year. Healthy demand from 2/3 wheelers (up by16% YoY), and other flat steel reliant industries point towards robust sales are likely to contribute to the growth. The company might witness a 25% YoY in its revenue due to several price hikes during the period. CRC-HRC spreads also improved during the quarter, averaging US$136/ton, up 69% QoQ. It is expected that gross margins to clock in at 12.6% (vs 8.9% during 1Q).

Amreli Steels (ASTL), too, is likely to post a net profit of PKR200 million (EPS: PKR0.67) for 2QFY21, which will come off a loss last year (LPS: PKR0.78) while better than the previous quarter’s result (1QFY21 EPS: PKR0.37). The company is expected to improve profitability for the 2nd consecutive quarter with healthy gross margins (11.2% expected during 2Q vs. 7.9% in SPLY). This is backed by a strong demand post easing of lockdowns, no more electricity one-offs, and the ability to pass on any cost pressures through price increments. Besides, the brokerage house expects that the improvement in earnings also stems from lower finance cost (drop-in interest rates to 7%), expected 40% lower YoY.

As per the projections put forwarded in the report, Mughal Steel (MUGHAL) is likely to post net profits of PKR551mn (EPS: PKR2.19) for 2QFY21, compared to profits after tax of PKR102mn (EPS: PKR0.41) in the corresponding period last year. The expected earnings growth emanates from higher sales, which is inspired by increased cement dispatches during 2Q (up 17% QoQ and 12% YoY). Net sales is likely to grow by 34% YoY and 40% YoY on the back of a rise in rebar/girder volumes, greater exports of copper, and an increase in finished good prices. Gross margins are also expected to improve by 1.6ppt QoQ to 12.8%. The report expects MUGHAL to have exported greater copper ingots during 2Q as international copper prices surged 30% to over US$8,000/ton.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 125,627.31 258.99M |

1.00% 1248.25 |

| ALLSHR | 78,584.71 1,142.41M |

1.16% 904.89 |

| KSE30 | 38,153.79 69.25M |

0.63% 238.06 |

| KMI30 | 184,886.50 91.38M |

0.01% 13.72 |

| KMIALLSHR | 53,763.81 554.57M |

0.54% 290.61 |

| BKTi | 31,921.68 33.15M |

1.78% 557.94 |

| OGTi | 27,773.98 9.65M |

-0.40% -112.21 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 107,945.00 | 108,105.00 107,505.00 |

-290.00 -0.27% |

| BRENT CRUDE | 66.52 | 66.63 66.48 |

-0.22 -0.33% |

| RICHARDS BAY COAL MONTHLY | 97.00 | 97.00 97.00 |

1.05 1.09% |

| ROTTERDAM COAL MONTHLY | 107.65 | 107.65 105.85 |

1.25 1.17% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 64.85 | 65.02 64.82 |

-0.26 -0.40% |

| SUGAR #11 WORLD | 16.19 | 16.74 16.14 |

-0.52 -3.11% |

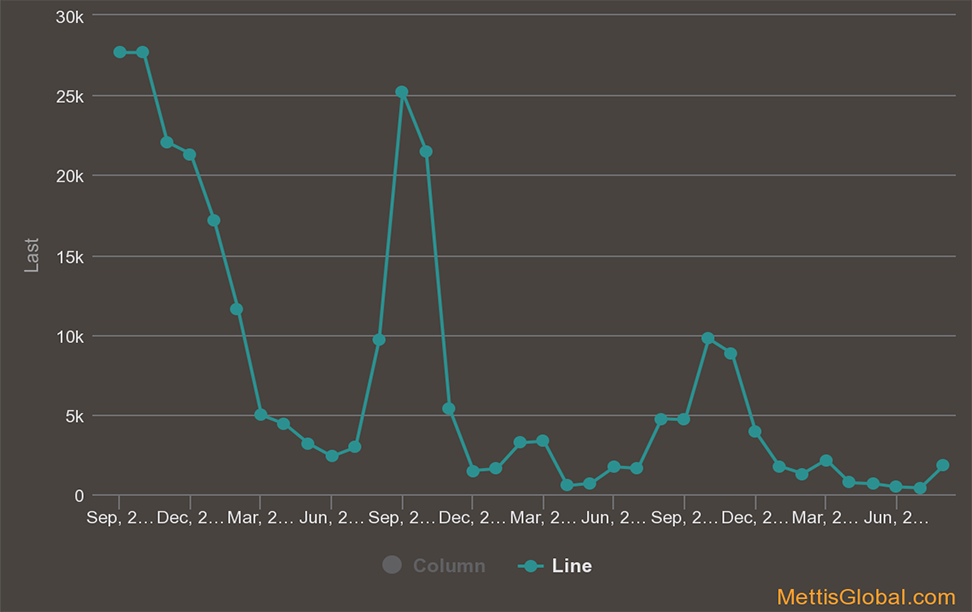

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|