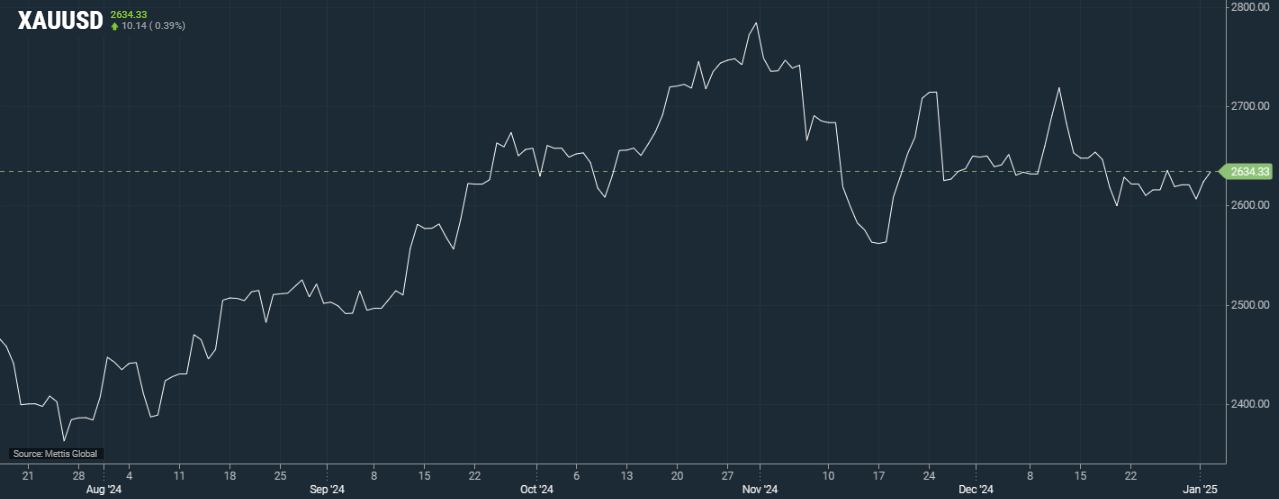

Spot gold market maintains upward trend heading into 2025

By MG News | January 02, 2025 at 11:50 AM GMT+05:00

January 02, 2025 (MLN): Gold spot prices increased by 0.39% ($10.14) at $2,634.33 per ounce, as of [11:43 am PST] from the prior day's close of $2,624.26 per ounce.

Gold futures edged up 0.2% to $2,646.70.

Gold prices rose on Thursday, keeping up the momentum from a positive end to a record-breaking 2024.

Traders braced for U.S. President-elect Donald Trump's expected policy shifts that will shape the economic and interest rate outlook for the new year.

Bullion surged over 27% last year, its biggest annual gain since 2010.

The U.S. Federal Reserve's substantial rate cuts, robust central bank purchases, and escalating geopolitical tensions boosted it to multiple record highs, as Reuters reported.

"Gold seems to be consolidating in a tight range, which often signals a market that's poised for a breakout", said Kyle Rodda, financial market analyst at Capital.com.

"I suspect that breakout will be to the upside", Kyle Rodda added.

Gold is likely to remain bullish in 2025, driven by geopolitical risks and expectations of rising government debt due to a deep fiscal deficit under Trump’s administration.

However, potential challenges could arise from slower Fed rate cuts and dollar strength, according to Rodda.

The market will now take cues from a slew of U.S. economic data due next week, which could influence the interest rate outlook for 2025, and Trump's tariff policies.

Donald Trump will be sworn in as president of the United States on January 20, Reuters further added.

Traders anticipate the Fed to adopt a slow and cautious approach to further rate cuts in 2025, as inflation continues to exceed its 2% target.

According to the CME's FedWatch Tool markets are pricing in just an 11.2% chance of a cut in January.

Gold, which is seen as a safe investment in times of geopolitical and economic uncertainty, tends to be negatively impacted by high interest rates.

Spot silver rose 1.6% to $29.34 per ounce, palladium added 1.1% to $913.47 and platinum gained 0.9% to $918.65.

Silver ended 2024 as its best year since 2020, while platinum and palladium declined.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 125,627.31 258.99M |

1.00% 1248.25 |

| ALLSHR | 78,584.71 1,142.41M |

1.16% 904.89 |

| KSE30 | 38,153.79 69.25M |

0.63% 238.06 |

| KMI30 | 184,886.50 91.38M |

0.01% 13.72 |

| KMIALLSHR | 53,763.81 554.57M |

0.54% 290.61 |

| BKTi | 31,921.68 33.15M |

1.78% 557.94 |

| OGTi | 27,773.98 9.65M |

-0.40% -112.21 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,155.00 | 109,565.00 107,195.00 |

670.00 0.62% |

| BRENT CRUDE | 66.59 | 67.20 65.92 |

-0.21 -0.31% |

| RICHARDS BAY COAL MONTHLY | 97.00 | 97.00 97.00 |

1.05 1.09% |

| ROTTERDAM COAL MONTHLY | 107.65 | 107.65 105.85 |

1.25 1.17% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 64.96 | 65.82 64.50 |

-0.56 -0.85% |

| SUGAR #11 WORLD | 16.19 | 16.74 16.14 |

-0.52 -3.11% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.jpg)