Runup to budget FY25 may fuel KSE-100 rally

Abdur Rahman | April 21, 2024 at 05:01 PM GMT+05:00

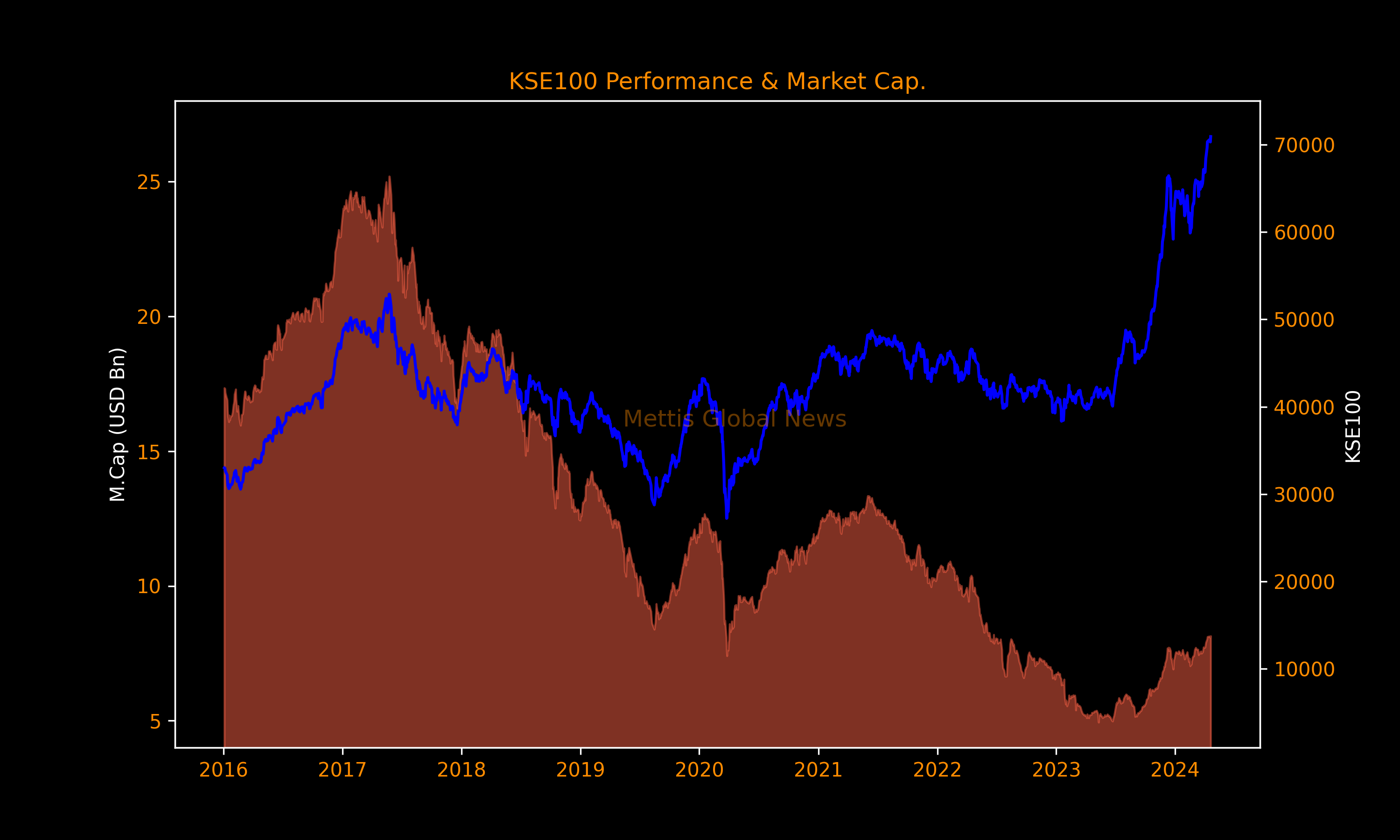

April 21, 2024 (MLN): The record-breaking stock market's benchmark KSE-100 Index may continue its leg higher leading up to the Budget FY25, history shows.

The index has yielded an average gain of 1.8% for investors who bought shares a month prior to the announcement of Federal budget.

Moreover, investors who bought shares two months prior saw an average return of 3.3%, while those who invested three months prior experienced a 5.8% return, data from the past 15 budgets compiled by Mettis Global show.

| Before Budget KSE-100 Performance | |||

|---|---|---|---|

| Budget Year | Before 1 Month |

Before 2 Months |

Before 3 Months |

| FY10 | -1.2% | -9.9% | 22.8% |

| FY11 | -8.7% | -7.5% | 0.1% |

| FY12 | 4.8% | 3.1% | 2.0% |

| FY13 | -1.9% | 1.6% | 6.0% |

| FY14 | 10.3% | 19.3% | 25.8% |

| FY15 | 2.0% | 3.9% | 11.2% |

| FY16 | 0.5% | 7.1% | 2.3% |

| FY17 | 5.4% | 10.1% | 14.7% |

| FY18 | 5.6% | 8.1% | 7.4% |

| FY19 | 0.8% | 6.1% | 2.2% |

| FY20 | -0.2% | -7.2% | -11.0% |

| FY21 | 2.7% | 11.5% | -4.0% |

| FY22 | 6.9% | 7.4% | 10.3% |

| FY23 | -2.0% | -9.0% | -3.8% |

| FY24 | 2.0% | 5.2% | 0.3% |

| Average Return | 1.8% | 3.3% | 5.8% |

Meanwhile, post-budget, the KSE-100 index has displayed a mixed trend.

The local bourse recorded a meager 0.3%, 2.5%, and 1.7% average return over the next one, two, and three months respectively, after the budget announcement.

| After Budget KSE-100 Performance | |||

|---|---|---|---|

| Budget Year | After 1 Month |

After 2 Months |

After 3 Months |

| FY10 | 8.9% | 14.2% | 28.3% |

| FY11 | 0.0% | 7.8% | 0.7% |

| FY12 | 2.0% | -0.1% | -9.5% |

| FY13 | -0.5% | 5.0% | 9.9% |

| FY14 | 3.2% | 4.1% | 3.0% |

| FY15 | 0.7% | 2.7% | -3.4% |

| FY16 | 4.2% | 5.6% | 1.1% |

| FY17 | 1.5% | 6.9% | 6.8% |

| FY18 | -12.0% | -12.8% | -19.7% |

| FY19 | -7.6% | -9.4% | -7.6% |

| FY20 | -2.3% | -15.1% | -12.1% |

| FY21 | 4.6% | 17.2% | 23.2% |

| FY22 | -1.5% | -2.4% | -3.5% |

| FY23 | -1.6% | 0.2% | -0.5% |

| FY24 | 5.5% | 13.2% | 9.2% |

| Average Return | 0.3% | 2.5% | 1.7% |

This gain would be on top of a 29,457 points or 71.1% surge in the current fiscal year, since the International Monetary Fund (IMF)'s bailout program.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 158,014.15 426.62M | 3.98% 6041.16 |

| ALLSHR | 93,566.86 758.07M | 2.62% 2388.00 |

| KSE30 | 48,302.97 216.64M | 4.27% 1976.50 |

| KMI30 | 222,491.73 205.90M | 4.86% 10321.56 |

| KMIALLSHR | 60,355.49 430.59M | 3.38% 1973.11 |

| BKTi | 46,193.08 61.15M | 4.26% 1887.06 |

| OGTi | 30,193.10 21.21M | 3.73% 1086.31 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 66,185.00 | 67,760.00 64,325.00 | -1640.00 -2.42% |

| BRENT CRUDE | 71.88 | 71.96 70.69 | 0.12 0.17% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.50 -3.52% |

| ROTTERDAM COAL MONTHLY | 107.95 | 107.95 107.95 | 0.30 0.28% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.60 | 66.67 65.38 | 0.12 0.18% |

| SUGAR #11 WORLD | 14.05 | 14.10 13.78 | 0.18 1.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Trade Balance

Trade Balance