PSX Closing Bell: The Turn Of A Friendly Card

MG News | January 10, 2022 at 05:22 PM GMT+05:00

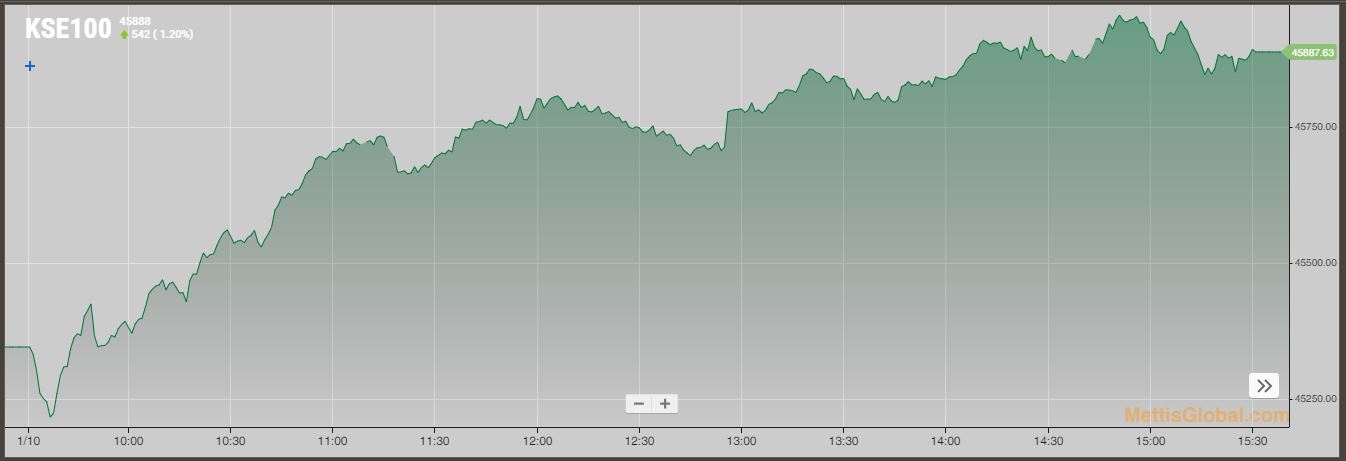

January 10, 2022 (MLN): Domestic equities extended gains today as they closed up by 542 points or 1.2% DoD to settle at 45,887 level.

Market opened on a negative note on the back of news regarding further delay in IMF program. However, it turned positive in the later hours, leading the index to close in green as buying activity was witnessed in the blue chip stocks ahead of the commencement of earnings season.

Moreover, the bourse also took positive cues from last week’s foreign investment, which further supported the investors’ confidence, a closing note by Aba Ali Habib Securities said.

The Index traded in a range of 764.45 points or 1.69 percent of previous close, showing an intraday high of 45,969.63 and a low of 45,205.18.

Of the 97 traded companies in the KSE100 Index 71 closed up 20 closed down, while 6 remained unchanged. Total volume traded for the index was 126.94 million shares.

Sectors propping up the index were Commercial Banks with 205 points, Power Generation & Distribution with 70 points, Cement with 64 points, Miscellaneous with 56 points and Technology & Communication with 49 points.

The most points added to the index was by HUBC which contributed 68 points followed by PSEL with 57 points, MCB with 46 points, TRG with 38 points and HBL with 37 points.

Sector wise, the index was let down by Fertilizer with 34 points, Oil & Gas Exploration Companies with 19 points, Insurance with 2 points, Inv. Banks / Inv. Cos. / Securities Cos. with 1 points and Close - End Mutual Fund with 1 points.

The most points taken off the index was by EFERT which stripped the index of 35 points followed by POL with 14 points, MARI with 11 points, ENGRO with 11 points and DAWH with 8 points.

All Share Volume increased by 114.70 Million to 356.97 Million Shares. Market Cap increased by Rs.82.10 Billion.

Total companies traded were 383 compared to 354 from the previous session. Of the scrips traded 243 closed up, 112 closed down while 28 remained unchanged.

Total trades increased by 37,611 to 135,014.

Value Traded increased by 3.94 Billion to Rs.11.87 Billion

| Company | Volume |

|---|---|

| Unity Foods Ltd(R) | 33,211,276 |

| Worldcall Telecom | 30,072,000 |

| TRG Pakistan | 25,789,423 |

| Hum Network | 25,767,500 |

| Telecard | 20,745,500 |

| Treet Corporation | 18,703,000 |

| Unity Foods | 12,596,652 |

| Cnergyico PK | 10,757,194 |

| Fauji Foods | 8,527,500 |

| Pakistan Refinery | 6,447,476 |

| Sector | Volume |

|---|---|

| Technology & Communication | 113,449,535 |

| Food & Personal Care Products | 76,430,248 |

| Commercial Banks | 27,498,845 |

| Refinery | 20,902,551 |

| Chemical | 13,813,080 |

| Power Generation & Distribution | 12,879,319 |

| Inv. Banks / Inv. Cos. / Securities Cos. | 11,541,462 |

| Cement | 10,434,964 |

| Textile Spinning | 9,967,100 |

| Engineering | 9,050,978 |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,412.25 167.69M | 0.32% 447.43 |

| ALLSHR | 85,702.96 423.92M | 0.15% 131.52 |

| KSE30 | 42,254.84 82.09M | 0.43% 180.24 |

| KMI30 | 194,109.59 84.37M | 0.15% 281.36 |

| KMIALLSHR | 56,713.67 217.03M | 0.03% 16.37 |

| BKTi | 37,831.34 13.04M | 1.62% 603.62 |

| OGTi | 27,440.63 3.93M | -0.09% -23.70 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,945.00 | 119,275.00 117,905.00 | 1325.00 1.13% |

| BRENT CRUDE | 72.34 | 72.82 72.33 | -0.90 -1.23% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 69.95 | 70.41 69.95 | -0.05 -0.07% |

| SUGAR #11 WORLD | 16.46 | 16.58 16.37 | -0.13 -0.78% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|