PSX Closing Bell: Still in the Works

By MG News | September 04, 2024 at 04:22 PM GMT+05:00

September 04, 2024 (MLN): Pakistan stocks gained momentum on Wednesday after the prime minister provided some clarity regarding the International Monetary Fund (IMF) loan approval, which had muted investor sentiment over the past few sessions.

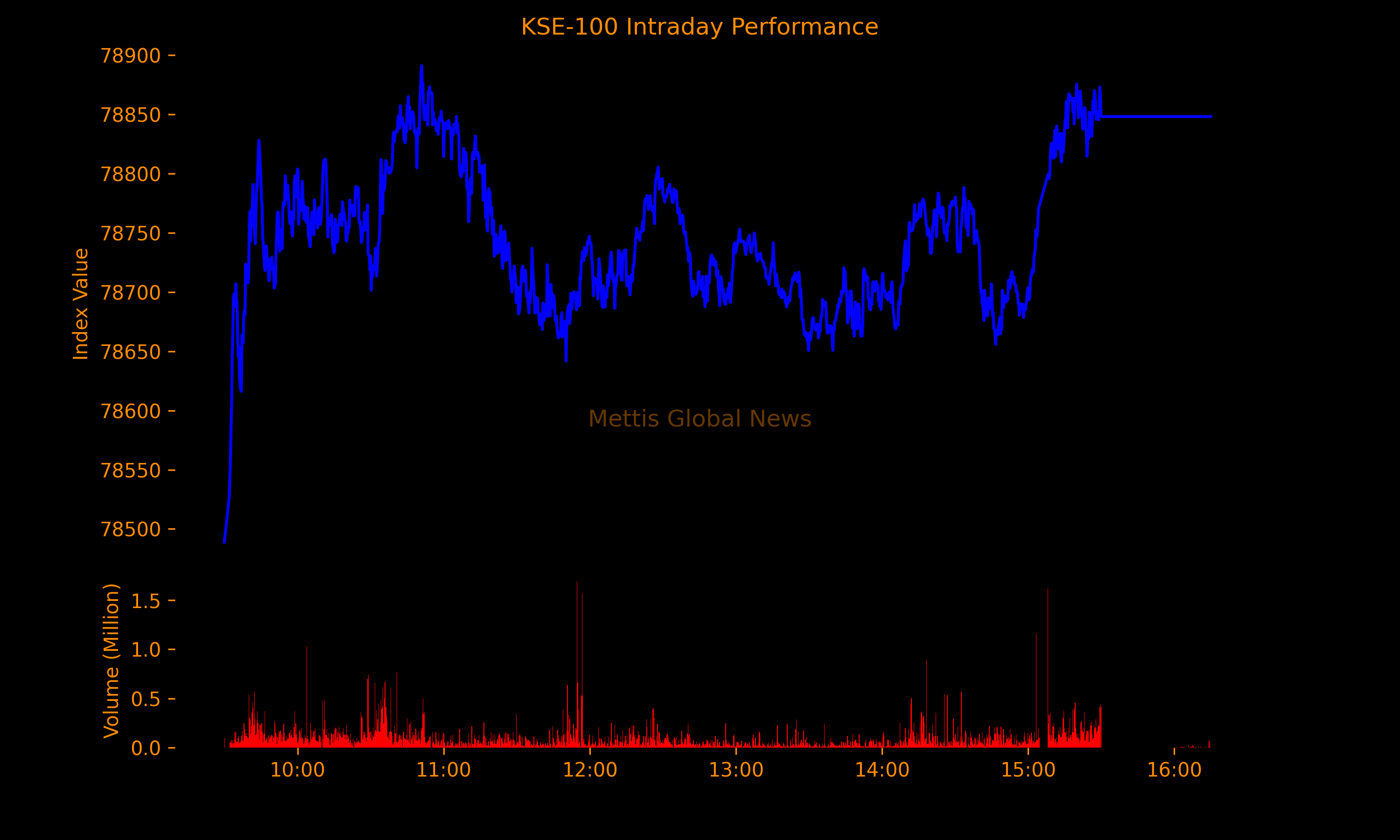

The benchmark KSE-100 Index closed the trading session at 78,848.01, showing an increase of 491.70 points or 0.63%.

Prime Minister Shehbaz Sharif said that his government was working on implementing conditions from the IMF to complete its loan programme, which he hoped would be the country's last.

Pakistan signed an IMF staff-level agreement on July 12 for a new $7 billion programme due to last 37 months, but the country is still waiting for the Fund's executive board to approve it, pending confirmation of financing assurances from development and bilateral partners.

The index remained positive throughout the day showing an intraday high of 78,890.79 (+534.48) and a low of 78,488.88 (+132.57) points.

The total volume of the KSE-100 Index was 146.30 million shares.

Of the 100 index companies 66 closed up, 31 closed down, while 3 were unchanged.

Top gainers during the day were PIBTL (+7.16%), SHFA (+4.52%), KTML (+4.27%), FCCL (+4.23%), and MARI (+3.72%).

On the other hand, top losers were HABSM (-4.18%), NBP (-3.03%), GADT (-1.88%), NPL (-1.78%), and POL (-1.72%).

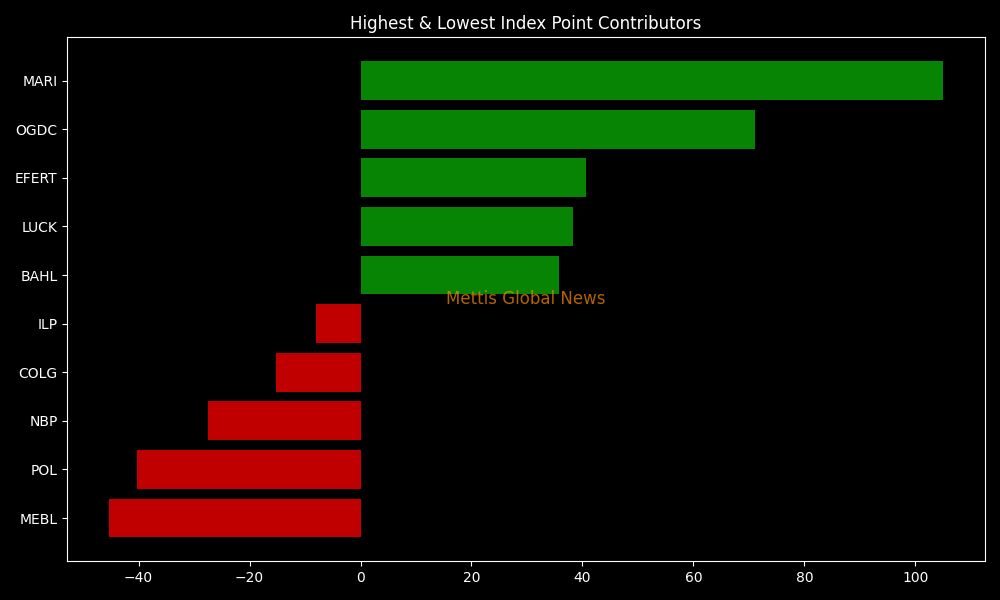

In terms of index-point contributions, companies that propped up the index were MARI (+105.04pts), OGDC (+71.13pts), EFERT (+40.73pts), LUCK (+38.31pts), and BAHL (+35.86pts).

Meanwhile, companies that dragged the index lower were MEBL (-45.32pts), POL (-40.26pts), NBP (-27.46pts), COLG (-15.23pts), and ILP (-7.94pts).

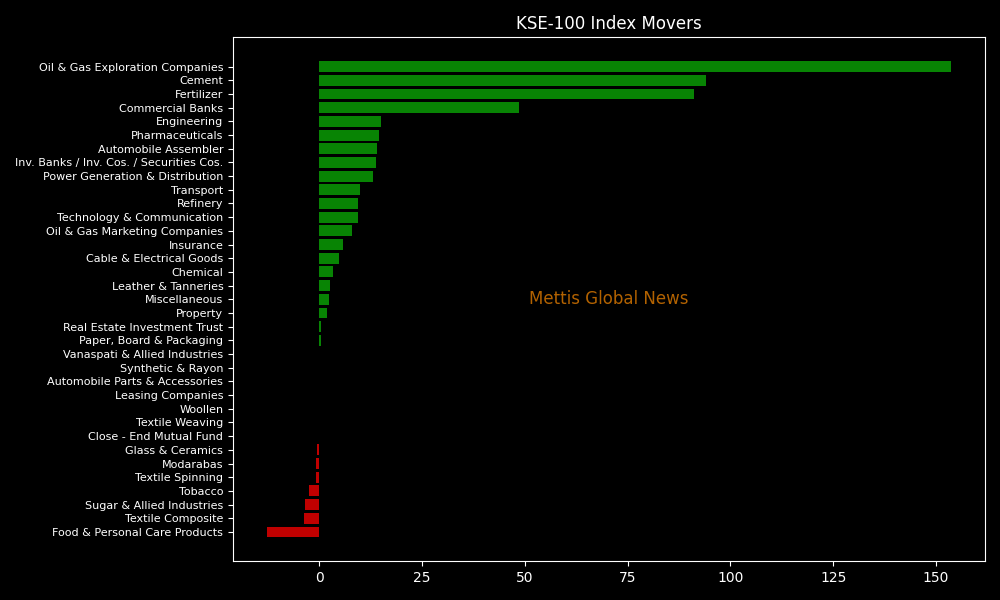

Sector-wise, KSE-100 Index was supported by Oil & Gas Exploration Companies (+153.62pts), Cement (+94.01pts), Fertilizer (+91.22pts), Commercial Banks (+48.59pts), and Engineering (+15.01pts).

While the index was let down by Food & Personal Care Products (-12.67pts), Textile Composite (-3.73pts), Sugar & Allied Industries (-3.57pts), Tobacco (-2.56pts), and Textile Spinning (-0.81pts).

In the broader market, the All-Share Index closed at 50,779.06 with a net gain of 302.02 points or 0.60%.

Total market volume was 969.77 million shares compared to 436.67m from the previous session while traded value was recorded at Rs17.51 billion showing an increase of Rs5.26bn.

There were 277,667 trades reported in 442 companies with 258 closing up, 138 closing down, and 46 remaining unchanged.

| Symbol | Price | Change % | Volume |

|---|---|---|---|

| WTL | 1.37 | 13.22% | 234,639,397 |

| PASL | 1.44 | 33.33% | 48,686,662 |

| KOSM | 11.41 | 2.52% | 45,083,409 |

| FLYNG | 16.34 | 5.97% | 35,345,035 |

| SYM | 10.99 | 10.01% | 30,335,264 |

| AMTEEF | 4.38 | 29.59% | 27,018,078 |

| PACE | 4.66 | 27.32% | 26,317,629 |

| MDTL | 2.19 | 28.07% | 21,957,572 |

| HASCOL | 7.73 | 0.78% | 21,601,853 |

| PIBTL | 6.14 | 7.16% | 19,087,390 |

To note, the KSE-100 has gained 403 points or 0.51% during the fiscal year, whereas the ongoing calendar year has witnessed a cumulative increase of 16,397 points, equivalent to 26.26%.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 125,627.31 258.99M |

1.00% 1248.25 |

| ALLSHR | 78,584.71 1,142.41M |

1.16% 904.89 |

| KSE30 | 38,153.79 69.25M |

0.63% 238.06 |

| KMI30 | 184,886.50 91.38M |

0.01% 13.72 |

| KMIALLSHR | 53,763.81 554.57M |

0.54% 290.61 |

| BKTi | 31,921.68 33.15M |

1.78% 557.94 |

| OGTi | 27,773.98 9.65M |

-0.40% -112.21 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,055.00 | 109,565.00 107,195.00 |

570.00 0.53% |

| BRENT CRUDE | 66.64 | 67.20 65.92 |

-0.16 -0.24% |

| RICHARDS BAY COAL MONTHLY | 97.00 | 97.00 97.00 |

1.05 1.09% |

| ROTTERDAM COAL MONTHLY | 107.65 | 107.65 105.85 |

1.25 1.17% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 64.97 | 65.82 64.50 |

-0.55 -0.84% |

| SUGAR #11 WORLD | 16.19 | 16.74 16.14 |

-0.52 -3.11% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|