PSX Closing Bell: Silence of the Lenders...

MG News | June 07, 2022 at 05:32 PM GMT+05:00

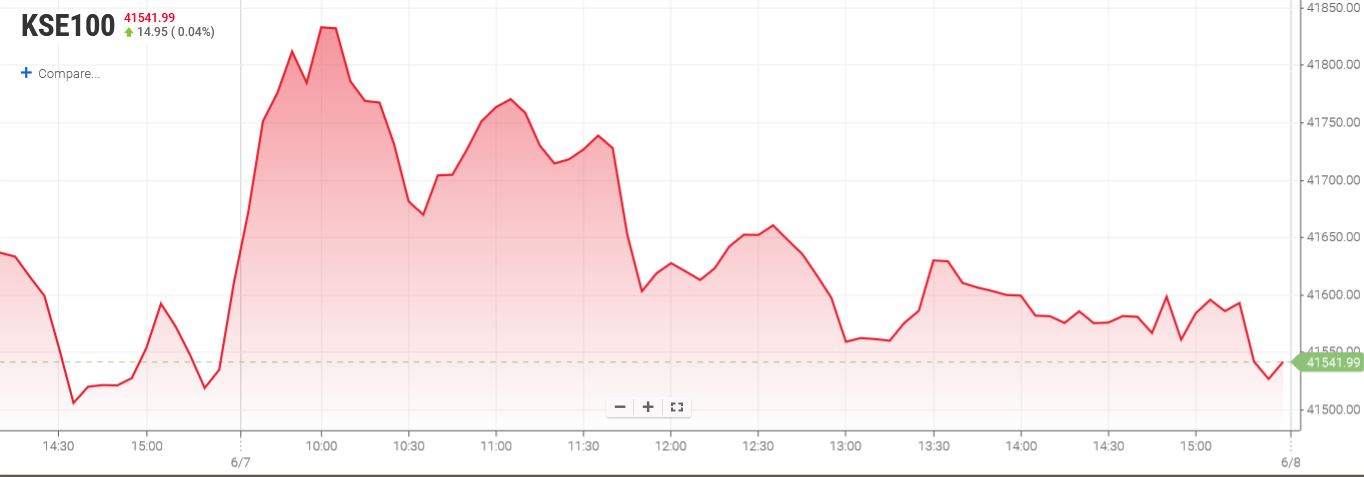

June 07, 2022 (MLN): Domestic equities ended today’s session on a slightly negative note, as they failed to maintain yesterday’s momentum amid lack of triggers, closing flat by negative 9 points to sette at 41,568 points level.

The market showed signs of nervousness throughout the day and investors adopted a wait-and-see approach ahead of budget announcement as the government is mulling new tax measures to raise an additional Rs300bn in the next fiscal year.

These measures may include levy of luxury tax on big houses, luxury vehicles, taxation on rental income, and revision in the valuation rates of properties. In the power sector, Govt is likely to set aside Rs516bn ascprovisional indicative budget ceilings as compared to revised allocation of Rs869bn in

FY22, a note Ismail Iqbal Securities cited.

On the economic front, Pakistani rupee (PKR) has lost further ground by 2.8 rupees against the greenback in today's interbank session as the currency settled the trade at PKR 202.83 per USD.

Moreover, the recent data released by SBP showed that Real Effective Exchange Rate (REER) clocked in at 95.85 in the month of April 2022, showing a drop of 0.84% and 6.90% against the value of 96.66 in March 2022 and 102.95 in April 2021 respectively.

As a result, the market made an intra an intraday high of 41,854 points and a low of 41,522.23 points before settling at 41,568 level.

Of the 94 traded companies in the KSE100 Index 36 closed up 52 closed down, while 6 remained unchanged. Total volume traded for the index was 62.25 million shares.

Sector wise, the index was let down by Commercial Banks with 21 points, Technology & Communication with 21 points, Food & Personal Care Products with 15 points, Power Generation & Distribution with 13 points and Inv. Banks / Inv. Cos. / Securities Cos. with 9 points.

The most points taken off the index was by HBL which stripped the index of 20 points followed by TRG with 13 points, UNITY with 12 points, HUBC with 11 points and MCB with 11 points.

Sectors propping up the index were Oil & Gas Exploration Companies with 36 points, Chemical with 26 points, Textile Composite with 23 points, Oil & Gas Marketing Companies with 14 points and Automobile Assembler with 9 points.

The most points added to the index was by NML which contributed 17 points followed by SNGP with 16 points, MARI with 11 points, EPCL with 11 points and PPL with 10 points.

All Share Volume decreased by 31.81 Million to 157.44 Million Shares. Market Cap increased by Rs.7.95 Billion.

Total companies traded were 329 compared to 342 from the previous session. Of the scrips traded 128 closed up, 180 closed down while 21 remained unchanged.

Total trades decreased by 5,595 to 83,889.

Value Traded decreased by 0.68 Billion to Rs.4.22 Billion

| Company | Volume |

|---|---|

| TPL Properties | 17,453,992 |

| Unity Foods | 15,525,766 |

| Pakistan Refinery | 13,410,260 |

| Oilboy Energy(R) | 12,941,500 |

| Sui Northern Gas Pipelines | 6,569,131 |

| Dost Steels | 5,264,000 |

| Worldcall Telecom | 5,263,500 |

| Telecard | 4,703,000 |

| Nishat Mills | 4,586,209 |

| Ghani Global Holdings | 4,509,457 |

| Sector | Volume |

|---|---|

| Oil & Gas Marketing Companies | 26,626,501 |

| Refinery | 19,146,935 |

| Food & Personal Care Products | 19,051,782 |

| Technology & Communication | 18,751,513 |

| Miscellaneous | 17,789,592 |

| Chemical | 9,689,895 |

| Cement | 8,130,876 |

| Textile Composite | 7,339,356 |

| Commercial Banks | 6,860,423 |

| Engineering | 6,829,380 |

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,412.25 167.69M | 0.32% 447.43 |

| ALLSHR | 85,702.96 423.92M | 0.15% 131.52 |

| KSE30 | 42,254.84 82.09M | 0.43% 180.24 |

| KMI30 | 194,109.59 84.37M | 0.15% 281.36 |

| KMIALLSHR | 56,713.67 217.03M | 0.03% 16.37 |

| BKTi | 37,831.34 13.04M | 1.62% 603.62 |

| OGTi | 27,440.63 3.93M | -0.09% -23.70 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,335.00 | 118,355.00 117,905.00 | 715.00 0.61% |

| BRENT CRUDE | 73.47 | 73.63 71.75 | 0.96 1.32% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 70.26 | 70.33 70.18 | 0.26 0.37% |

| SUGAR #11 WORLD | 16.46 | 16.58 16.37 | -0.13 -0.78% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|