PSX Closing Bell: Love the Way You Lie

By MG News | May 09, 2025 at 05:12 PM GMT+05:00

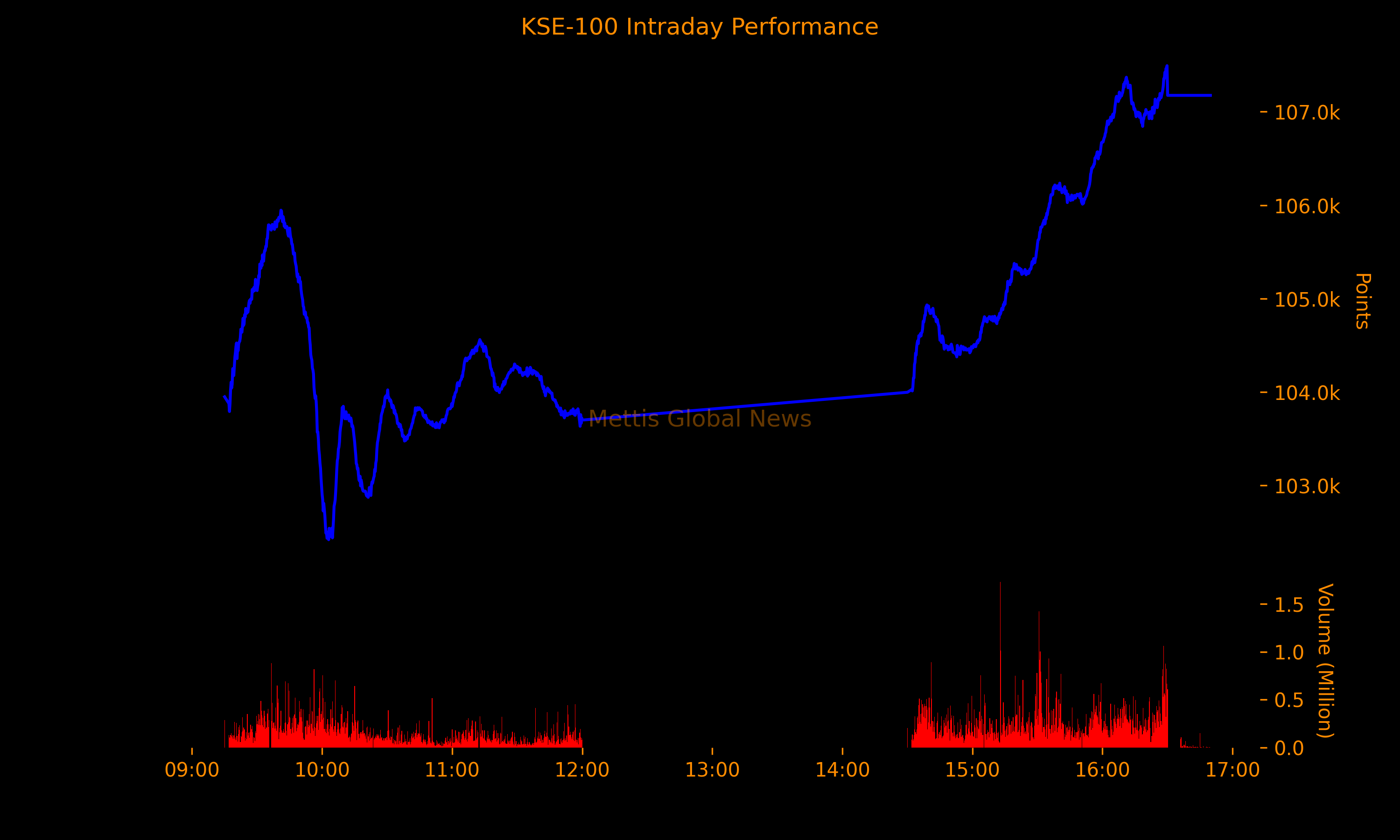

May 09, 2025 (MLN): After suffering a steep 6% drop a day earlier, the local bourse witnessed a strong rebound on Friday as the benchmark KSE-100 Index surged by 3,647 points or 3.52% to close at 107,174.63.

This recovery is primarily attributed to the absence of any fresh escalation in the Pakistan-India conflict, which helped restore investor confidence.

Equities remained volatile throughout the session, initially gaining ground as investors grew hopeful that a full-scale conflict with India might be avoided. Despite the volatility, long-term investors opted to avoid panic selling and gradually rebuilt their portfolios.

Investor optimism was further lifted by expectations surrounding the IMF Executive Board meeting scheduled for later in the day. The board is likely to approve a $1 billion tranche under the existing Extended Fund Facility (EFF), along with an additional $1.3 billion under the Resilience and Sustainability Facility (RSF).

The index traded in a range of 5,120.63 points, showing an intraday high of 107,541.45 (+4,014.64) and a low of 102,420.82 (-1,105.99) points.

The total volume of the KSE-100 Index was 238.40 million shares.

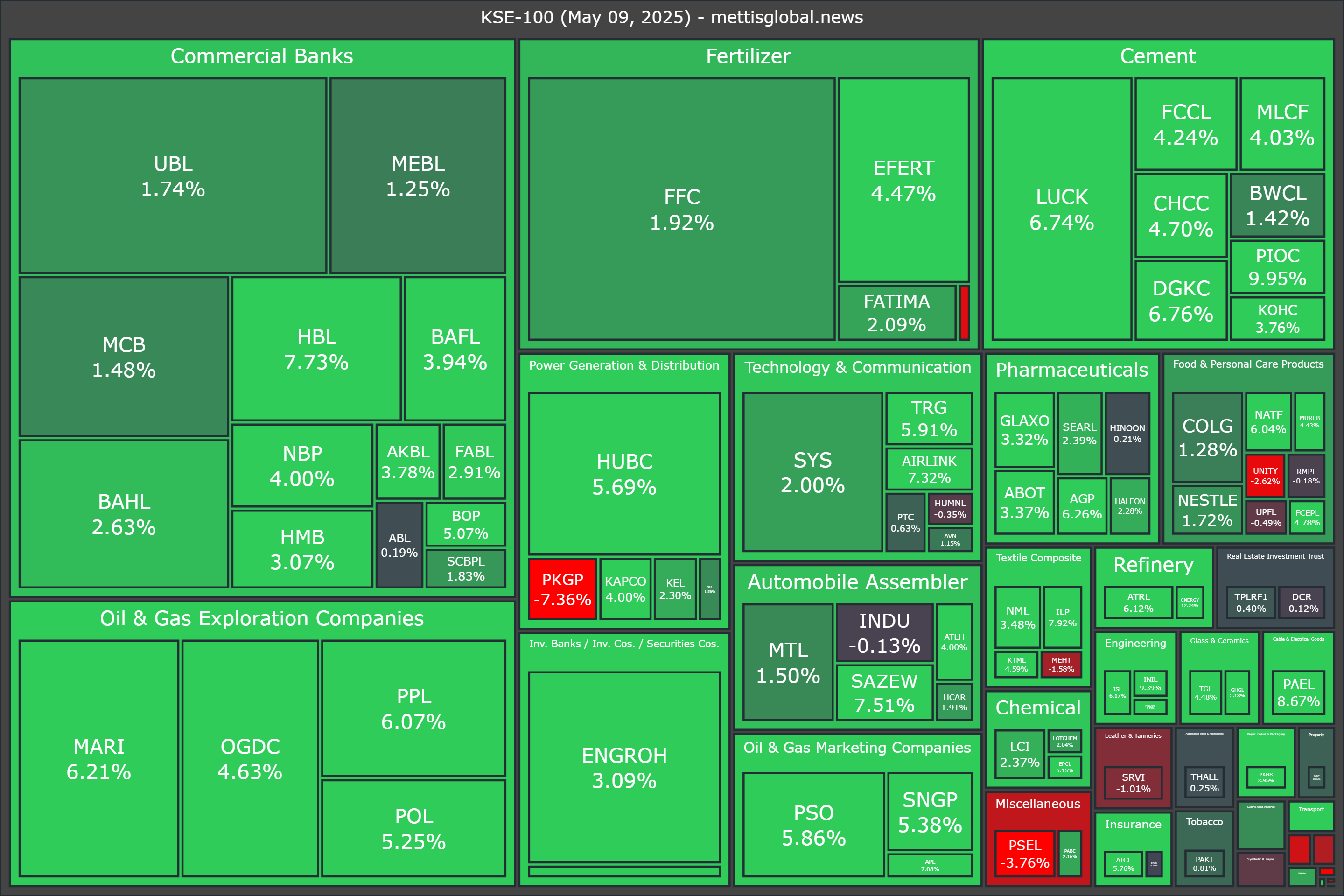

Of the 100 index companies 83 closed up, 16 closed down, while 1 were unchanged.

Top gainers during the day were CNERGY (+12.24%), PIOC (+9.95%), INIL (+9.39%), PAEL (+8.67%), and MUGHAL (+8.25%).

On the other hand, top losers were PGLC (-8.07%), PKGP (-7.36%), PSEL (-3.76%), POML (-3.26%), and UNITY (-2.62%).

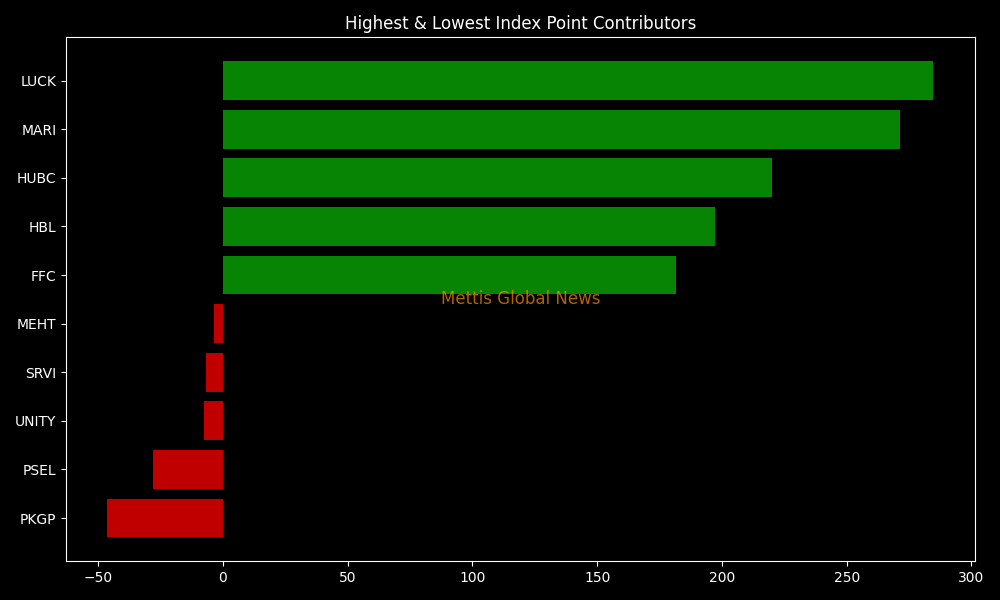

In terms of index-point contributions, companies that propped up the index were LUCK (+284.78pts), MARI (+271.39pts), HUBC (+220.10pts), HBL (+197.06pts), and FFC (+181.48pts).

Meanwhile, companies that dragged the index lower were PKGP (-46.30pts), PSEL (-28.10pts), UNITY (-7.54pts), SRVI (-6.59pts), and MEHT (-3.65pts).

Sector-wise, KSE-100 Index was supported by Oil & Gas Exploration Companies (+736.42pts), Commercial Banks (+718.97pts), Cement (+565.32pts), Fertilizer (+335.64pts), and Oil & Gas Marketing Companies (+205.81pts).

While the index was let down by Miscellaneous (-21.64pts), Leather & Tanneries (-6.59pts), Close-End Mutual Fund (-1.77pts), Textile Spinning (-1.34pts), and Synthetic & Rayon (-0.81pts).

In the broader market, the All-Share Index closed at 66,513.47 with a net gain of 1,985.48 points or 3.08%.

Total market volume was 516.30 million shares compared to 653.55m from the previous session while traded value was recorded at Rs28.84 billion showing a decrease of Rs6.60bn.

There were 311,765 trades reported in 441 companies with 300 closing up, 99 closing down, and 42 remaining unchanged.

| Symbol | Price | Change % | Volume |

|---|---|---|---|

| WTL | 1.16 | 5.46% | 47,087,025 |

| CNERGY | 6.42 | 12.24% | 33,590,475 |

| SSGC | 27.69 | -5.24% | 29,288,646 |

| BOP | 9.12 | 5.07% | 18,310,598 |

| PRL | 24.56 | 1.24% | 15,347,121 |

| PIAHCLA | 12.23 | -9.94% | 14,961,675 |

| SNGP | 111.48 | 5.38% | 14,847,660 |

| KEL | 4.01 | 2.30% | 14,463,181 |

| MLCF | 63.32 | 4.03% | 13,544,491 |

| KOSM | 3.99 | 1.27% | 13,517,642 |

To note, the KSE-100 has gained 28,730 points or 36.62% during the fiscal year, whereas it has decreased 7,952 points or 6.91% so far this calendar year.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 125,627.31 258.99M |

1.00% 1248.25 |

| ALLSHR | 78,584.71 1,142.41M |

1.16% 904.89 |

| KSE30 | 38,153.79 69.25M |

0.63% 238.06 |

| KMI30 | 184,886.50 91.38M |

0.01% 13.72 |

| KMIALLSHR | 53,763.81 554.57M |

0.54% 290.61 |

| BKTi | 31,921.68 33.15M |

1.78% 557.94 |

| OGTi | 27,773.98 9.65M |

-0.40% -112.21 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,165.00 | 109,565.00 107,195.00 |

680.00 0.63% |

| BRENT CRUDE | 66.65 | 67.20 65.92 |

-0.15 -0.22% |

| RICHARDS BAY COAL MONTHLY | 97.00 | 97.00 97.00 |

1.05 1.09% |

| ROTTERDAM COAL MONTHLY | 107.65 | 107.65 105.85 |

1.25 1.17% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 64.99 | 65.82 64.50 |

-0.53 -0.81% |

| SUGAR #11 WORLD | 16.19 | 16.74 16.14 |

-0.52 -3.11% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|