PSX Closing Bell: Interlude

MG News | April 05, 2022 at 08:27 PM GMT+05:00

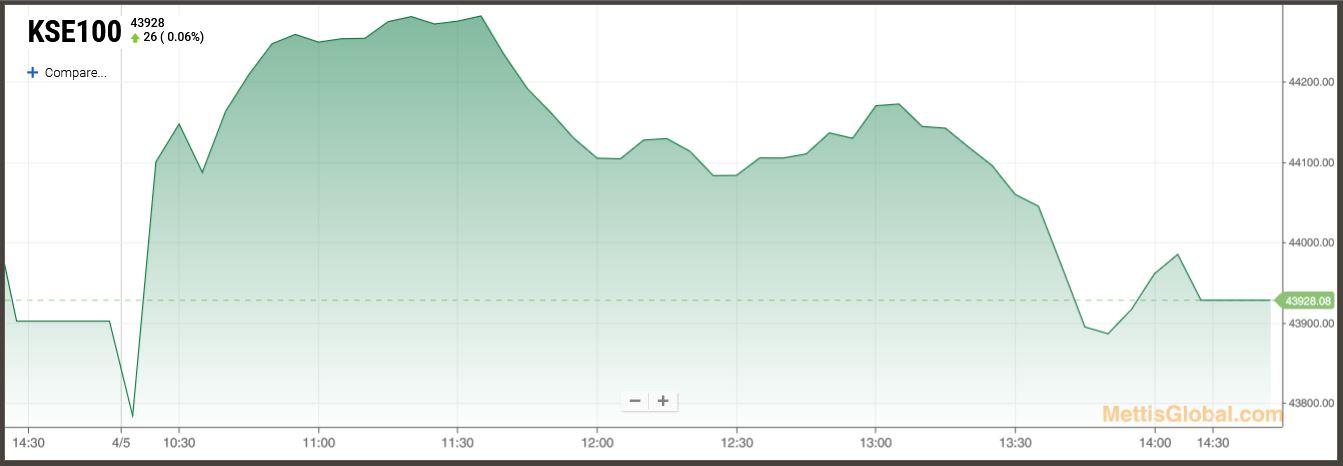

April 5, 2022 (MLN): Domestic equities observed a volatile trading session today mainly due to political unrest, PKR devaluation and falling foreign reserves below a certain level.

The market opened on a negative note, however, during the 2nd hour of trading, value buying was observed which led the KSE 100 index to close at the 43,928 level, up by 26 points or 0.06% DoD as rally was witnessed in the cement and fertilizer sector, a closing note by Arif Habib Securities said.

The Index traded in a range of 507.29 points or 1.16 percent of the previous close, showing an intraday high of 44,289.56 and a low of 43,782.27.

Of the 90 traded companies in the KSE100 Index 45 closed up 41 closed down, while 4 remained unchanged. Total volume traded for the index was 52.69 million shares.

Sectors propping up the index were Commercial Banks with 50 points, Chemical with 42 points, Fertilizer with 31 points, Technology & Communication with 11 points and Inv. Banks / Inv. Cos. / Securities Cos. with 10 points.

The most points added to the index was by EPCL which contributed 40 points followed by MEBL with 26 points, EFERT with 25 points, MCB with 14 points and MTL with 12 points.

Sector wise, the index was let down by Cement with 60 points, Oil & Gas Exploration Companies with 38 points, Leather & Tanneries with 11 points, Paper & Board with 11 points and Engineering with 5 points.

The most points taken off the index was by LUCK which stripped the index of 33 points followed by POL with 18 points, MARI with 13 points, DGKC with 12 points and SRVI with 11 points.

All Share Volume decreased by 54.84 Million to 115.64 Million Shares. Market Cap increased by Rs.3.09 Billion.

Total companies traded were 302 compared to 305 from the previous session. Of the scrips traded 154 closed up, 125 closed down while 23 remained unchanged.

Total trades decreased by 23,180 to 62,698.

Value Traded decreased by 0.91 Billion to Rs.4.58 Billion

| Company | Volume |

|---|---|

| Telecard | 12,908,821 |

| TPL Properties | 6,707,583 |

| Engro Polymer & Chemicals | 6,522,763 |

| Ghani Global Holdings | 6,037,500 |

| K-Electric | 5,705,000 |

| Worldcall Telecom | 5,664,000 |

| Hum Network | 3,801,825 |

| Nishat Chunian | 3,176,692 |

| Treet Corporation | 3,006,000 |

| Jahangir Siddiqui & Co. Ltd. | 2,588,000 |

| Sector | Volume |

|---|---|

| Technology & Communication | 30,504,787 |

| Chemical | 15,549,783 |

| Power Generation & Distribution | 8,957,506 |

| Cement | 8,475,411 |

| Miscellaneous | 7,780,983 |

| Textile Composite | 6,954,726 |

| Food & Personal Care Products | 6,442,321 |

| Commercial Banks | 5,027,246 |

| Fertilizer | 4,399,454 |

| Inv. Banks / Inv. Cos. / Securities Cos. | 3,830,200 |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 139,858.51 52.71M | 1.04% 1446.26 |

| ALLSHR | 86,656.22 117.21M | 1.11% 953.26 |

| KSE30 | 42,735.90 30.90M | 1.14% 481.06 |

| KMI30 | 197,088.80 33.99M | 1.53% 2979.21 |

| KMIALLSHR | 57,517.03 57.06M | 1.42% 803.36 |

| BKTi | 38,032.22 2.98M | 0.53% 200.88 |

| OGTi | 28,374.48 14.76M | 3.40% 933.84 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 119,330.00 | 119,430.00 117,905.00 | 1710.00 1.45% |

| BRENT CRUDE | 72.23 | 72.82 72.19 | -1.01 -1.38% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 69.86 | 70.41 69.83 | -0.14 -0.20% |

| SUGAR #11 WORLD | 16.46 | 16.58 16.37 | -0.13 -0.78% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|