PSX Closing Bell: Insignificance

By MG News | May 17, 2022 at 05:38 PM GMT+05:00

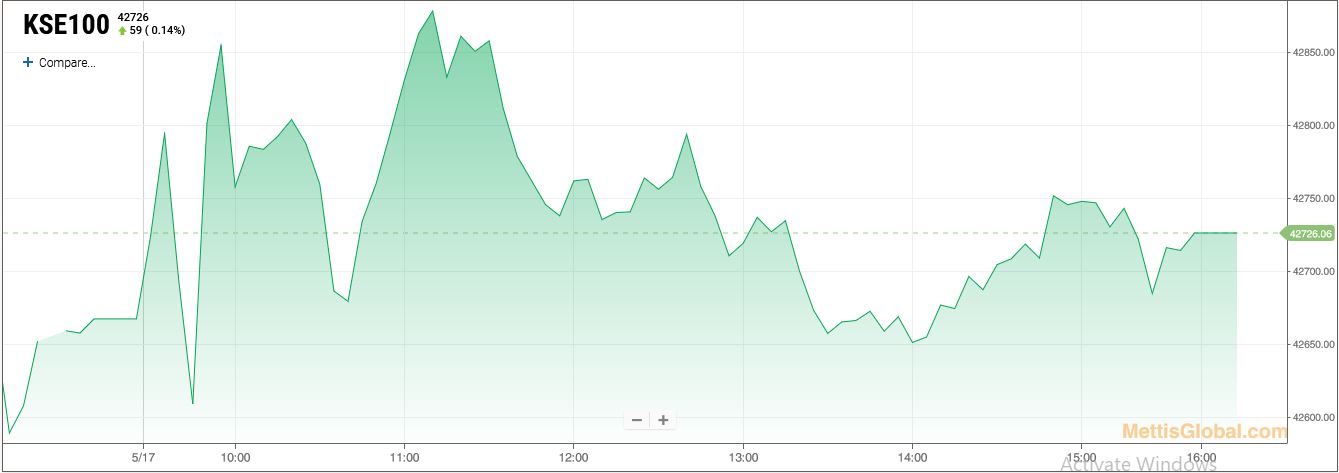

May 17, 2022 (MLN): After plummeting to its lowest level of 42,667 points since December 2020 yesterday, domestic equities took a breather today as the benchmark KSE-100 index landed in consolidation by gaining 59 points or up by 0.14% to close the day’s session at 42,726 level.

The market had a range bound activity on the backdrop of media news regarding PM address to the nation. Investors opted to stay sideline ahead of the aforesaid address as it is expected that PM may announce some tough decision while taking the nation into confidence to curtail deterioration on the macro front, a note by Topline Securities said.

Furthermore, the pending decision of the coalition government whether to carry on with the current setup or call general elections kept investors cautious.

Moreover, the Pakistani Rupee weakened to another new all-time low of 195.74 against the US dollar, as depletion in foreign exchange reserves, lack of clearity on IMF tranche and funding from friendly countries have triggered a spell of uncertainty.

The Index traded in a range of 282.50 points or 0.66 percent of previous close, showing an intraday high of 42,887.61 and a low of 42,605.11.

Of the 93 traded companies in the KSE100 Index 51 closed up 37 closed down, while 5 remained unchanged. Total volume traded for the index was 97.15 million shares.

Sectors propping up the index were Commercial Banks with 31 points, Technology & Communication with 31 points, Fertilizer with 18 points, Engineering with 13 points and Inv. Banks / Inv. Cos. / Securities Cos. with 13 points.

The most points added to the index was by TRG which contributed 18 points followed by UBL with 16 points, HBL with 14 points, FFC with 14 points and DAWH with 13 points.

Sector wise, the index was let down by Cement with 39 points, Power Generation & Distribution with 16 points, Textile Composite with 7 points, Sugar & Allied Industries with 5 points and Oil & Gas Exploration Companies with 4 points.

The most points taken off the index was by LUCK which stripped the index of 18 points followed by HUBC with 17 points, MLCF with 9 points, FCCL with 8 points and FATIMA with 7 points.

All Share Volume decreased by 52.53 Million to 197.92 Million Shares. Market Cap increased by Rs.9.01 Billion.

Total companies traded were 326 compared to 340 from the previous session. Of the scrips traded 171 closed up, 127 closed down while 28 remained unchanged.

Total trades decreased by 32,536 to 86,763.

Value Traded decreased by 2.73 Billion to Rs.6.18 Billion

| Company | Volume |

|---|---|

| Worldcall Telecom | 21,946,500 |

| Cnergyico PK | 15,472,098 |

| Lotte Chemical Pakistan | 11,484,953 |

| Pakistan Refinery | 10,993,864 |

| Treet Corporation | 10,944,500 |

| Telecard | 7,420,500 |

| Engro Polymer & Chemicals | 7,201,365 |

| Ghani Global Holdings | 6,549,648 |

| Hum Network | 5,706,500 |

| Pakistan International Bulk Terminal | 5,625,500 |

| Sector | Volume |

|---|---|

| Technology & Communication | 41,451,711 |

| Refinery | 32,627,993 |

| Chemical | 30,850,616 |

| Food & Personal Care Products | 21,561,135 |

| Cement | 13,828,149 |

| Commercial Banks | 8,977,938 |

| Fertilizer | 6,650,894 |

| Transport | 5,891,900 |

| Power Generation & Distribution | 5,669,934 |

| Engineering | 4,331,512 |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 132,724.13 98.16M |

-0.51% -679.06 |

| ALLSHR | 83,022.05 543.11M |

-0.20% -166.01 |

| KSE30 | 40,400.33 35.28M |

-0.62% -251.12 |

| KMI30 | 191,117.65 39.67M |

-0.50% -966.27 |

| KMIALLSHR | 55,725.89 278.31M |

-0.22% -121.80 |

| BKTi | 36,223.65 6.20M |

-0.55% -199.22 |

| OGTi | 28,287.49 7.25M |

-0.53% -150.12 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 109,225.00 | 109,545.00 108,625.00 |

10.00 0.01% |

| BRENT CRUDE | 70.10 | 70.13 69.85 |

-0.05 -0.07% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

2.05 2.15% |

| ROTTERDAM COAL MONTHLY | 106.65 | 106.65 106.25 |

0.50 0.47% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.27 | 68.31 67.78 |

-0.06 -0.09% |

| SUGAR #11 WORLD | 16.15 | 16.37 16.10 |

-0.13 -0.80% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.png)