PSX Closing Bell: Higher Power

MG News | January 17, 2025 at 04:56 PM GMT+05:00

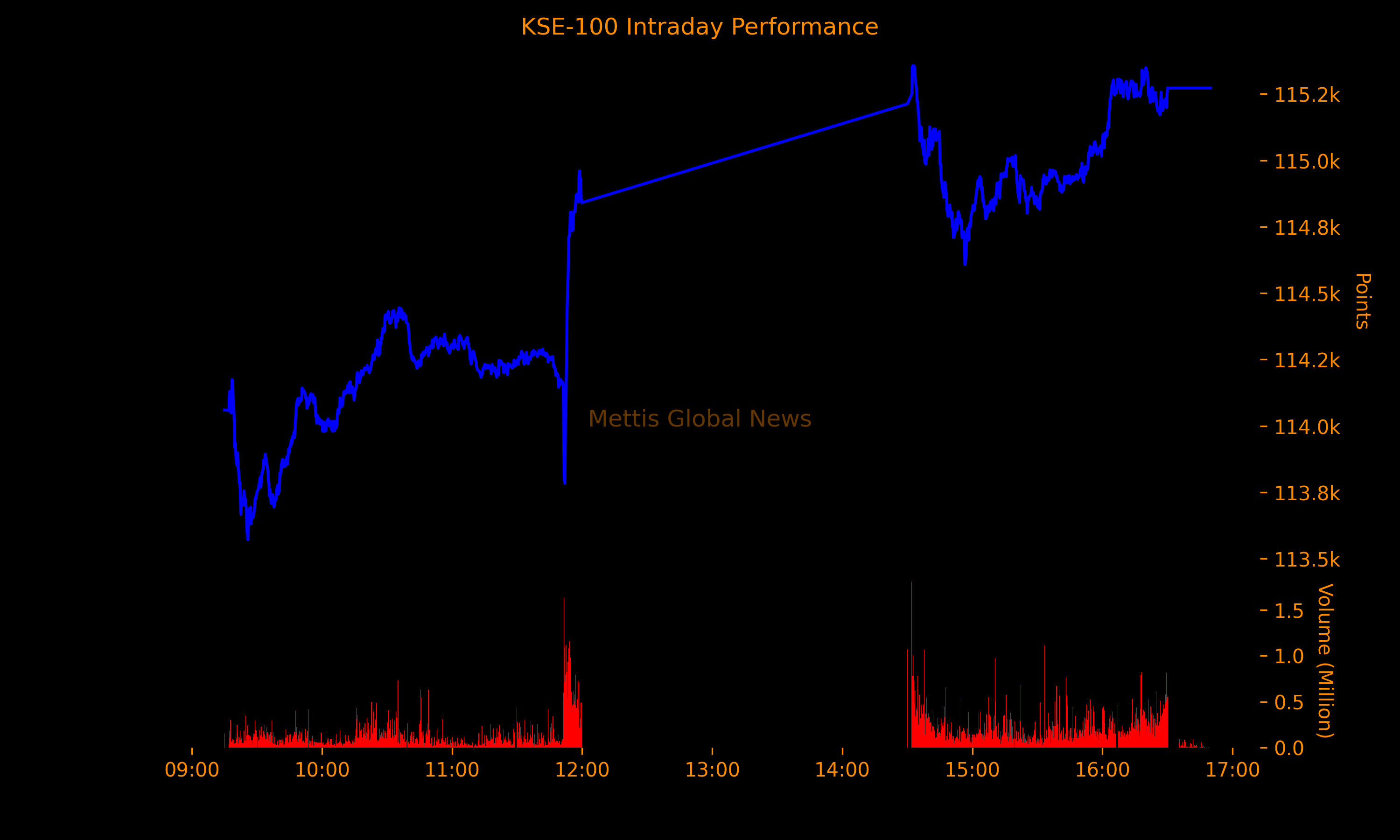

January 17, 2025 (MLN): The benchmark KSE-100 Index concluded Friday's trading session at 115,272.08, showing an increase of 1,435.34 points or 1.26%.

The index traded in a range of 1,784.17 points showing an intraday high of 115,356.12 (+1,519.38) and a low of 113,571.95 (-264.79) points.

The total volume of the KSE-100 Index was 212.26 million shares.

The session began on a subdued note, with market participants closely monitoring a pivotal political judgment involving senior opposition leaders, while speaking to Mettis global Ali Najib Head of Sales Insight Securities said.

However, the bulls made a strong comeback after the announcement of the verdict just before the end of the AM session, he added.

The positive sentiment carried through the end of PM session, as investors viewed the decision as a step towards easing political uncertainty, he noted.

He further said that adding to the optimism was the better-than-expected current account surplus of USD 582 million for December 2024, which further bolstered market confidence.

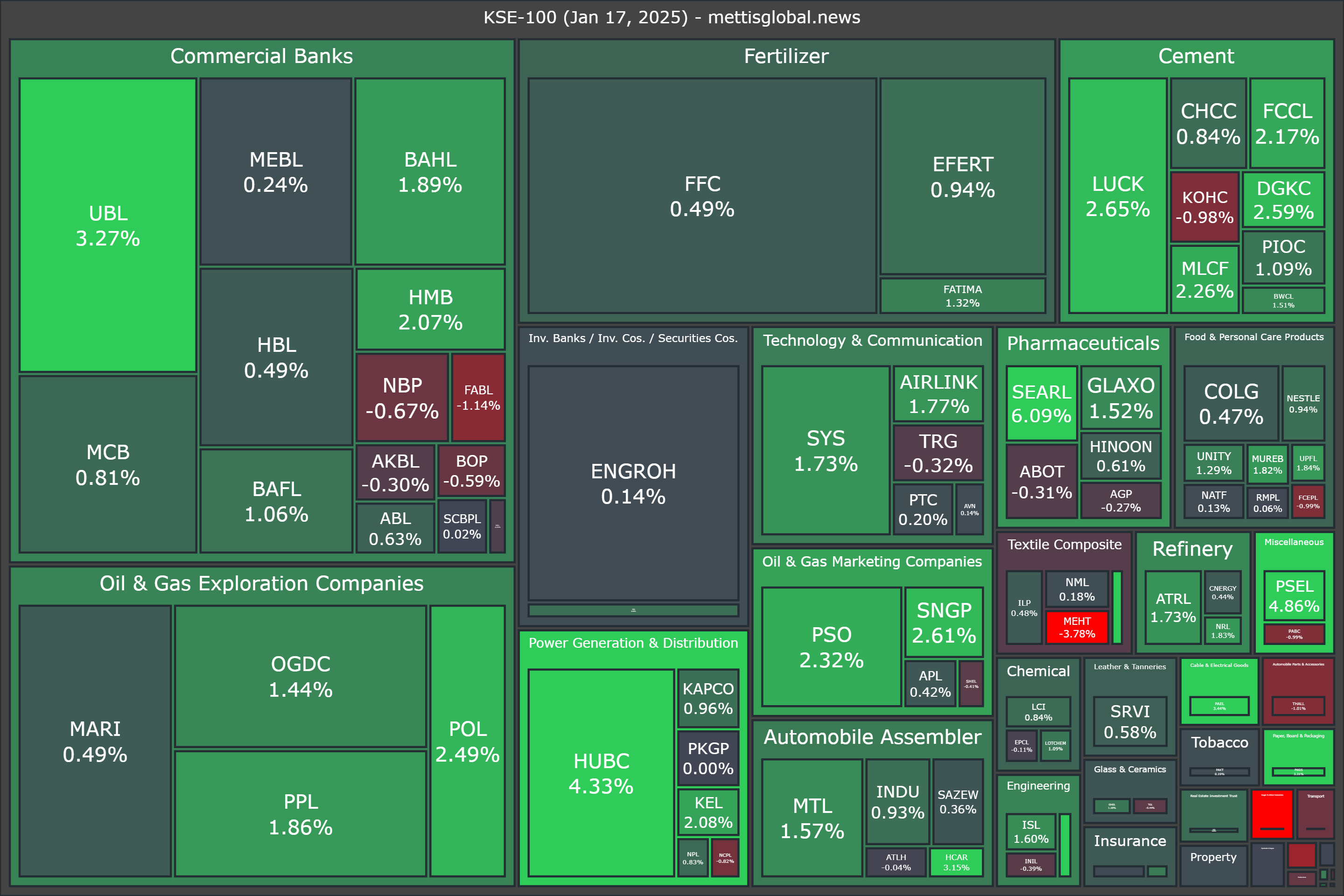

Of the 100 index companies 72 closed up, 25 closed down, while 3 were unchanged.

Top gainers during the day were PGLC (+6.25%), SEARL (+6.09%), PSEL (+4.86%), HUBC (+4.33%), and KTML (+4.12%).

On the other hand, top losers were JDWS (-3.91%), MEHT (-3.78%), HGFA (-1.43%), FABL (-1.14%), and THALL (-1.01%).

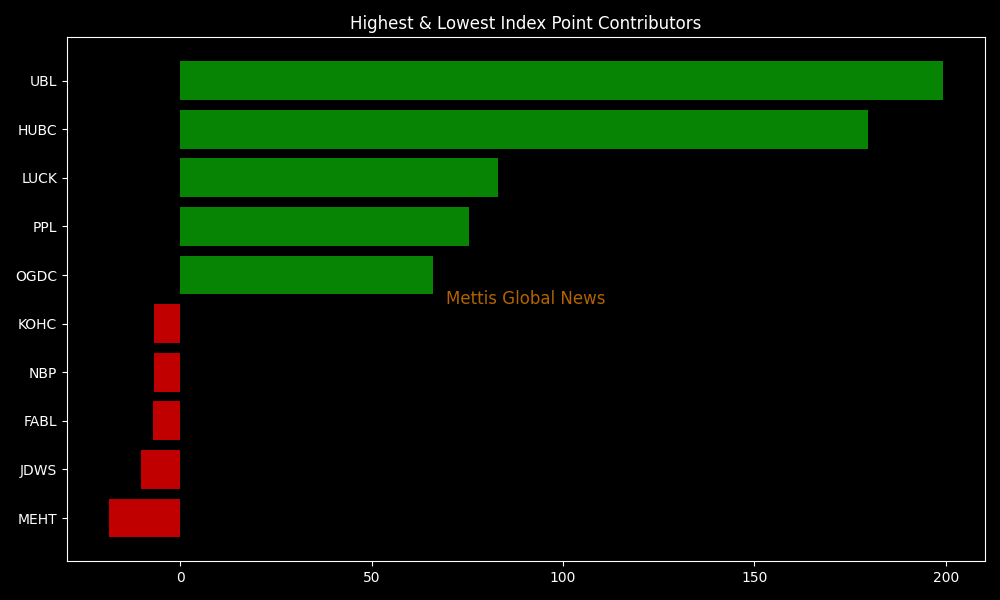

In terms of index-point contributions, companies that propped up the index were UBL (+199.36pts), HUBC (+179.75pts), LUCK (+83.05pts), PPL (+75.38pts), and OGDC (+66.08pts).

Meanwhile, companies that dragged the index lower were MEHT (-18.71pts), JDWS (-10.16pts), FABL (-7.01pts), NBP (-6.93pts), and KOHC (-6.91pts).

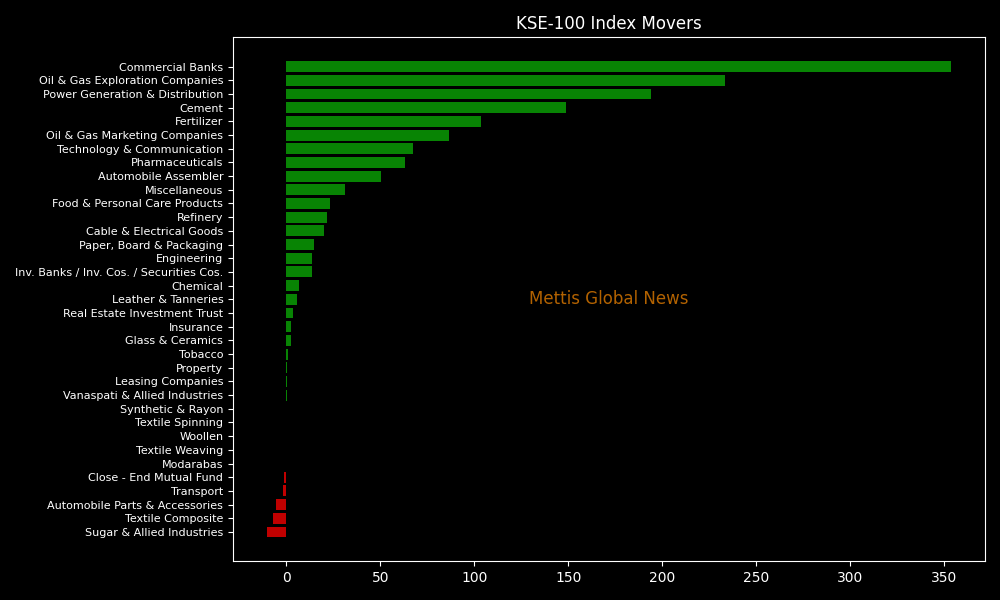

Sector-wise, KSE-100 Index was supported by Commercial Banks (+353.51pts), Oil & Gas Exploration Companies (+233.22pts), Power Generation & Distribution (+194.01pts), Cement (+148.56pts), and Fertilizer (+103.56pts).

While the index was let down by Sugar & Allied Industries (-10.16pts), Textile Composite (-6.90pts), Automobile Parts & Accessories (-5.57pts), Transport (-1.56pts), and Close-End Mutual Fund (-1.37pts).

In the broader market, the All-Share Index closed at 71,553.93 with a net gain of 782.73 points or 1.11%.

Total market volume was 549.58 million shares compared to 469.44m from the previous session while traded value was recorded at Rs35.93 billion showing an increase of Rs10.95bn.

There were 296,604 trades reported in 461 companies with 265 closing up, 127 closing down, and 69 remaining unchanged.

| Symbol | Price | Change % | Volume |

|---|---|---|---|

| WTL | 1.87 | 0.54% | 101,934,297 |

| HUBC | 137.4 | 4.33% | 36,888,747 |

| HASCOLNC | 12.9 | 6.61% | 32,496,536 |

| DFML | 49.12 | 7.39% | 28,438,701 |

| CPHL | 77.09 | 10.00% | 24,244,731 |

| FFL | 17.21 | 1.36% | 16,809,928 |

| CNERGY | 6.91 | 0.44% | 16,567,302 |

| KEL | 4.91 | 2.08% | 16,176,076 |

| PRL | 43.04 | 2.33% | 14,466,388 |

| SEARL | 106.41 | 6.09% | 14,305,050 |

To note, the KSE-100 has gained 36,827 points or 46.95% during the fiscal year, whereas it has increased 145 points or 0.13% so far this calendar year.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 144,989.23 96.45M | -7.94% -12506.87 |

| ALLSHR | 87,634.97 150.60M | -7.00% -6592.04 |

| KSE30 | 44,435.55 39.42M | -8.06% -3894.66 |

| KMI30 | 205,863.10 35.59M | -8.38% -18824.23 |

| KMIALLSHR | 56,361.24 97.12M | -7.36% -4477.85 |

| BKTi | 42,165.06 14.44M | -7.31% -3324.90 |

| OGTi | 30,063.57 4.39M | -6.30% -2019.90 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 67,350.00 | 67,795.00 65,685.00 | -945.00 -1.38% |

| BRENT CRUDE | 115.40 | 119.50 99.00 | 22.71 24.50% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -11.85 -10.65% |

| ROTTERDAM COAL MONTHLY | 127.00 | 0.00 0.00 | 0.05 0.04% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 113.23 | 119.48 98.00 | 22.33 24.57% |

| SUGAR #11 WORLD | 14.09 | 14.17 13.69 | 0.37 2.70% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.png?width=280&height=140&format=Webp)