PSX Closing Bell: Empty Spaces

MG News | January 28, 2022 at 09:58 PM GMT+05:00

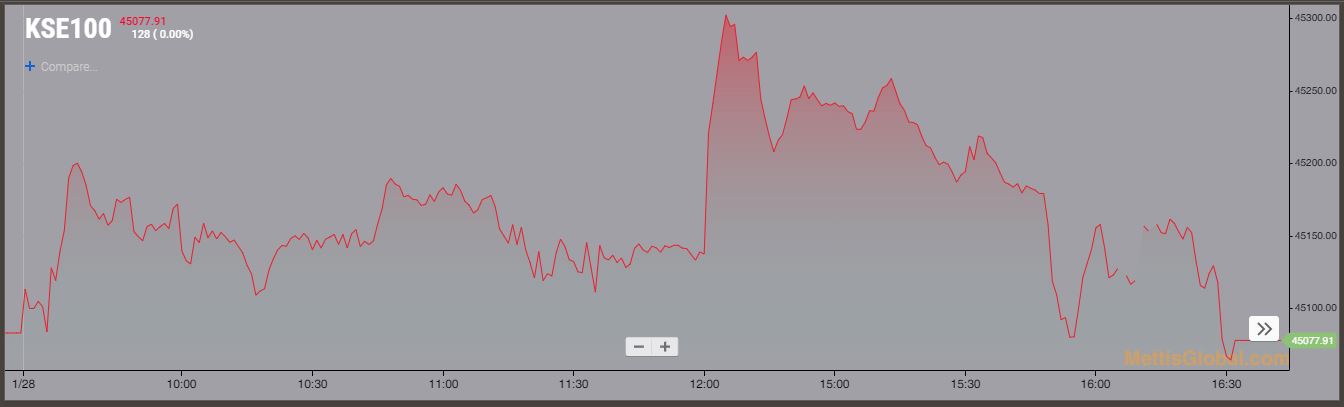

January 28, 2022 (MLN): The capital market observed a volatile trading session on Friday as the index swayed between an intraday low of 45,042.25, down by 40.79 points and a high of 45,311.10, up by 229 points.

Investors cheered the amendment bill of SBP by Senate today which offset some of the previous losses. However, profit-taking during the later hours led the index to close flat.

Accordingly, the benchmark KSE100 index ended the trading session with a drop of 5.13 points to settled at 45,077.91.

Of the 92 traded companies in the KSE100 Index, 50 closed up 38 closed down, while 4 remained unchanged. The total volume traded for the index was 89.32 million shares.

Sector-wise, the index was let down by Cement with 39 points, Oil & Gas Exploration Companies with 18 points, Chemical with 13 points, Oil & Gas Marketing Companies with 11 points and Automobile Assembler with 3 points.

The most points taken off the index was by LUCK which stripped the index of 39 points followed by COLG with 20 points, SYS with 16 points, MCB with 11 points and OGDC with 11 points.

Sectors propping up the index were Food & Personal Care Products with 20 points, Fertilizer with 14 points, Inv. Banks / Inv. Cos. / Securities Cos. with 11 points, Tobacco with 10 points and Textile Composite with 6 points.

The most points added to the index was by TRG which contributed 16 points followed by BAFL with 15 points, PAKT with 10 points, DAWH with 9 points and EFERT with 8 points.

All Share Volume increased by 85.32 million to 258.91 million Shares. Market Cap increased by Rs10.47 billion.

Total companies traded were 333 compared to 333 from the previous session. Of the scrips traded 200 closed up, 113 closed down while 20 remained unchanged.

Total trades increased by 13,582 to 95,443.

Value Traded increased by 1.56 billion to Rs8.13 billion

| Company | Volume |

|---|---|

| Hum Network | 37,883,500 |

| Worldcall Telecom | 31,457,000 |

| Ghani Global Holdings | 16,530,000 |

| TRG Pakistan | 11,853,813 |

| Engro Fertilizers | 10,252,501 |

| Telecard | 9,988,500 |

| Unity Foods | 6,736,982 |

| Al Shaheer Corporation | 5,623,000 |

| Bank Alfalah | 5,486,000 |

| Waves Singer Pakistan | 4,904,000 |

| Sector | Volume |

|---|---|

| Technology & Communication | 100,880,650 |

| Food & Personal Care Products | 22,667,643 |

| Chemical | 21,441,190 |

| Commercial Banks | 18,927,127 |

| Fertilizer | 12,269,989 |

| Engineering | 10,032,641 |

| Power Generation & Distribution | 9,704,342 |

| Cement | 8,201,020 |

| Refinery | 6,443,212 |

| Cable & Electrical Goods | 5,809,350 |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,412.25 167.69M | 0.32% 447.43 |

| ALLSHR | 85,702.96 423.92M | 0.15% 131.52 |

| KSE30 | 42,254.84 82.09M | 0.43% 180.24 |

| KMI30 | 194,109.59 84.37M | 0.15% 281.36 |

| KMIALLSHR | 56,713.67 217.03M | 0.03% 16.37 |

| BKTi | 37,831.34 13.04M | 1.62% 603.62 |

| OGTi | 27,440.63 3.93M | -0.09% -23.70 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,665.00 | 118,670.00 117,905.00 | 1045.00 0.89% |

| BRENT CRUDE | 73.47 | 73.63 71.75 | 0.96 1.32% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 70.36 | 70.37 70.18 | 0.36 0.51% |

| SUGAR #11 WORLD | 16.46 | 16.58 16.37 | -0.13 -0.78% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|