PSX Closing Bell: Do or Do Not

By MG News | May 13, 2024 at 04:21 PM GMT+05:00

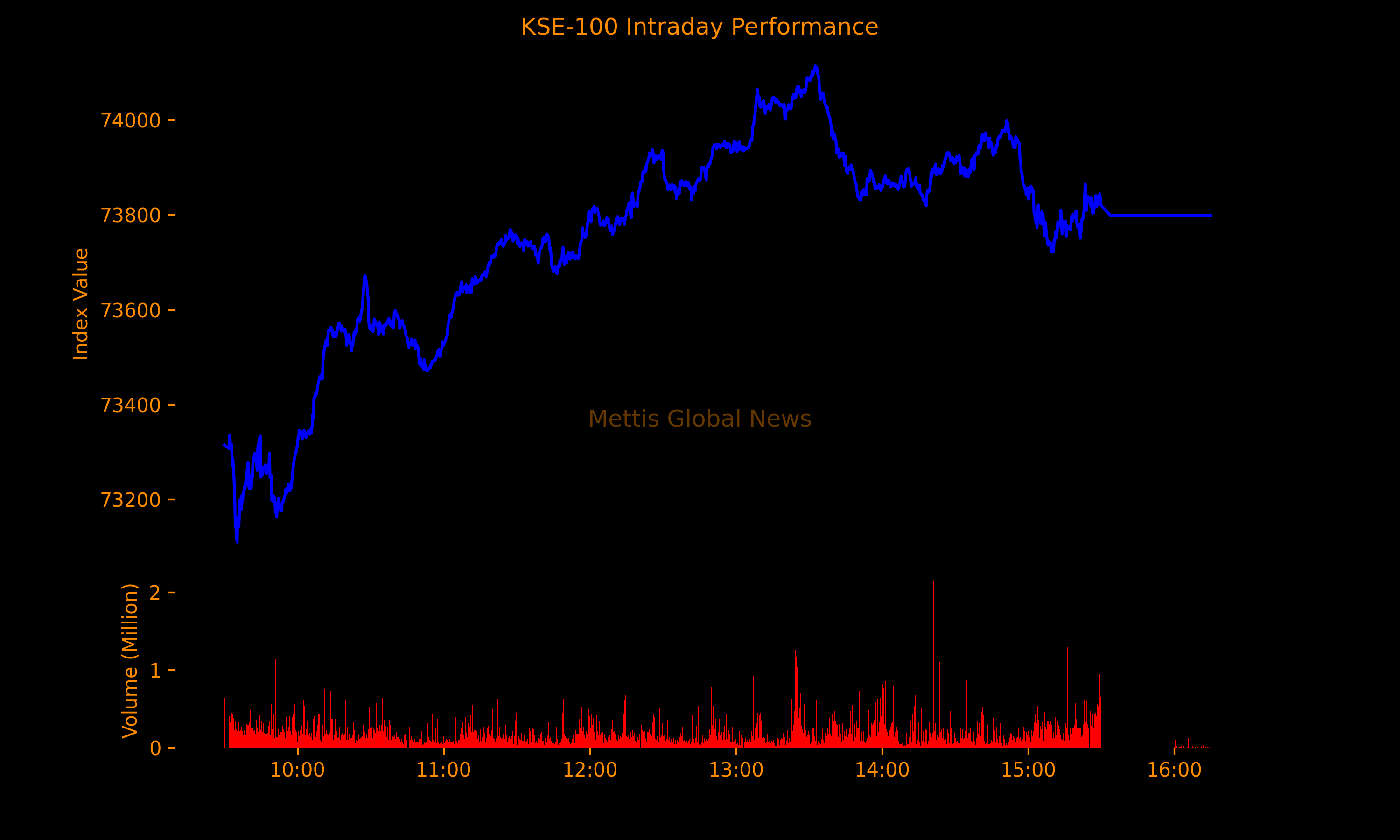

May 13, 2024 (MLN): Pakistan stocks extended their bullish rally on Monday, with its benchmark KSE-100 index surging 713.61 points or 0.98% to conclude Monday's trading session at 73,799.11.

The index remained positive throughout the day, showing an intraday high of 74,114.23 (+1,028.73) and a low of 73,109.76 (+24.26) points.

The total volume of the KSE-100 index was 308.96 million shares.

The positivity comes amid bets for a rate cut as early as June, following a fourth consecutive decline in weekly inflation.

Accordingly, the CPI-based inflation for May is expected to fall to about 14-15% YoY, expanding real interest rates to 7-8%.

Yesterday, Finance Minister Muhammad Aurangzeb said that formal discussions between Pakistan and the International Monetary Fund (IMF) will kick off from Monday for a longer and bigger program.

Highlighting the objectives behind the program, Aurangzeb emphasized the need to solidify the existing macroeconomic stability and implement structural reforms.

These reforms will primarily focus on three key sectors: the tax-to-GDP ratio, the state-owned enterprises (SOEs) reforms, and energy.

In Monday's trading session, of the 100 index companies 66 closed up, 29 closed down, 4 were unchanged, while 1 remained untraded.

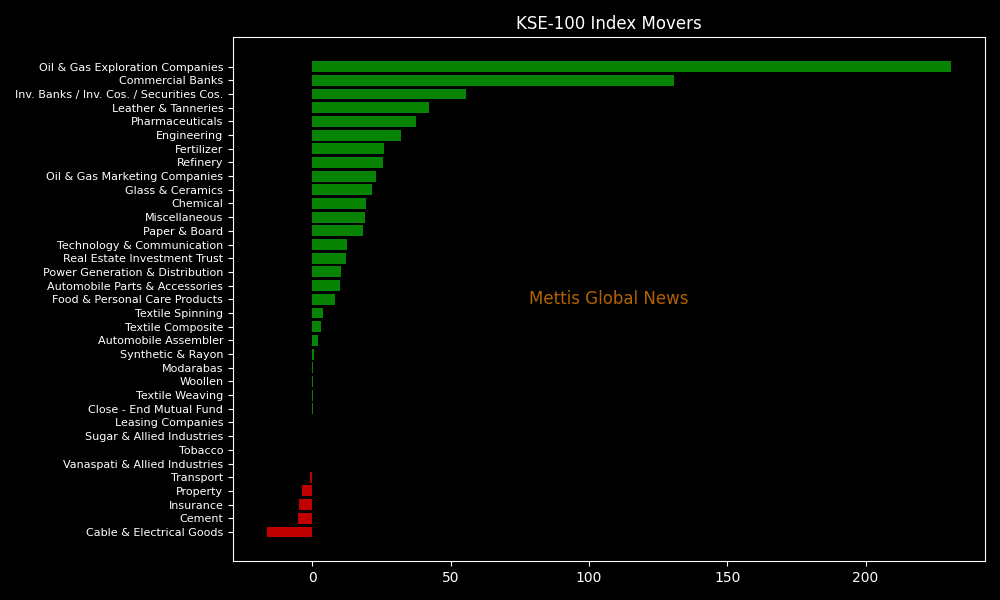

KSE-100 index was supported by Oil & Gas Exploration Companies (230.8pts), Commercial Banks (130.75pts), Inv. Banks / Inv. Cos. / Securities Cos. (55.51pts), Leather & Tanneries (42.13pts), and Pharmaceuticals (37.53pts).

On the flip-side, the index was let down by Cable & Electrical Goods (16.35pts), Cement (5.2pts), Insurance (4.78pts), Property (3.82pts), and Transport (1.02pts).

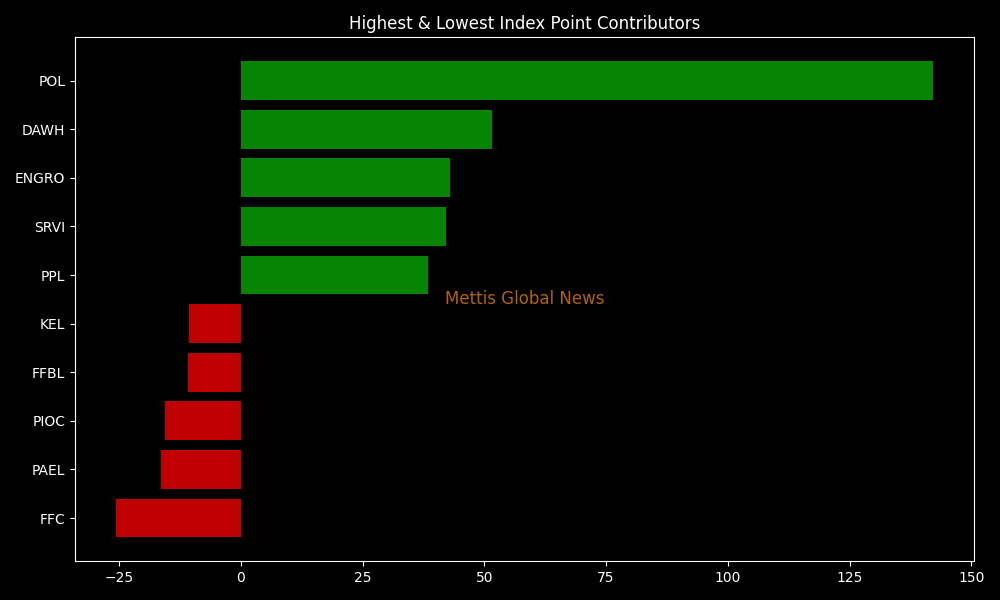

Companies adding points to the index were POL (142.2pts), DAWH (51.68pts), ENGRO (43.04pts), SRVI (42.13pts), and PPL (38.48pts).

Meanwhile, companies that dragged the index lower were FFC (25.61pts), PAEL (16.35pts), PIOC (15.52pts), FFBL (10.79pts), and KEL (10.55pts).

In the broader market, the All-Share index closed at 47,934.88 with a net gain of 388.34 points.

Total market volume was 721.60 million shares compared to 741.20m from the previous session while traded value was recorded at Rs25.65 billion showing an increase of Rs377.22m.

There were 297,017 trades reported in 385 companies with 240 closing up, 119 closing down and 26 remaining unchanged.

| Company | Volume |

|---|---|

| CNERGY | 64,224,241 |

| WTL | 51,639,862 |

| HUMNL | 29,028,603 |

| PAEL | 27,558,689 |

| FCCL | 21,206,203 |

| KEL | 20,092,701 |

| GGL | 17,550,765 |

| ASL | 16,563,667 |

| MLCF | 16,268,606 |

| POWER | 15,463,723 |

To note, the KSE-100 has gained 32,346 points or 78.03% during the fiscal year, whereas the ongoing calendar year has witnessed a cumulative increase of 11,348 points, equivalent to 18.17%.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 125,627.31 258.99M |

1.00% 1248.25 |

| ALLSHR | 78,584.71 1,142.41M |

1.16% 904.89 |

| KSE30 | 38,153.79 69.25M |

0.63% 238.06 |

| KMI30 | 184,886.50 91.38M |

0.01% 13.72 |

| KMIALLSHR | 53,763.81 554.57M |

0.54% 290.61 |

| BKTi | 31,921.68 33.15M |

1.78% 557.94 |

| OGTi | 27,773.98 9.65M |

-0.40% -112.21 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,055.00 | 109,565.00 107,195.00 |

570.00 0.53% |

| BRENT CRUDE | 66.64 | 67.20 65.92 |

-0.16 -0.24% |

| RICHARDS BAY COAL MONTHLY | 97.00 | 97.00 97.00 |

1.05 1.09% |

| ROTTERDAM COAL MONTHLY | 107.65 | 107.65 105.85 |

1.25 1.17% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 64.97 | 65.82 64.50 |

-0.55 -0.84% |

| SUGAR #11 WORLD | 16.19 | 16.74 16.14 |

-0.52 -3.11% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|