PSX Closing Bell: Do not Resuscitate

MG News | February 16, 2022 at 05:59 PM GMT+05:00

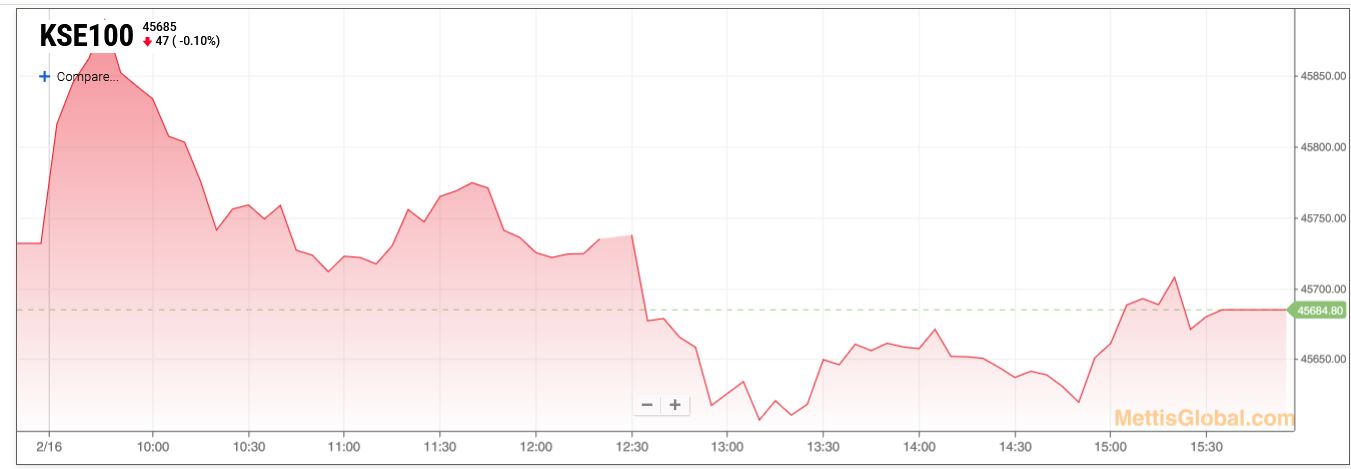

February 16, 2022 (MLN): Pakistan’s stock market remained under pressure today as it concluded the session on a negative note, declining by 47% points or 0.1% DoD to settle at 45,685 points.

“Local indices witnessed bearish spell as negative sentiments stemmed from the speculations regarding hike in inflation owing to increase in prices of petroleum products,” Aba Ali Habib Securities in its market closing note said.

Moreover, investors remained cautious on the back of uncertainty in domestic politics and concerns over Russia Ukraine conflict.

The Index traded in a range of 301.04 points or 0.66 percent of previous close, showing an intraday high of 45,904.69 and a low of 45,603.65.

Of the 92 traded companies in the KSE100 Index 34 closed up 53 closed down, while 5 remained unchanged. Total volume traded for the index was 78.14 million shares.

Sector wise, the index was let down by Commercial Banks with 28 points, Cement with 28 points, Oil & Gas Marketing Companies with 12 points, Oil & Gas Exploration Companies with 6 points and Sugar & Allied Industries with 4 points.

The most points taken off the index was by HMB which stripped the index of 15 points followed by HBL with 11 points, LUCK with 11 points, AKBL with 8 points and MLCF with 8 points.

Sectors propping up the index were Textile Composite with 11 points, Power Generation & Distribution with 10 points, Automobile Assembler with 8 points, Fertilizer with 8 points and Tobacco with 5 points.

The most points added to the index was by ENGRO which contributed 11 points followed by MEBL with 9 points, MTL with 9 points, HUBC with 8 points and POL with 6 points.

All Share Volume decreased by 129.27 Million to 145.31 Million Shares. Market Cap decreased by Rs.6.77 Billion.

Total companies traded were 339 compared to 336 from the previous session. Of the scrips traded 135 closed up, 181 closed down while 23 remained unchanged.

Total trades decreased by 37,690 to 64,102.

Value Traded decreased by 2.62 Billion to Rs.4.14 Billion

| Company | Volume |

|---|---|

| K-Electric | 23,646,000 |

| Worldcall Telecom | 17,057,500 |

| Faysal Bank | 10,139,000 |

| Hum Network | 7,452,219 |

| The Bank of Punjab | 5,862,500 |

| Engro Polymer & Chemicals | 5,532,000 |

| TPL Properties | 5,093,500 |

| Ghani Global Holdings | 4,563,500 |

| TRG Pakistan | 4,407,428 |

| Telecard | 4,152,397 |

| Sector | Volume |

|---|---|

| Technology & Communication | 39,002,458 |

| Power Generation & Distribution | 28,850,963 |

| Commercial Banks | 20,273,155 |

| Chemical | 11,572,130 |

| Food & Personal Care Products | 6,114,269 |

| Miscellaneous | 6,005,200 |

| Cement | 4,945,431 |

| Fertilizer | 3,390,178 |

| Textile Composite | 3,301,483 |

| Refinery | 3,156,929 |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,412.25 167.69M | 0.32% 447.43 |

| ALLSHR | 85,702.96 423.92M | 0.15% 131.52 |

| KSE30 | 42,254.84 82.09M | 0.43% 180.24 |

| KMI30 | 194,109.59 84.37M | 0.15% 281.36 |

| KMIALLSHR | 56,713.67 217.03M | 0.03% 16.37 |

| BKTi | 37,831.34 13.04M | 1.62% 603.62 |

| OGTi | 27,440.63 3.93M | -0.09% -23.70 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 119,080.00 | 119,080.00 117,905.00 | 1460.00 1.24% |

| BRENT CRUDE | 72.74 | 72.82 72.70 | -0.50 -0.68% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 70.33 | 70.41 70.18 | 0.33 0.47% |

| SUGAR #11 WORLD | 16.46 | 16.58 16.37 | -0.13 -0.78% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|