PSX Closing Bell: Comin' Apart at Every Nail

By MG News | November 24, 2021 at 06:01 PM GMT+05:00

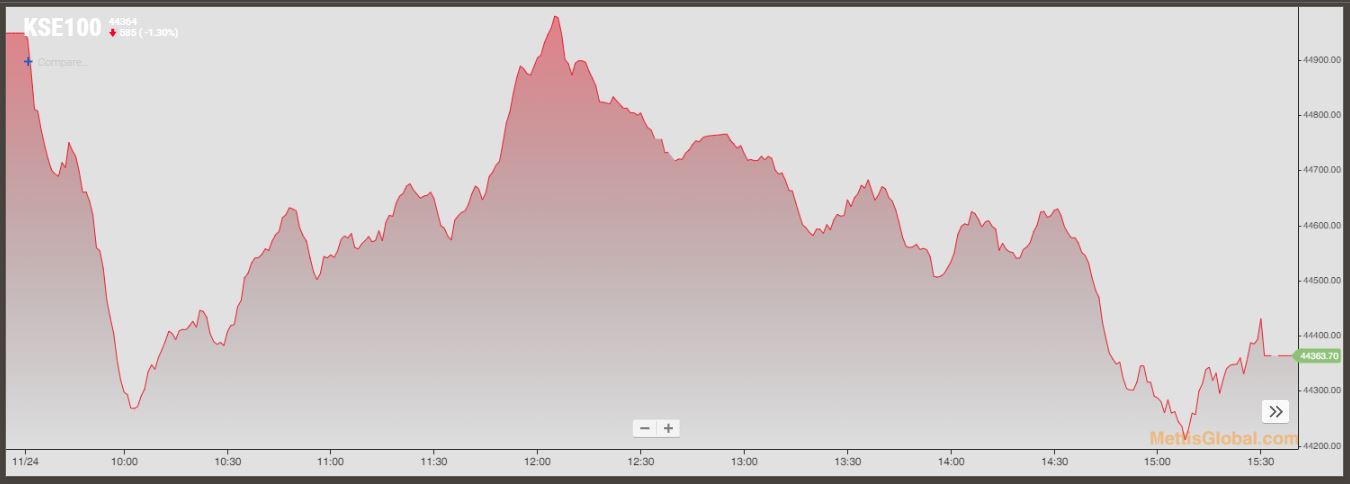

November 24, 2021 (MLN): Bearish sentiments continued to prevail on the trading floor for the third consecutive day on Wednesday as the benchmark KSE-100 index shed over 584 points to settle the trade at 44,363.70.

Lack of positive triggers and concerns over the fulfillment of the IMF conditions kept investors’ interests subdued.

The fund has rejected Pakistan's request to keep a door open for borrowing from the central bank and also did not agree on any meaningful accountability of the State Bank of Pakistan (SBP).

On the institutional front, a cautious stance was recorded due to the concerns of foreign selling spree in the upcoming MSCI re-balancing day, market closing note by Arif Habib Limited said.

Throughout the session, the index traded in a range of 775.21 points or 1.72 percent of the previous close, witnessing an intraday high of 44,984.28 and a low of 44,209.07.

Of the 92 traded companies in the KSE100 index, 17 closed up 72 closed down, while 3 remained unchanged. The total volume traded for the index was 140.13 million shares.

Sector-wise, the index was let down by commercial banks with 159 points, fertilizer with 124 points, cement with 118 points, pharmaceuticals with 49 points, and oil & gas marketing companies with 33 points.

The most points taken off the index was by LUCK which stripped the index of 76 points followed by ENGRO with 66 points, HBL with 55 points, FFC with 52 points, and MCB with 41 points.

Sectors propping up the index were technology & communication with 43 points and close-end Mutual fund with 2 points.

The most points added to the index were by SYS which contributed 34 points followed by UBL with 26 points, TRG with 20 points, MARI with 18 points, and KAPCO with 9 points.

All share volume increased by 45.78 Million to 310.39 million shares. Market cap decreased by Rs.87.85 Billion.

Total companies traded were 341 compared to 358 from the previous session. Of the scrips traded 76 closed up, 245 closed down while 20 remained unchanged.

Total trades increased by 15,533 to 134,244.

Value Traded increased by 3.22 Billion to Rs.12.95 Billion

| Company | Volume |

|---|---|

| TRG Pakistan | 26,519,206 |

| Worldcall Telecom | 24,680,000 |

| TPL Properties | 24,083,000 |

| Telecard | 15,433,000 |

| Byco Petroleum Pakistan | 14,779,000 |

| G3 Technologies | 13,059,000 |

| Hum Network | 11,665,500 |

| Fauji Foods Ltd(R) | 8,675,500 |

| Unity Foods | 6,736,506 |

| Treet Corporation | 6,694,500 |

| Sector | Volume |

|---|---|

| Technology & Communication | 87,985,596 |

| Food & Personal Care Products | 27,300,346 |

| Miscellaneous | 27,037,500 |

| Refinery | 20,983,268 |

| Commercial Banks | 19,877,810 |

| Chemical | 16,332,950 |

| Cement | 13,764,560 |

| Textile Weaving | 13,434,500 |

| Engineering | 9,916,996 |

| Power Generation & Distribution | 9,418,757 |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 132,653.56 95.74M |

-0.56% -749.63 |

| ALLSHR | 82,975.88 531.35M |

-0.26% -212.18 |

| KSE30 | 40,370.98 34.57M |

-0.69% -280.48 |

| KMI30 | 190,958.24 38.84M |

-0.59% -1125.68 |

| KMIALLSHR | 55,702.65 271.83M |

-0.26% -145.04 |

| BKTi | 36,200.45 6.07M |

-0.61% -222.43 |

| OGTi | 28,238.42 7.14M |

-0.70% -199.19 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 109,245.00 | 109,545.00 108,625.00 |

30.00 0.03% |

| BRENT CRUDE | 70.09 | 70.10 69.85 |

-0.06 -0.09% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

2.05 2.15% |

| ROTTERDAM COAL MONTHLY | 106.65 | 106.65 106.25 |

0.50 0.47% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.27 | 68.29 67.78 |

-0.06 -0.09% |

| SUGAR #11 WORLD | 16.15 | 16.37 16.10 |

-0.13 -0.80% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.png)