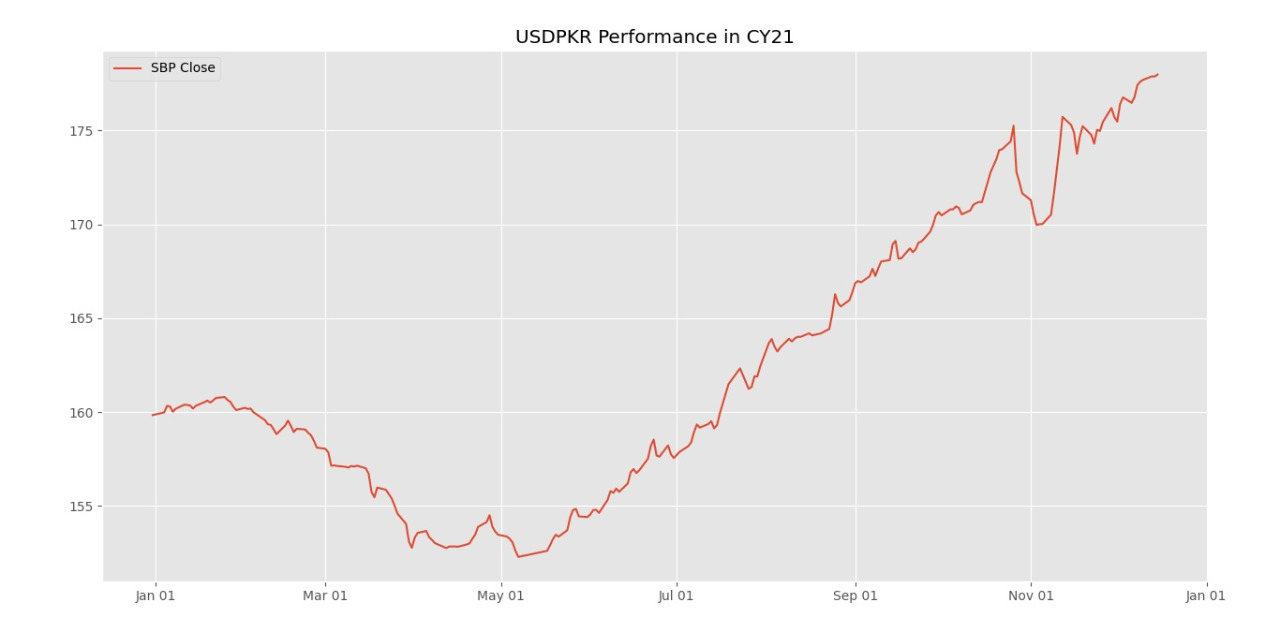

PKR closes fresh low of 177.98

By MG News | December 15, 2021 at 04:45 PM GMT+05:00

December 15, 2021 (MLN): Rattled by worries amid persistent weak economic indicators, the Pakistani rupee (PKR) resumed its downward spiral, falling by 10 paisa against US Dollar (USD) in today's interbank session as the currency closed the day's trade at PKR 177.98 per USD, a fresh all-time low.

Yesterday, the local unit has closed the trade at PKR 177.88 per USD.

The rupee endured a relatively dull trading session with very little intraday movement, trading in a range of 10 paisa per USD showing an intraday high bid of 177.95 and an intraday low offer of 177.95.

Soaring import bill and depleting forex reserves have been continuously building up the pressure on the rupee that also pushed inflation higher. In order to counter inflationary pressures and ensure sustainable growth, the State Bank of Pakistan (SBP) once again raised the policy rate by 100 bps to 9.75%.

Asad Rizvi, the Former Treasury Head at Chase Manhattan said, for PKR moves, the focus will shift on mini-budget.

“As per monetary policy announced yesterday, if $13bn or 4% CAD to GDP is okay as funding arrangements are available, then the market will follow domestic Agri growth/int’l commodity prices & imports.” Adding, “Complacent approach or higher prices will not be sustainable.”

Within the open market, PKR was traded at 180/181 per USD.

The local unit has depreciated by 11.48% or PKR20.44 in the fiscal year-to-date against the USD. Similarly, the rupee has weakened by 10.20% or PKR18.15 in CY21, with the month-to-date (MTD) position showing a decline of 1.27%, as per data compiled by Mettis Global.

Meanwhile, the currency lost 1.1 rupees to the Pound Sterling as the day's closing quote stood at PKR 235.85 per GBP, while the previous session closed at PKR 234.78 per GBP.

Similarly, PKR's value weakened by 7 paisa against EUR which closed at PKR 200.48 at the interbank today.

On another note, within the money market, the overnight repo rate towards the close of the session was 10.10/10.40 percent, whereas the 1-week rate was 9.60/9.70 percent.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 131,176.40 73.64M |

0.37% 489.75 |

| ALLSHR | 81,639.81 346.18M |

0.41% 334.56 |

| KSE30 | 40,111.55 31.92M |

0.42% 166.10 |

| KMI30 | 191,132.18 37.36M |

0.23% 434.13 |

| KMIALLSHR | 55,131.55 169.19M |

0.10% 57.39 |

| BKTi | 35,005.42 6.16M |

1.26% 437.02 |

| OGTi | 28,583.18 2.85M |

-0.54% -156.17 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 109,565.00 | 110,525.00 109,375.00 |

-850.00 -0.77% |

| BRENT CRUDE | 68.43 | 68.89 68.38 |

-0.37 -0.54% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

-0.75 -0.76% |

| ROTTERDAM COAL MONTHLY | 108.45 | 109.80 108.45 |

-0.55 -0.50% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.72 | 67.18 66.69 |

-0.28 -0.42% |

| SUGAR #11 WORLD | 16.37 | 16.40 15.44 |

0.79 5.07% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.jpg)

FX Reserves

FX Reserves

CPI

CPI