Pioneer Cement's sales droop at the hands of surged international coal prices: PACRA

MG News | December 19, 2018 at 10:23 AM GMT+05:00

December 19, 2018 (MLN): Pakistan Credit Rating Agency (PACRA) has maintained entity ratings of Pioneer Cement Limited at ‘A’ for long-term and ‘A1’ for short-term, with a stable outlook forecast.

As per the press release issued by PACRA, the ratings reflect Pioneer Cement’s healthy business profile. The company has been operating a single manufacturing facility and its sales are majorly driven by local market fundamental – an industry wide phenomenon.

During FY18, industry dynamics have shifted significantly on account of lower retention prices, surged international coal prices, increase in FED on coal import. The aforementioned factors have affected the company’s sales.

The upcoming energy projects (12MW WHRPP and 24MW coal power plant) are likely to assist bottom-line in future through power cost savings. The company’s brown-field expansion – 2.2mln tpa – is expected to commission in 4QFY19. This will supplement company’s business profile given higher capacity utilization and adequate channeling of production.

The ratings are dependent on the management's ability to uphold margins, and optimal utilization of existing lines. Timely repayment of long term financing is essential. The company's improved business performance in current stretched economic scenario - challenges on demand front - remains vital for ratings.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 139,583.74 206.61M | 0.85% 1171.49 |

| ALLSHR | 86,474.29 386.22M | 0.90% 771.33 |

| KSE30 | 42,671.53 86.39M | 0.99% 416.69 |

| KMI30 | 196,869.67 87.95M | 1.42% 2760.08 |

| KMIALLSHR | 57,414.96 165.32M | 1.24% 701.29 |

| BKTi | 37,874.43 15.11M | 0.11% 43.09 |

| OGTi | 28,311.61 36.97M | 3.17% 870.97 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 119,470.00 | 119,785.00 117,905.00 | 1850.00 1.57% |

| BRENT CRUDE | 72.41 | 72.82 72.16 | -0.83 -1.13% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 70.05 | 70.41 69.80 | 0.05 0.07% |

| SUGAR #11 WORLD | 16.50 | 16.52 16.45 | 0.05 0.30% |

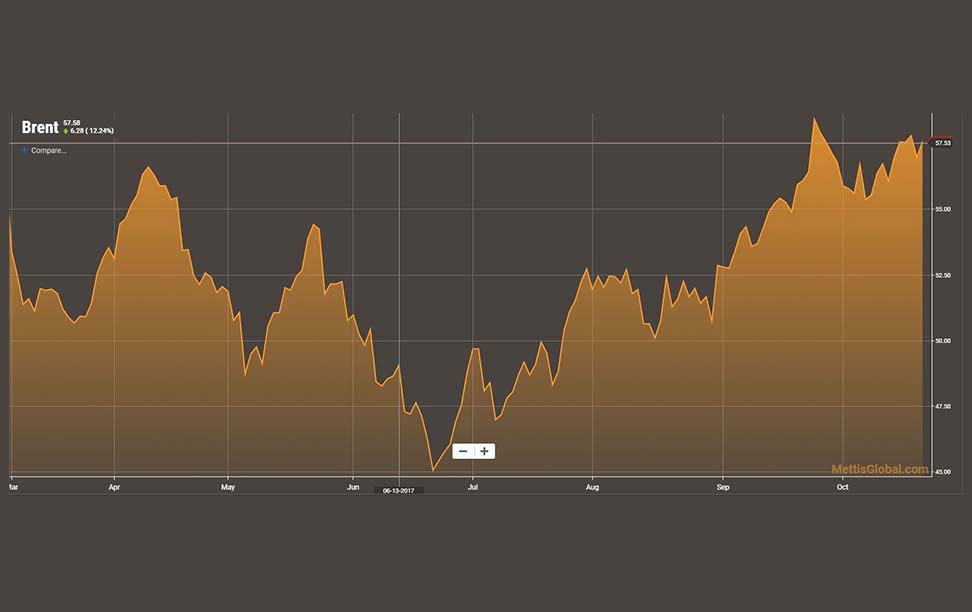

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Consumer Confidence Survey

Consumer Confidence Survey