Pakistan's retail payments reach 1,951mn in first quarter

By MG News | December 20, 2024 at 05:05 PM GMT+05:00

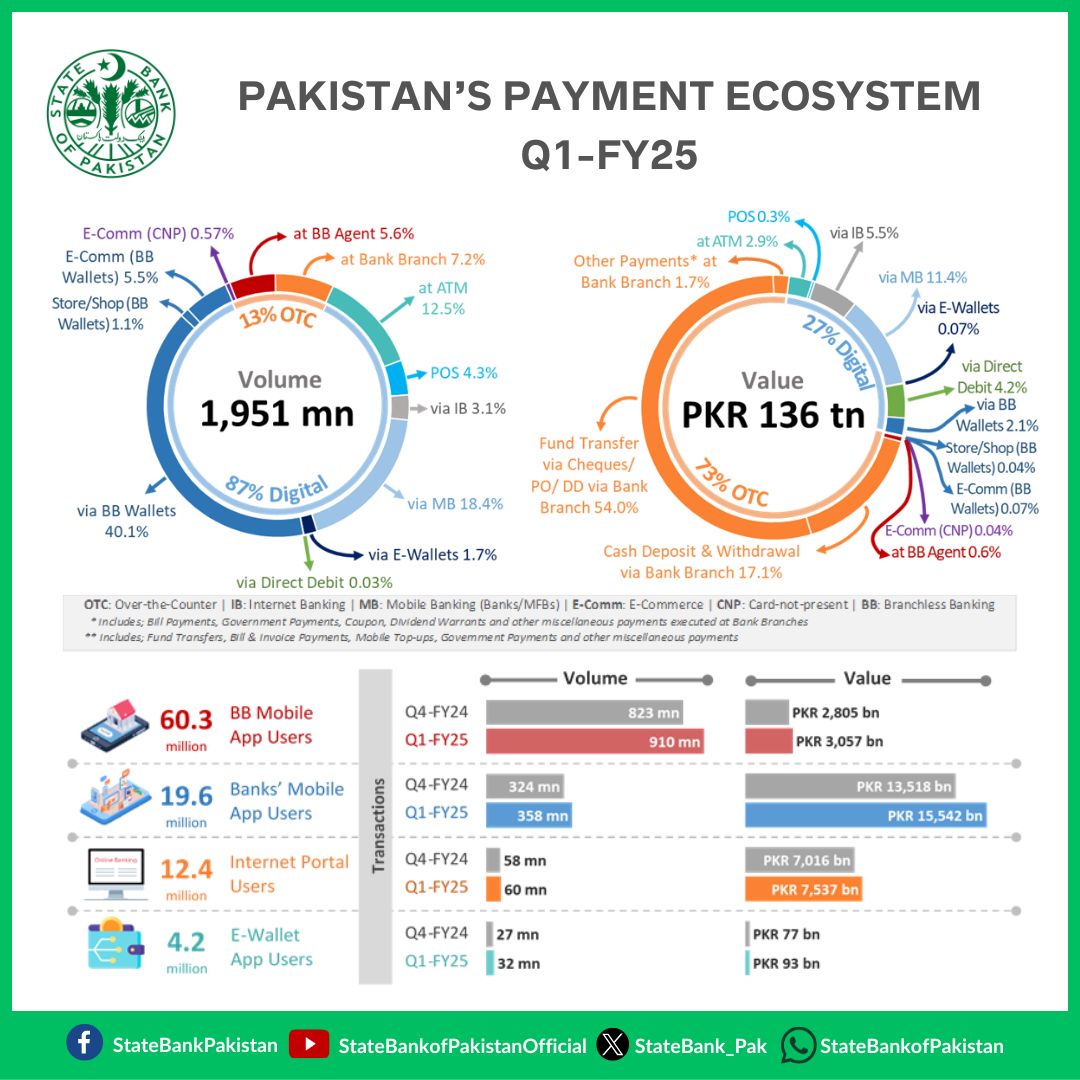

December 20, 2024 (MLN): Retail payments in Pakistan saw a strong increase in Q1 FY25, rising by 8% in volume to reach 1,951 million transactions.

The total value of these payments amounted to Rs136 trillion, according to the First Quarterly Review of Payment Systems for FY 25 released today.

Payments through digital channels witnessed a quarterly growth of 9% by both volume and value reaching 1,699mn amounting to Rs36tr.

Digital channels are now handling 87% of retail payments by volume, showcasing the public growing trust in digital payments.

Mobile banking apps provided by Banks, MFBs, BBs, and EMIs played a pivotal role in this growth, with 1,30mn transactions amounting to Rs19tr being carried out through these apps during the quarter, reflecting an 11% rise in volume and 14% in value.

The collective number of mobile banking app users grew by 4%, reaching 96.5mn from 93.0mn in the previous quarter.

E-commerce is also emerging as an integral component of Pakistan’s digital payments, with a 29% increase in online e-commerce payments.

Of the 118mn online e-commerce payments during the quarter, 91% were conducted through digital wallets, signifying a shift from traditional card-based systems.

Complementing this growth, the number of Point-of-Sale (POS) terminals expanded to 132,224, enabling 83mn transactions worth Rs429 billion.

Furthermore, the ATM network grew to 19,170 units, facilitating 243mn transactions worth Rs3.9tr, maintaining its key role as a cash withdrawal channel.

Efforts to include underserved segments have gained further momentum, with branchless banking agents playing a critical role in extending financial services, especially in rural and remote areas.

Over 693,178 agents processed 28mn bill payments/mobile top-ups and 75mn cash deposit and withdrawal transactions during the quarter.

Retail merchants accepting digital payments witnessed a 16% growth, driven by branchless banking initiatives that enable payments through mobile wallets, QR codes, and other digital tools.

These developments underscore the importance of alternative financial channels in bridging economic disparities across regions.

The report also highlights the success of the Raast instant payment system, which processed 197mn transactions worth Rs4.7tr, further enhancing the efficiency of instant payments for individuals and businesses alike.

Pakistan’s payment ecosystem continues to thrive due to the combined efforts of banks, fintechs, payment service providers, and regulators.

This collaborative approach has fostered innovation, accessibility, and a greater sense of financial inclusion across the country.

The SBP remains committed to driving a sustainable and inclusive financial future, ensuring that digital innovation continues to empower individuals and businesses.

The progress highlighted in this review reflects the nation’s potential to transition toward a fully digital economy while fostering trust and reliability in financial services.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 125,627.31 258.99M |

1.00% 1248.25 |

| ALLSHR | 78,584.71 1,142.41M |

1.16% 904.89 |

| KSE30 | 38,153.79 69.25M |

0.63% 238.06 |

| KMI30 | 184,886.50 91.38M |

0.01% 13.72 |

| KMIALLSHR | 53,763.81 554.57M |

0.54% 290.61 |

| BKTi | 31,921.68 33.15M |

1.78% 557.94 |

| OGTi | 27,773.98 9.65M |

-0.40% -112.21 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 107,610.00 | 107,860.00 107,555.00 |

-625.00 -0.58% |

| BRENT CRUDE | 66.63 | 67.20 65.92 |

-0.17 -0.25% |

| RICHARDS BAY COAL MONTHLY | 97.00 | 97.00 97.00 |

1.05 1.09% |

| ROTTERDAM COAL MONTHLY | 107.65 | 107.65 105.85 |

1.25 1.17% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 64.90 | 65.02 64.83 |

-0.21 -0.32% |

| SUGAR #11 WORLD | 16.19 | 16.74 16.14 |

-0.52 -3.11% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.jpg)