Pakistan’s GDP records 1.73% growth in Q2FY25

MG News | March 26, 2025 at 11:58 AM GMT+05:00

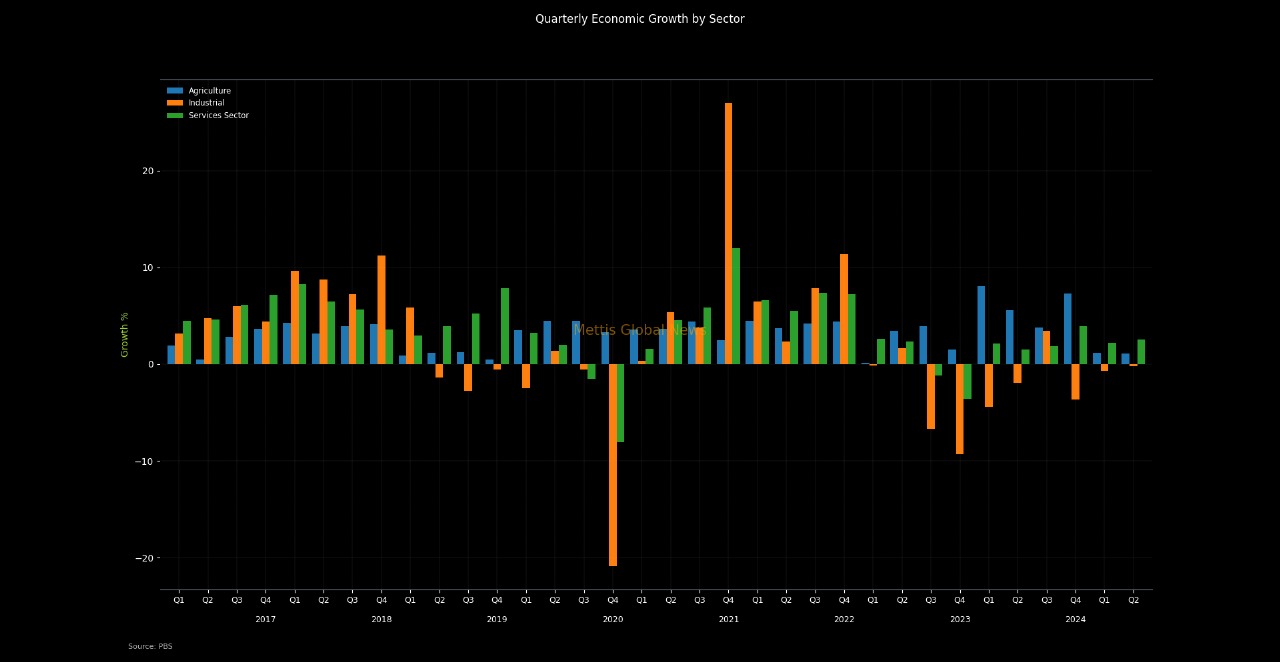

March 26, 2025 (MLN): Pakistan’s Gross Domestic Product (GDP) has posted a growth of 1.73% in the second quarter of FY25 despite contraction in industry of -0.18%.

This growth was bolstered by due to positive growth in agriculture (1.10%) and services (2.57%), according to the National Accounts Committee (NAC).

Due to upward revisions in services from 1.43% to 2.21% and improvement in the industrial sector from -1.03% to -0.66%, the overall updated growth during FY25Q1 stands at 1.34% as compared to 0.92% approved in the previous NAC meeting.

The 112th meeting of the NAC was held today wherein the committee approved the updated growth rate of GDP during Q1 and provisional growth rate during Q2 FY25.

The committee approved the updated growth of GDP during FY25Q1 at 1.34% as compared to 0.92% estimated previously.

The updated growth in agriculture has moved down to 0.74% from 1.15% mainly due to downward revision in other crops (from 2.08% to 0.43% due to decrease in production of green fodder (-1.9%) and forestry (from 0.78% to -2.07%).

The rate of contraction in industry moved down from 1.03% to 0.66% due to improvement in electricity, gas & water supply (from 0.58% to 1.37%) and construction (from -14.91 to -11.71%).

The mining and quarrying industry witnessed downward revisions from -6.49% to -8.06% due to decline in production of coal (-2.08%), limestone (- 8.01%) and other minerals (-5.47%).

Despite downward revisions in finance & insurance (from 1.14% to -0.28%), improvement in transport (from -0.07 % to 0.16%), public administration & social security (from -4.49% to 4.40%), education (from 2.03% to 4.76%) and health (from 5.60% to 6.70%) improved overall growth of services from 1.43% to 2.21%.

The growth in agriculture, industry and services stands at 1.10%, -0.18% and 2.57%, respectively.

During Q2, crops have contracted by 5.38%. The contraction of 7.65% in important crops is due to reduction in production of cotton (-30.7% from 10.22 to 7.084 million bales), maize (-15.4% from 9.74 to 8.24 million tons), rice (-1.4% from 9.86 to 9.72 million tons), and sugarcane (-2.3% from 87.64 to 85.62 million tons).

The wheat crop, which has no impact in Q1, has shown a decline of -6.8% in area as compared to last year. High base of 2023-24 has also resulted in decline in growth of important crops.

Other crops have shown a modest growth of 0.73% due to increase in area of potatoes (14.2%).

Livestock has increased by 6.51% as compared to 2.96% in Q2 last year mainly because of low base and partly due to decline in intermediate consumption i.e. dry and green fodders.

Forestry has declined by 0.64% due to lower production in KP and fishing industry has witnessed modest growth of 0.79%.

The rate of contraction in industry has slowed down from 1.81% in 2023-24Q2 to 0.18% in 2024-25Q2.

Mining and quarrying industry has contracted by 3.29% due to low quarterly production of mining products e.g. coal (-6.34%), gas (-6.16%) and crude oil (-11.4%) provided by the sources.

The LSM, driven by Quantum Index of Manufacturing (QIM), has declined by 2.86% due to negative contributions from sugar (-12.63%), cement (-1.82%), and iron & steel (-17.86%) during October-December. The electricity, gas and water supply industry has posted a growth of 7.71% due to increase in output of gas industry as well as decline in deflator.

The construction industry, estimated on the basis of production of construction inputs, has declined by 7.14% mainly due to reduction in production of cement (-1.82%) and iron & steel (-17.86%).

Despite contraction in wholesale & retail trade (-1.13% due to decline in output of LSM and imports), the services have grown by 2.57% as compared to 1.32% in Q2 last year.

Transportation & storage industry has grown by 1.15% due to increase in output of road transport, air transport, and water transport.

The slowdown in CPI-based inflation has resulted into positive contributions in real value added of industries primarily compiled at current prices including information and communication (8.45%), finance & insurance (10.21%), public administration & social security (9.10%), public sector education (4.80%) and health (6.60%).

Further, positive contributions have also been registered in accommodation and food services (4.45%), real estate activities (4.12%), and other private services (3.14%).

Overall, the forum appreciated the efforts of National Accounts team of PBS and key stakeholders including Ministry of Planning, Development and Special Initiatives, Ministry of Finance and State Bank of Pakistan in preparation of quarterly GDP.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 154,941.35 304.33M | -7.81% -13120.81 |

| ALLSHR | 92,804.64 519.27M | -7.58% -7614.18 |

| KSE30 | 47,253.88 150.24M | -7.93% -4068.51 |

| KMI30 | 216,336.87 122.67M | -8.07% -18988.25 |

| KMIALLSHR | 59,427.02 286.96M | -7.57% -4865.15 |

| BKTi | 45,237.12 54.60M | -7.90% -3878.30 |

| OGTi | 29,686.89 21.21M | -8.14% -2629.89 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 66,185.00 | 67,760.00 64,325.00 | -1640.00 -2.42% |

| BRENT CRUDE | 71.88 | 71.96 70.69 | 0.12 0.17% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.50 -3.52% |

| ROTTERDAM COAL MONTHLY | 107.95 | 107.95 107.95 | 0.30 0.28% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.60 | 66.67 65.38 | 0.12 0.18% |

| SUGAR #11 WORLD | 14.05 | 14.10 13.78 | 0.18 1.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.jpeg)

.png?width=280&height=140&format=Webp)