Pakistan’s Banking sector rises from the ashes after IMF deal

By Abdur Rahman | July 13, 2023 at 01:10 PM GMT+05:00

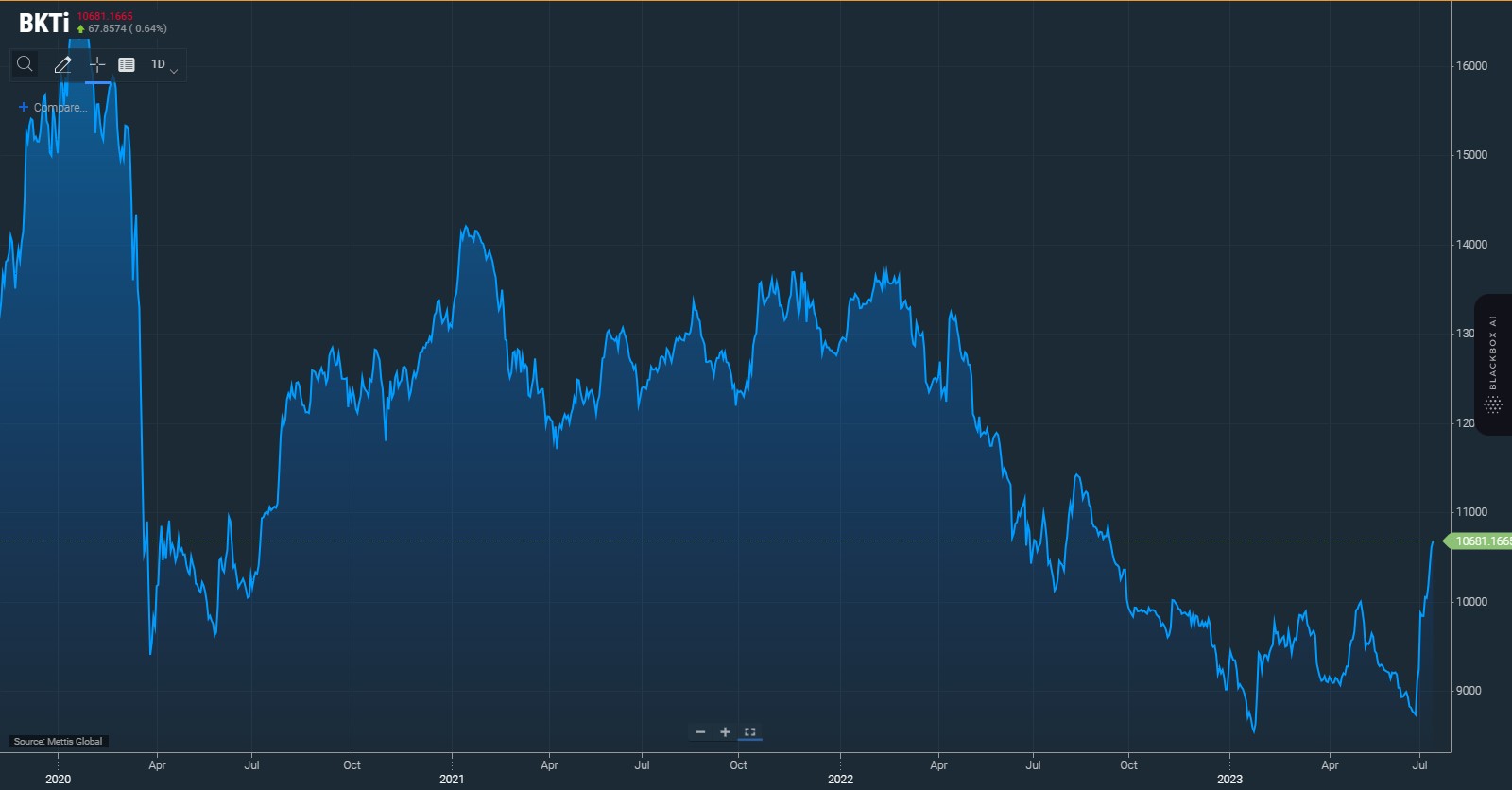

July 13, 2023 (MLN): The banking sector in Pakistan has left behind the dark days after being in the pit for so long, witnessing a remarkable rally in the last nine trading sessions since the signing of the Staff-level agreement of $3 billion with the International Monetary Fund (IMF) on top of other positive news inflows.

The Banking tradeable index (BKTI) which tracks the performance of 20 listed banks has gained 16.07% in the last nine trading sessions, outperforming the broader KSE-100 Index which has risen 10.88% in the same period.

The top performers in the banking sector are Meezan Bank Limited (MEBL), which has surged 30.96%, Faysal Bank Limited (FABL), which has jumped 17.74%, and Bank Alfalah Limited (BAFL), which has soared 16.14% since the market opened after the Eid-ul-Adha holidays.

| Banks | July 13, 2023 | June 27, 2023 | Change % |

|---|---|---|---|

| MEBL | 113.11 | 86.37 | 30.96% |

| FABL | 23.76 | 20.18 | 17.74% |

| BAFL | 35.35 | 30.44 | 16.13% |

| UBL | 134.4 | 117.54 | 14.34% |

| BAHL | 49.3 | 43.22 | 14.07% |

| MCB | 129.3 | 114.47 | 12.96% |

| AKBL | 14.25 | 12.96 | 9.95% |

| HBL | 80.31 | 73.23 | 9.67% |

| BOP | 3.8 | 3.47 | 9.51% |

| HMB | 33.01 | 30.22 | 9.23% |

| ABL | 72.5 | 67 | 8.21% |

| NBP | 20.9 | 19.48 | 7.29% |

| SCBPL | 22 | 21.75 | 1.15% |

Stock Close/Current Price

The banking sector, which accounts for about 21.13% of the KSE-100’s market capitalization, has been one of the main beneficiaries of the IMF deal, as the economy is expected to move towards stability with increasing Foreign Exchange Reserves and strengthening PKR.

BKTi Weekly time-frame chart

.jpg)

The aforementioned development comes at a time when Pakistan was struggling to meet its finances, with its foreign exchange reserves depleting rapidly.

To recall, as of June 30, 2023, the country's total reserves stood at $9.75bn.

Yesterday, the IMF executive board approved the 9-month Stand-By-Agreement (SBA) for Pakistan for an amount of $3 billion, with an immediate disbursement of $1.2bn to support the authorities’ economic stabilization program.

However, according to Bloomberg, the loans will allow the country to pay its debts through April 2024, more aid will be needed after that.

Apart from the IMF deal, the banking sector has also received a boost from other positive news inflows.

In the past three days, the State Bank of Pakistan (SBP) has received a $1.2bn immediate disbursement from IMF, a $1bn deposit from United Arab Emirates (UAE), and a $2bn deposit from Saudi Arabia.

Pakistan’s new SBA-supported program has started to pave new ways for financial support from multilateral and bilateral partners.

Investors’ confidence was also sparked when Fitch Ratings upgraded Pakistan's Long-Term Foreign-Currency Issuer Default Rating (IDR) to 'CCC' from 'CCC-' on July 10.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 132,576.99 161.03M |

-0.62% -826.20 |

| ALLSHR | 82,983.68 903.36M |

-0.25% -204.38 |

| KSE30 | 40,358.80 56.86M |

-0.72% -292.66 |

| KMI30 | 190,727.32 67.92M |

-0.71% -1356.60 |

| KMIALLSHR | 55,698.48 457.08M |

-0.27% -149.22 |

| BKTi | 36,242.06 11.15M |

-0.50% -180.82 |

| OGTi | 28,323.42 10.71M |

-0.40% -114.19 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 109,855.00 | 110,265.00 108,625.00 |

640.00 0.59% |

| BRENT CRUDE | 70.44 | 70.71 69.61 |

0.29 0.41% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.45 1.51% |

| ROTTERDAM COAL MONTHLY | 108.00 | 109.00 107.95 |

0.90 0.84% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.67 | 68.94 67.70 |

0.34 0.50% |

| SUGAR #11 WORLD | 16.55 | 16.61 16.08 |

0.42 2.60% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Worker Remittances

Worker Remittances