Pakistan Tax-to-GDP ratio remains dangerously low

Abdur Rahman | November 09, 2024 at 02:56 PM GMT+05:00

November 09, 2024 (MLN): Pakistan’s Tax-to-Gross Domestic Product (GDP) ratio remained low in fiscal year 2023-24 compared to its development needs and peers as the tax base remained too narrow.

The tax-to-GDP ratio, a key metric for assessing a country's tax revenue in relation to its GDP size, edged up to 8.77% in FY24 from 8.54% last year, the Federal Board of Revenue reported.

According to the World Bank, tax revenues that exceed 15% of a country's GDP are crucial for fostering economic growth and reducing poverty. Pakistan has remained well below that level in the past two decades.

Pakistan’s tax-to-GDP ratio has also remained significantly lower than the country’s capacity, which is estimated at 22.3% of GDP, according to World bank.

The ratio in Pakistan is also one of the lowest compared to emerging and developing economies, as well as its regional peers.

According to the State Bank of Pakistan (SBP), improving Pakistan's tax-to-GDP ratio can be achieved through the proper implementation of value-added tax (VAT), rationalization of corporate income tax (CIT) and tax expenditures, simplification of the overall tax system, efficient use of federal excise duties (FED), and strengthening tax administration.

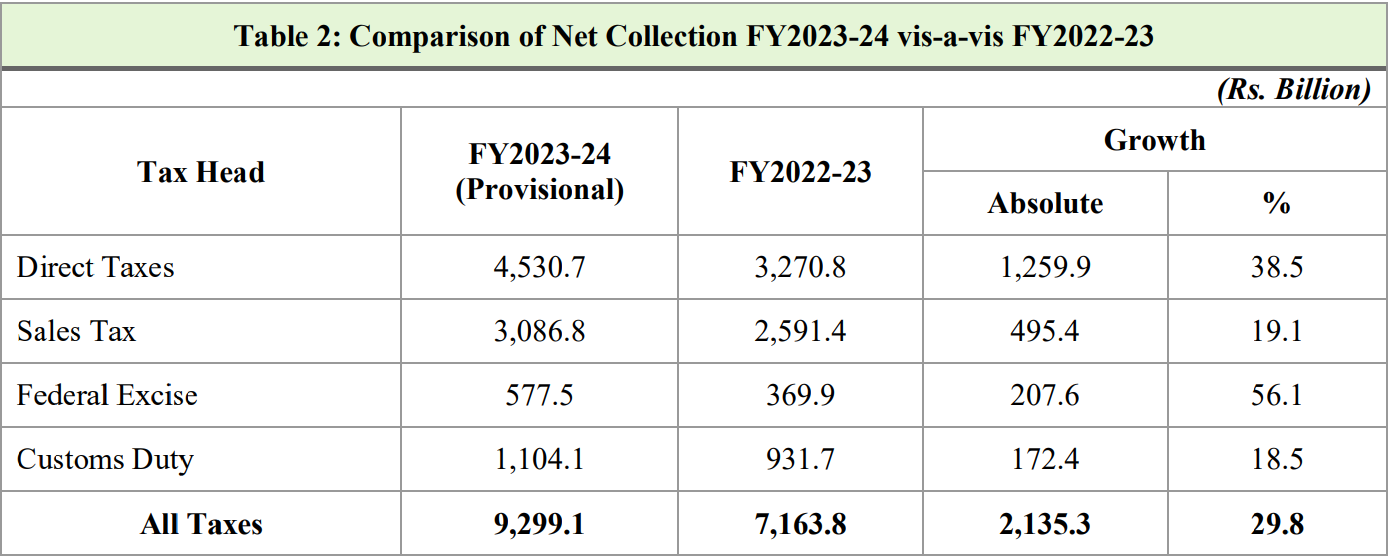

To note, in FY2023-24, FBR collected Rs9,299 billion taxes against Rs7,164bn collected in the previous financial year, indicating a growth of 29.8%.

All tax categories have shown growth: Federal Excise Duty (FED) collection increased by 56.1%, followed by direct taxes at 38.5%, sales tax at 19.1%, and customs duty at 18.5%.

The tax-to-GDP ratio offers insight into the general trajectory of tax policy and allows for global comparisons of tax revenues relative to economic scales.

This ratio also reflects how effectively a nation's government allocates its economic resources through taxation.

Typically, developed nations exhibit higher tax-to-GDP ratios compared to developing countries. Higher tax revenues enable a country to invest more in essential areas such as infrastructure, healthcare, and education.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 168,062.17 222.44M | -0.49% -830.92 |

| ALLSHR | 100,418.83 533.18M | -0.47% -469.95 |

| KSE30 | 51,322.39 95.56M | -0.78% -400.92 |

| KMI30 | 235,325.12 71.27M | -0.62% -1468.03 |

| KMIALLSHR | 64,292.17 192.91M | -0.54% -350.28 |

| BKTi | 49,115.42 49.83M | -0.78% -388.38 |

| OGTi | 32,316.78 8.08M | -1.33% -436.77 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 66,185.00 | 67,760.00 64,325.00 | -1640.00 -2.42% |

| BRENT CRUDE | 71.88 | 71.96 70.69 | 0.12 0.17% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.50 -3.52% |

| ROTTERDAM COAL MONTHLY | 107.95 | 107.95 107.95 | 0.30 0.28% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.60 | 66.67 65.38 | 0.12 0.18% |

| SUGAR #11 WORLD | 14.05 | 14.10 13.78 | 0.18 1.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

_20251003092603298_af0c50_20251010094012153_327c07.webp?width=280&height=140&format=Webp)

_20251226081441672_22beb3.webp?width=280&height=140&format=Webp)

Monetary Aggregates (M3) - Monthly Profile

Monetary Aggregates (M3) - Monthly Profile