Pakistan Chemical companies see profits dry up despite revenue gains in Q1 2024

By Rafay Malik | May 14, 2024 at 10:27 AM GMT+05:00

May 14, 2024 (MLN): Pakistan’s Chemical sector has faced a challenging start in the first quarter of 2024, witnessing a profit contraction amid inflationary pressures and high borrowing costs, which outweighed the moderate revenue growth.

The KSE-100 listed Chemical sector reported a profit after tax of Rs7.73 billion, around 58% or Rs10.6bn lower compared to the unconsolidated earnings of Rs18.33bn in the same quarter last year (Q1 2023).

This compiled profit is derived from four companies, namely Engro Polymer & Chemicals Limited (EPCL), Lotte Chemical Pakistan Limited (LOTCHEM), Lucky Core Industries Limited (LCI) and Colgate-Palmolive (Pakistan) Limited (COLG).

Out of these four companies, COLG stood out by contradicting the struggling period with a substantial profit boost of 58.81% YoY, while all other members reported a massive drop of up to 2.66 times in their bottom line.

Concerning shareholder return, LOTCHEM emerged as the sole dividend payer during the review quarter, declaring a dividend per share (DPS) of 5%.

Majority of the members were of the view that the decline in financial performance is attributed to the slowdown in domestic consumer demand as the central bank held the policy rate at a record high of 22%.

The scenario was further worsened by the power and gas tariff hike by the government, which, in turn, slowed the rising pace of circular debt but resulted in expanded expenses for the sector.

Furthermore, rising steel prices and the availability of new housing inventory further dampened downstream demand.

These weak market fundamentals created a non-conducive business environment and given the sector’s involvement in multiple segments across the economy, the shock was tragic and massive.

Analyzing the sector’s profit and loss statement reveals that the sector’s topline improved by 14.36% YoY to Rs108.85bn in Q1 2024, compared to the net revenue of Rs95.18bn in Q1 2023.

The members associated this positivity on the earning front to an optimistic response from the export markets.

Export volumes from China remained high (above the three-year average), with India being a significant market for Chinese PVC, said EPCL.

Additionally, demand for caustic soda in export-oriented industries also saw an increase in the latter half of the quarter.

However, the revenue growth through exports was still not significant enough to cover the rising costs of sales, leading to a drop in gross profit (-12.3% YoY) to stand at Rs19.61bn during the period under review.

It is crucial to note that apart from local factors contributing to the rising costs, the crisis in the Red Sea and geopolitical tensions also played a role in increasing the costs to sell.

Accordingly, expenses associated with Selling and Distribution increased to Rs4.78bn, up by 24% YoY, while administration expenses rose to Rs1.79bn, marking a 38.07% YoY increase this quarter.

Conversely, all four correspondents managed to reduce their other operating expenses by more than half by reducing their outflow toward workers' welfare and participation funds.

Other income of the sector was recorded at Rs2.8bn in Q1 2024, marking a 39.38% YoY increase, thereby supporting the declining profits.

The sector’s outflow as finance charges also inched lower to Rs2.67bn versus Rs2.76bn in Q1 2023, despite higher interest rates.

Moreover, due to lower operational profit, the tax charge of the sector also dropped by 15% YoY to Rs4.51bn in Q1 2024 as in Q1 2023 the chemical sector paid Rs5.31bn as taxes to the government.

| Unconsolidated profit and loss statement for the quarter ended March 31, 2024 (Rupees in '000) | |||

|---|---|---|---|

| Mar-24 | Mar-23 | % Change | |

| Net Sales / Revenue | 108,853,899 | 95,182,124 | 14.36% |

| Cost Of Sales | 89,245,590 | 72,823,980 | 22.55% |

| Gross profit | 19,608,309 | 22,358,144 | -12.30% |

| Selling And Distribution Expenses | (4,779,814) | (3,854,997) | 23.99% |

| Administrative Expenses | (1,792,782) | (1,298,419) | 38.07% |

| Net Operating Profit | 13,035,713 | 17,204,728 | -24.23% |

| Other Income | 2,796,232 | 2,006,130 | 39.38% |

| Other Operating Expenses | (927,044) | (1,920,300) | -51.72% |

| Profit Before Interest And Tax | 14,904,901 | 17,290,558 | -13.80% |

| Finance Cost | (2,670,181) | (2,762,608) | -3.35% |

| Other Gains / (Losses) | 9,023 | 9,113,827 | -99.90% |

| Profit Before Taxation | 12,243,743 | 23,641,777 | -48.21% |

| Taxation | (4,510,929) | (5,308,566) | -15.03% |

| Profit After Tax | 7,732,814 | 18,333,211 | -57.82% |

Future Outlook

Pakistan has initiated its March towards stability with rising foreign exchange reserves, disinflation, positive real interest rates, SOE privatization, and a stable exchange rate.

The country is also seeking a longer and bigger program with the International Monetary Fund (IMF) and discussions are set to begin soon.

The recent visit from Saudi Arabia and international visitors also foster a brighter outlook for higher bilateral cooperation and in turn higher foreign direct investment (FDI) into the country.

Moreover, with easing inflation in the country, the central bank is soon expected to shift towards monetary easing, which will turn out to be bullish for the economic segments.

LCI states that the economic outlook will largely be predicated on the continued implementation of reforms by the Special Investment Facilitation Council (SIFC) aimed at stabilizing the economy to restore fiscal and external buffers, privatization of loss-making government entities and conclusion of a new long-term IMF programme.

LOTCHEM has also expressed its optimism and expects that positive developments on long-term Policy matters by the newly elected government may continue to give domestic producers confidence to maintain strong operations ahead of the higher demand expected ahead of the peak summer season.

On the other hand, Colgate-Palmolive foresees economic challenges to persist in the country due to high debt servicing, political uncertainty, and geopolitical instability.

The IMF has also raised concerns that a potential resurgence in Pakistan's social tensions, reflecting the complex political scene and high cost of living could weigh on policy and reform implementation.

Furthermore, the fund has asked for continued timely gas tariff determinations and notifications within their required 40-day window, while protecting vulnerable households, starting with the June 2024 semiannual adjustment.

These concerns make the cash-strapped nation’s outlook gloomy and mixed, prompting companies to focus on managing expenses efficiently and implementing various strategies to enhance individual profitability.

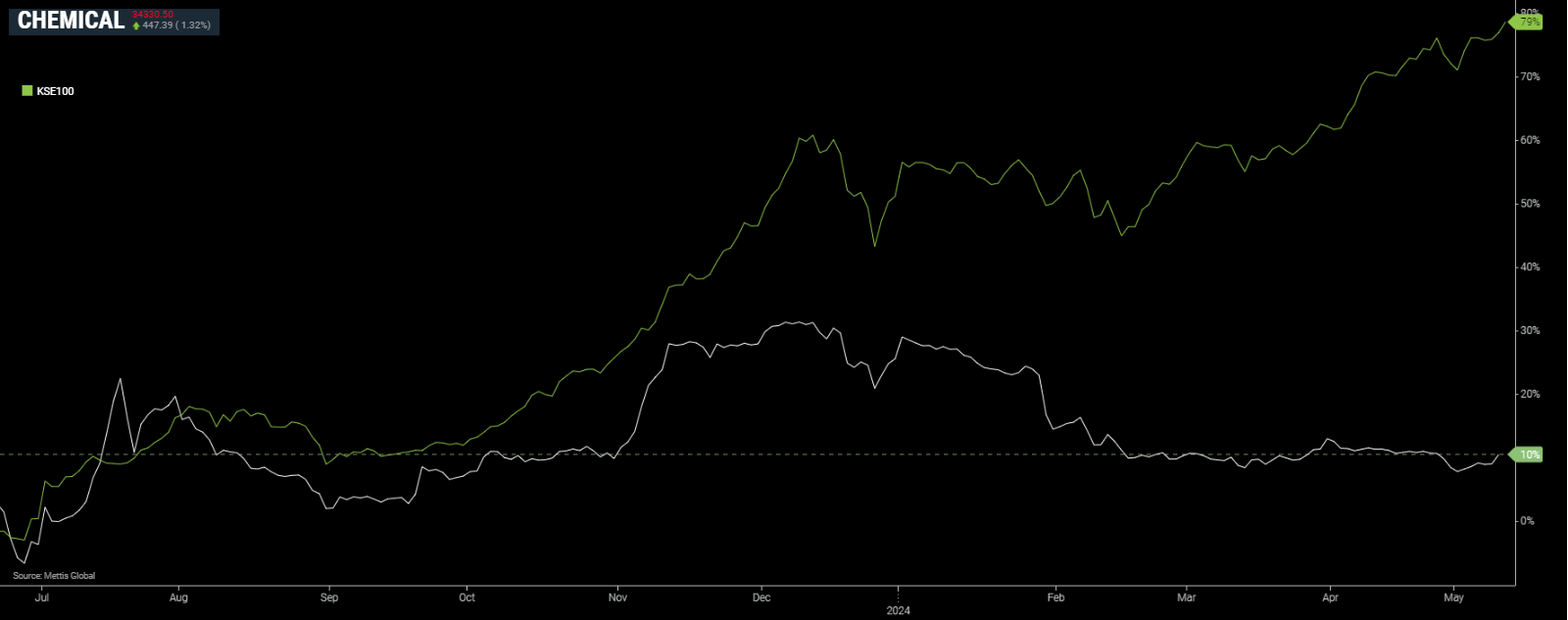

Chemical Sector Vs KSE-100 Index FYTD Performance

Note: Sector in chart includes all share companies

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 129,490.97 60.88M |

1.01% 1291.54 |

| ALLSHR | 80,592.85 188.69M |

1.01% 805.23 |

| KSE30 | 39,554.04 23.38M |

1.15% 449.04 |

| KMI30 | 188,570.40 22.42M |

0.89% 1654.79 |

| KMIALLSHR | 54,627.99 82.69M |

0.79% 426.11 |

| BKTi | 34,136.43 12.23M |

1.97% 659.75 |

| OGTi | 28,170.63 1.83M |

0.74% 208.05 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 106,600.00 | 106,610.00 105,440.00 |

850.00 0.80% |

| BRENT CRUDE | 67.18 | 67.29 67.05 |

0.07 0.10% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 97.50 97.50 |

0.70 0.72% |

| ROTTERDAM COAL MONTHLY | 103.80 | 103.80 103.80 |

-3.45 -3.22% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 65.47 | 65.65 65.34 |

0.02 0.03% |

| SUGAR #11 WORLD | 15.70 | 16.21 15.55 |

-0.50 -3.09% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

CPI

CPI