PACRA maintains entity ratings of Sapphire Fibres

MG News | November 14, 2023 at 01:21 PM GMT+05:00

November 14, 2023 (MLN): Pakistan Credit Rating Agency Limited (PACRA) has maintained entity ratings of Sapphire Fibres Limited (PSX: SFL) at "A+" for long term and "A1" for short term with a stable outlook forecast, latest press release issued by PACRA showed.

The ratings reflect the recognizable business profile of Sapphire Fibres Limited established from its presence in the broader value chain; enabling it to manage volatility in the textile industry.

The company enjoys a competitive edge in its respective market by the presence of a value-addition segment.

SFL’s core product range is segregated into three segments; Spinning, Knitting, and Denim.

The business profile, mainly emanating from a sizable contribution of the Spinning segment posted a noticeable growth over the years.

However, the volumetric analysis signifies a largely sustained pattern whereas the benefit is largely derived from Rupee devaluation in FY23.

The sheer quantum of the revenue base is large whilst the management captures attractive margins from the value-addition segment.

A major chunk of the exports comprise the sale of Yarn followed by Fabric and Garments.

As per management accounts, the company’s topline was recorded at Rs12.2 billion during 1QFY24 (FY23: Rs46.4bn) while it achieved net profitability of Rs716 million in 1QFY24 (FY23: Rs5.1bn).

During FY23, the margins remained in a comfortable range despite the challenges witnessed in the import of raw materials.

On the strategic side, the investments are meticulously worked out and rigorously followed which adds to the financial strength.

The adequate coverages exhibit sufficient cash flows to meet the outstanding debt obligations.

Ratings incorporate the association of the company with the well-established Sapphire Group which enjoys a distinguishing presence in several sectors.

During FY23, textile exports were valued at $16.5bn compared to $19.33bn, reflecting a dip of 15% YoY – the declining trend has been witnessed by the start of FY23.

The exports tumbled attributable to high energy costs, shortage of cotton, and uncertainty in the Foreign Exchange Rate.

During FY23, value-added products such as knitwear, bedwear, towels, and ready-made garments witnessed a decline of 13% YoY.

The basic textiles including raw cotton, cotton yarn, and cotton cloth posted a drop of 21% YoY.

The ratings are dependent on sustaining the business profile of the Company by maintaining profitability and margins achieved from core textile operations.

At the same time, the sustainability of non-core income and prudent management of surplus funds is important.

The sustainability of coverages would remain critical to avoid any drag on the financial profile.

Copyright Mettis Link News

Related News

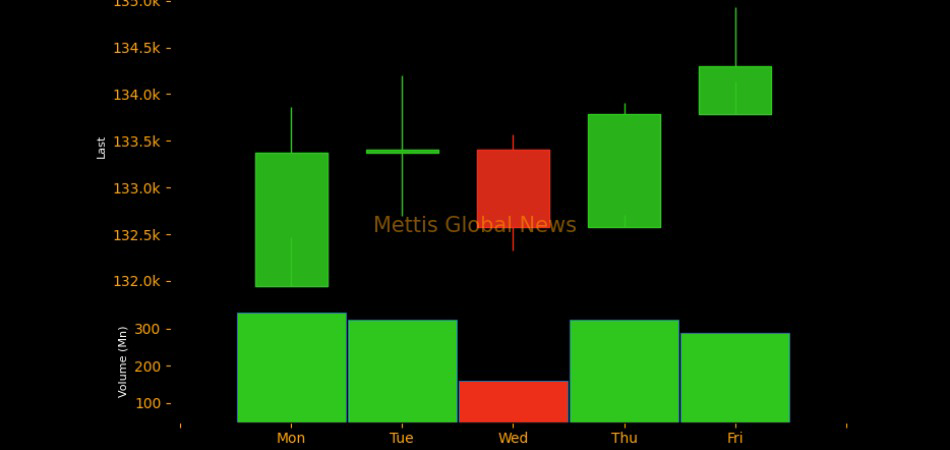

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 0.00 0.00 |

-390.00 -0.33% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 0.00 0.00 |

0.30 0.44% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|