PACRA maintains entity ratings of Loads Limited, assigns negative outlook

MG News | January 18, 2024 at 10:21 AM GMT+05:00

January 18, 2024 (MLN): Pakistan Credit Rating Agency Limited (PACRA) has maintained entity ratings Loads Limited (PSX: LOADS) at "A" for long term and "A1" for short term with a negative outlook forecast, latest press release issued by PACRA showed.

Pakistan's auto industry is a part of large-scale manufacturing, accounting for 76% of the overall value of manufacturing activities within the country.

The auto industry is considerably fragmented, holding over 2,000 vendors in the OEM market.

The demand is primarily driven by auto sales and is met through OEMs, replacements and export markets; while the remaining is met through imports.

However, during FY23, production level and thus, sales of the auto industry posted a decline, primarily due to import restrictions imposed by the SBP; encompassing essentials like CKD and SKD kits. Overall, the sector’s margins remain exposed to inclining inflation, interest rates, and exchange rate fluctuations.

Loads Limited holds association with Treet Corporation. The assigned ratings reflect the company's position in the niche market of automotive products.

Loads is a prominent automotive parts manufacturer catering to Original Equipment Manufacturers (OEMs) and Replacement/After Market (RM).

Persistent economic instability, inflationary pressures, and exchange rate fluctuations has impacted the overall performance of the company.

Loads maintain an adequate topline, despite a decline of 42%. Profitability was impacted due to impairment booked on the markup receivable from Hi-Tech Alloy Wheel Limited ('Hi-Tech'), a subsidiary.

The company holds a significant investment in Hi-Tech and its commissioning got delayed due to economic uncertainty and a downturn in the auto sector.

The company envisions strategies for its financial risk, however, remains susceptible. The expected sale of assets may bring in substantial liquidity so as to manage the company's repayment schedule.

The negative Outlook assigned to the company reflects a persistently weak financial performance and position.

A cautious effort is required to keep the financial profile intact. The company must overcome its working capital challenges and hold a declining equity base.

The ratings are dependent on the company’s ability to improve its business risk vis-à-vis financial risk profile along with sustainable margins.

Cautious management strategies amidst a challenging industry environment are pertinent. Moreover, prudent management of financial affairs remains important.

Copyright Mettis Link News

Related News

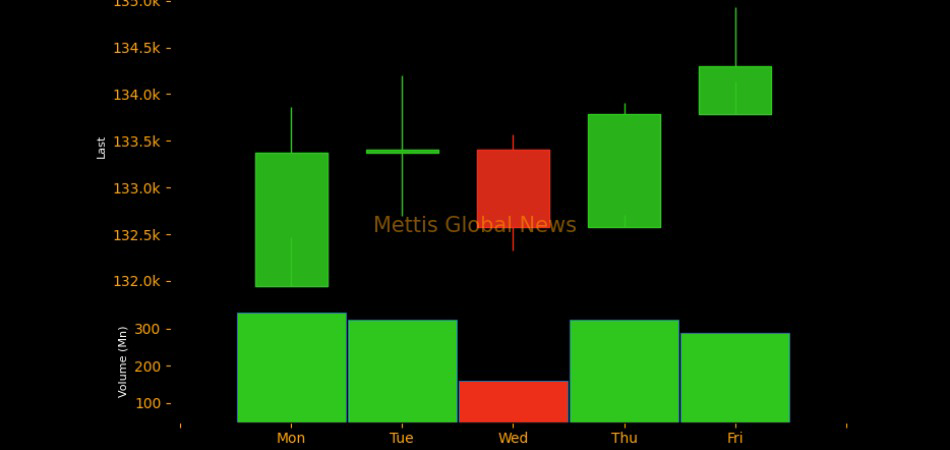

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 0.00 0.00 |

-390.00 -0.33% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 0.00 0.00 |

0.30 0.44% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|