PACRA maintains entity ratings of Ismail Industries Limited

MG News | December 12, 2023 at 12:31 PM GMT+05:00

December 12, 2023 (MLN): Pakistan Credit Rating Agency Limited (PACRA) has maintained entity ratings of Ismail Industries Limited (PSX: ISIL) at "A+" for long term and "A1" for short term with a stable outlook forecast, latest press release issued by PACRA showed.

While having a major dependency on mass marketing, the confectionery, biscuits and snack industry in Pakistan is highly price-sensitive.

Pakistan's large retail base is highly fragmented and dominated by small retailers.

However, a major transformation of establishing large retail chains has been observed, particularly in urban centers.

On the other hand, growth in disposable personal income of middle and upper middle class has led to improvement in the consumption pattern of branded non-essential items.

The ratings reflect Ismail Industries Limited’s diversified revenue stream generated from the well-established brands Candyland, Bisconni, Snackcity, Ismail Nutrition, Ghiza Flour and Astro Films.

The company has earned a promising profit in FY23 amounting to Rs6 billion (FY22: Rs2 billion).

The surge in the profit is due to export sales of the company, which is increased to Rs40bn (FY22: Rs15bn). The total revenue of the company stood at Rs99bn in FY23 (FY22: Rs65bn).

This coupled with increased food processing capacity, provides a competitive edge to Ismail Industries and allows the company to maintain its growth trajectory due to a significant surge in both domestic sales and exports. Ismail Industries Limited has investments in its subsidiaries and associates.

The company holds 78.53% shares of Hudson Pharma (Pvt) Limited. The company also holds 75% of Ismail Resin (Pvt) Limited which deals with the manufacturing of PET resin.

The associates of Ismail Industries include Bank of Khyber, Plastiflex Films (Pvt) Limited, and Innovita Nutrition (Pvt) Limited.

Despite inflation and devaluation, a surge can be seen in the margins of the company as the operating profit margin stood at 12% in FY23 (FY22: 8%) and net profit margin stood at 7% in FY23 (FY22: 5%).

The introduction of the new product line Giza Flour adds value to the company's profile and profits.

The company holds a strong financial risk profile as the capital structure of the company is moderately leveraged at 71%, at FY23 (FY22: 72%).

However, major borrowings remain from SBP at subsidized rates. The company's working capital management and coverages remain adequate.

The ratings are dependent on continued revenue growth and maintenance of margins. Prudent management of expansion and investment-related debt in order to meet financial obligations is important.

Stringent controls on the company's debt levels remain imperative for sustaining the ratings. Brand reputation through customer satisfaction remains a crucial parameter for the rating.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

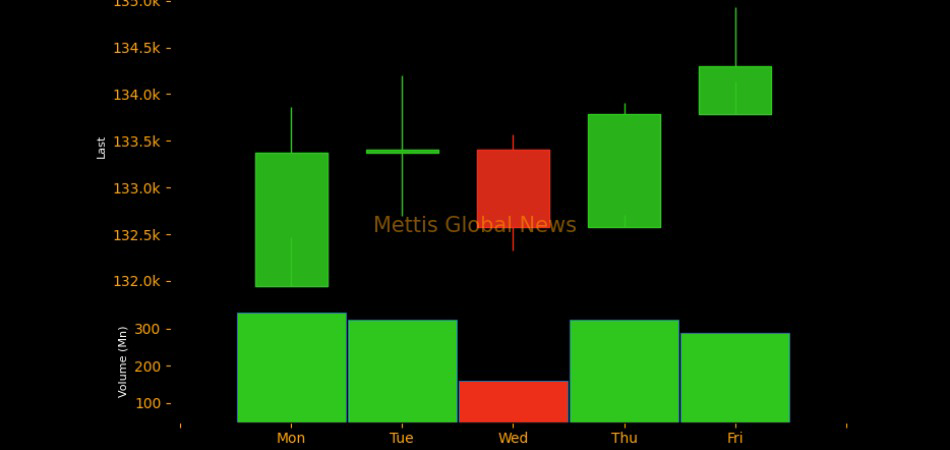

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 0.00 0.00 |

-390.00 -0.33% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 0.00 0.00 |

0.30 0.44% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|