PACRA downgrades Amreli Steels' rating to 'BBB'

MG News | May 13, 2024 at 10:12 AM GMT+05:00

May 13, 2024 (MLN): Pakistan Credit Rating Agency Limited (PACRA) has downgraded the entry ratings of Amreli Steels Limited (PSX: ASTL) to "BBB" for long term and "A3" for short term with a stable outlook forecast, based on latest press release issued by PACRA.

The steel industry is highly sensitive to economic cyclicality and exposed to fluctuations in exchange rates and international commodity prices.

In FY21, the steel industry reached its peak demand, standing at 4.8m tons, marking an increase of 20% YoY.

As demand surged, major players in the industrial sector seized the opportunity to bolster their capacities in anticipation of future growth through leveraging.

Amreli, as one of the key contributors, upscaled their melting capacity by 300,000 tons per annum and re rolling capacity by 305,000 tons per annum.

However, in the subsequent fiscal year of FY22, demand tapered slightly to 4.7 million tons, and then plummeted steeply to 4 million tons in FY23, significantly impacting the steel industry as a whole.

The steel industry, today, faces challenges such as low-capacity utilization, revenue and profitability issues, taxation challenges, higher financing costs, rupee depreciation, and increases in energy prices. Operating within these challenging dynamics has become a significant hurdle for industry players.

In FY23, the demand marked a decrease of 16% YoY. Meanwhile, the company's volumetric sales declined significantly from 361,587 tons to 218,589 tons, representing a material deterioration of 40%.

However, the rise in prices somewhat offset this negative impact of volumes, with revenue in FY23 reported to Rs45.492 million with a dip of approx. 22%.

The similar trend is witnessed during 1HFY24 where revenue clocked at PKR 22,251mln (1HFY23: Rs23.031bn).

During the 1HFY24, gross margins experienced a slight uptick to 11.2% from 10.6%, driven by higher prices.

However, due to high level of reliance on short-term borrowing and increased finance cost the company posted a net loss of Rs634m (FY23: Rs678m).

Consequently, the net margin deteriorated to -2.9% from -0.8%. The company’s current financial risk matrix is in distress.

The debt-to-equity ratio of the company stands at 61.7% due to significant reliance on short-term borrowing for its working capital requirement.

Moreover, at Dec-23 the FCFO’s of the company stood at Rs1.583bn whereas the finance cost stood at Rs2.263bn and CMLTD at Rs1.766bn depicting a stress on the repayment of its finance cost and timely repayment of its current obligations.

The rating downgrade is attributed to the depressed demand, which has had a significant impact on the company's financial standing and its ability to fulfill its financial commitments.

The management of the company has actively indulged in discussion with the financial institutions to figure out the breather for its debt servicing various options, including debt reprofiling are under consideration.

Meanwhile the management also undertook other measures including resizing itself according to the demand, sale of nonessential assets and injection of equity through other strategic partner in order to meet the current challenging scenario.

The ratings are dependent on the management's ability to translate strategies along with successful finalization of its reprofiling process. Moreover, the availability of sponsor support to address any shortfall will also be a crucial factor to consider, going forward.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

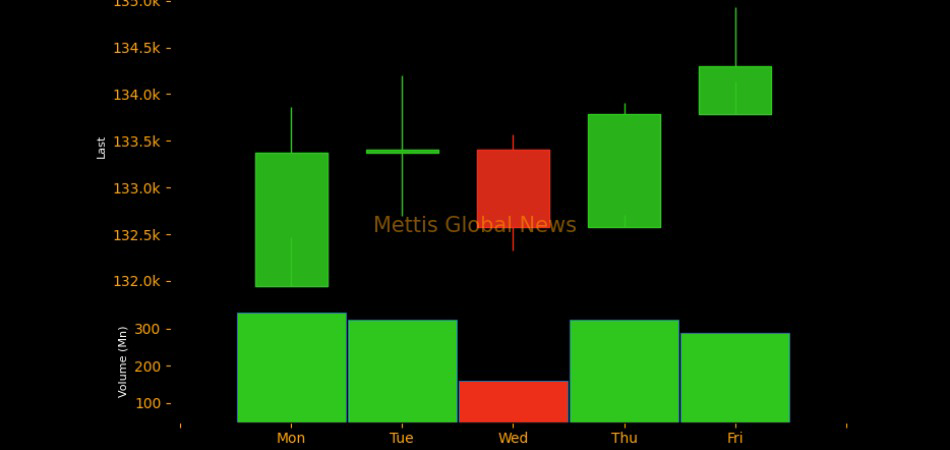

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 0.00 0.00 |

-390.00 -0.33% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 0.00 0.00 |

0.30 0.44% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|