Oil prices tumble as OPEC+ delays meeting amid production disagreements

By MG News | November 23, 2023 at 11:07 AM GMT+05:00

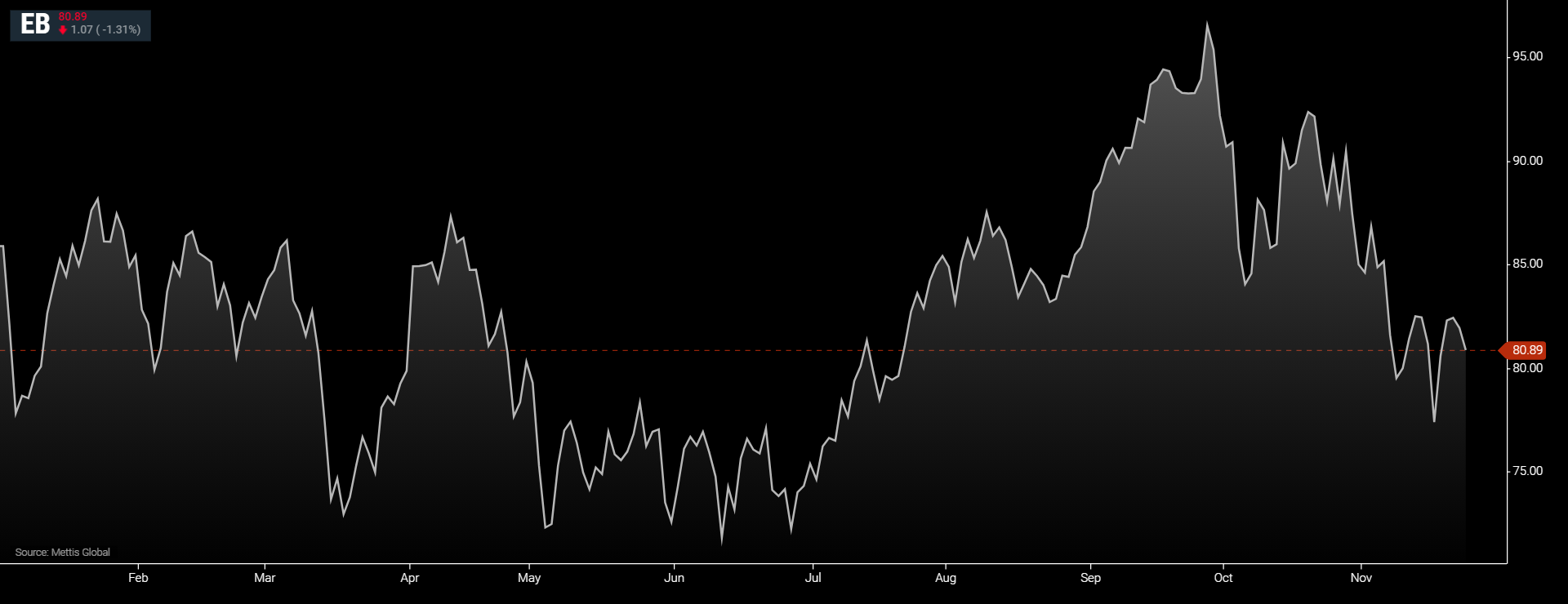

November 23, 2023 (MLN): Global oil prices fell on Thursday, extending loss from the previous session after OPEC+ delayed a ministerial meeting due to production disagreements with members, leading to uncertainty about output cuts.

Brent crude is currently trading at $80.77 per barrel, down by 0.77% on the day.

While West Texas Intermediate crude (WTI) is trading at $76.19 per barrel, down by 0.73% on the day.

In a surprise move, the Organization of the Petroleum Exporting Countries and allies including Russia delayed to November 30 a ministerial meeting where they were expected to discuss oil output cuts, as Reuters reported.

Producers were struggling to agree on output levels and hence possible reductions ahead of the meeting originally set for November 26, OPEC+ sources said.

Three OPEC+ sources, however, said this was linked to African countries, which are smaller producers in the group, which somewhat eased investor concerns.

Analysts said that Angola, Congo and Nigeria were seeking to raise their 2024 supply quotas above the provisional levels agreed at the OPEC+ June meeting.

"At that meeting, OPEC squared the books on increasing UAE’s quota... by reducing the targets for the African nations that were underperforming their required production numbers," said Helima Croft, an analyst at RBC Capital Markets in a client note.

Angola and Congo have been producing below their 2024 production targets, whilst Nigeria has been able to increase output above target due to the improving security situation in the oil-rich Niger Delta.

"We think Nigeria can be assuaged as the leadership values its longstanding OPEC membership and improving ties with Saudi Arabia... However, it may be more difficult to bridge the gap with Angola which has been a moodier member of the producer group since it joined in 2007," said RBC's Croft.

"Disagreement between members will likely increase volatility within the market over the course of the next week," analysts at ING Bank said in a note.

The questions over OPEC+ supply come as data showed U.S. crude stocks jumped by 8.7 million barrels last week, which was much more than the 1.16m build that analysts had expected.

U.S. oil rigs remained unchanged at 500 in the week to Nov. 22, energy services firm Baker Hughes said in its closely followed report on Wednesday.

Meanwhile, about 3% of crude oil production in the Gulf of Mexico, or around 61,165 barrels of daily output, was shut in by an underwater pipeline leak, the U.S. Coast Guard said on Wednesday.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 129,439.38 94.04M |

0.97% 1239.96 |

| ALLSHR | 80,551.90 264.34M |

0.96% 764.28 |

| KSE30 | 39,557.50 30.26M |

1.16% 452.50 |

| KMI30 | 188,363.60 28.28M |

0.77% 1447.99 |

| KMIALLSHR | 54,553.43 113.00M |

0.65% 351.54 |

| BKTi | 34,242.83 15.27M |

2.29% 766.14 |

| OGTi | 28,057.35 2.49M |

0.34% 94.77 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 106,690.00 | 106,710.00 105,440.00 |

940.00 0.89% |

| BRENT CRUDE | 67.19 | 67.29 67.05 |

0.08 0.12% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 97.50 97.50 |

0.70 0.72% |

| ROTTERDAM COAL MONTHLY | 103.80 | 103.80 103.80 |

-3.45 -3.22% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 65.50 | 65.65 65.34 |

0.05 0.08% |

| SUGAR #11 WORLD | 15.70 | 16.21 15.55 |

-0.50 -3.09% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

CPI

CPI