Oil prices steady amid demand expectations, rising U.S. inventories

MG News | January 09, 2025 at 03:32 PM GMT+05:00

January 09, 2025 (MLN): Oil prices were little changed on Thursday, with investors weighing firm winter fuel demand expectations against large builds of fuel inventories in the U.S., the world's biggest oil user, and macroeconomic concerns.

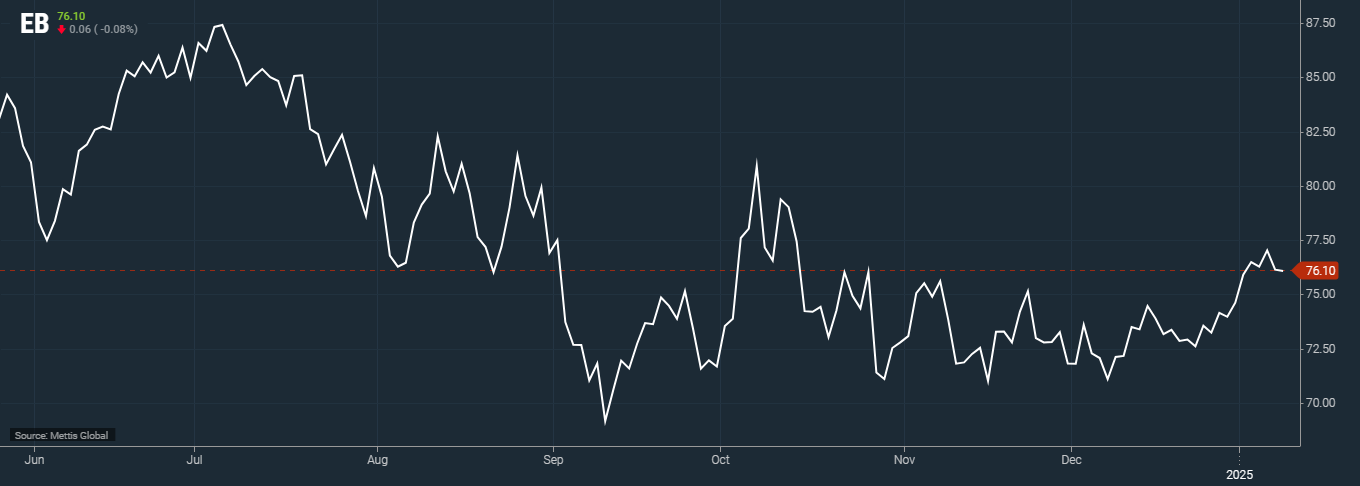

Brent crude futures decreased by $0.06, or 0.08%, to $76.10 per barrel.

West Texas Intermediate (WTI) crude futures fell by $0.03, or 0.04%, to $73.29 per barrel by [3:15 pm] PST.

Both benchmarks fell more than 1% on Wednesday as a stronger dollar and the bigger-than-expected rise in U.S. fuel stockpiles weighed on prices, as Reuters reported.

"The oil market is still grappling with opposite forces seasonal demand to support the bulls and macro data that supports a stronger U.S. dollar in the medium term ... that can put a ceiling to prevent the bulls from advancing further," said OANDA senior market analyst Kelvin Wong.

JPMorgan analysts expect oil demand for January to expand by 1.4 million barrels per day year-on-year to 101.4mn bpd, primarily driven by "increased use of heating fuels in the Northern Hemisphere".

"Global oil demand is expected to remain strong throughout January, fuelled by colder-than-normal winter conditions that are boosting heating fuel consumption, as well as an earlier onset of travel activities in China for the Lunar New Year holidays," the analysts said.

The market structure in the Brent futures is also indicating that traders are becoming more concerned about supply tightening at the same time the demand is increasing.

The premium of the first-month Brent contract over the six-month contract reached its widest since August on Wednesday.

A widening of this backwardation, when futures for prompt delivery are higher than for later delivery, typically indicates that supply is declining or demand is increasing.

Nevertheless, official Energy Information Administration data showed rising gasoline and distillate stockpiles last week in the United States.

The U.S. dollar firmed further on Thursday, underpinned by rising Treasury yields ahead of U.S. President-elect Donald Trump's entrance into the White House on Jan. 20.

Looking ahead, WTI crude oil is expected to oscillate within a range of $67.55-$77.95 into February as the market awaits more clarity on Trump's administration policies and fresh fiscal stimulus measures out of China, said OANDA's Wong.

Meanwhile, Saudi Arabia's crude oil supply to China is set to decline in February from the prior month, trade sources said on Thursday, after the kingdom hiked its official selling prices to Asia for the first time in three months.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 119,450.00 115,635.00 |

4270.00 3.75% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 68.77 66.50 |

2.18 3.27% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction