Oil prices spike amid Middle East tensions, China data

MG News | December 02, 2024 at 10:53 AM GMT+05:00

December 02, 2024 (MLN): Global oil prices rose on Monday, supported by upbeat factory activity in China, the world's second largest oil consumer, and as Israel resumed attacks on Lebanon despite a ceasefire pact, stoking tension in the Middle East.

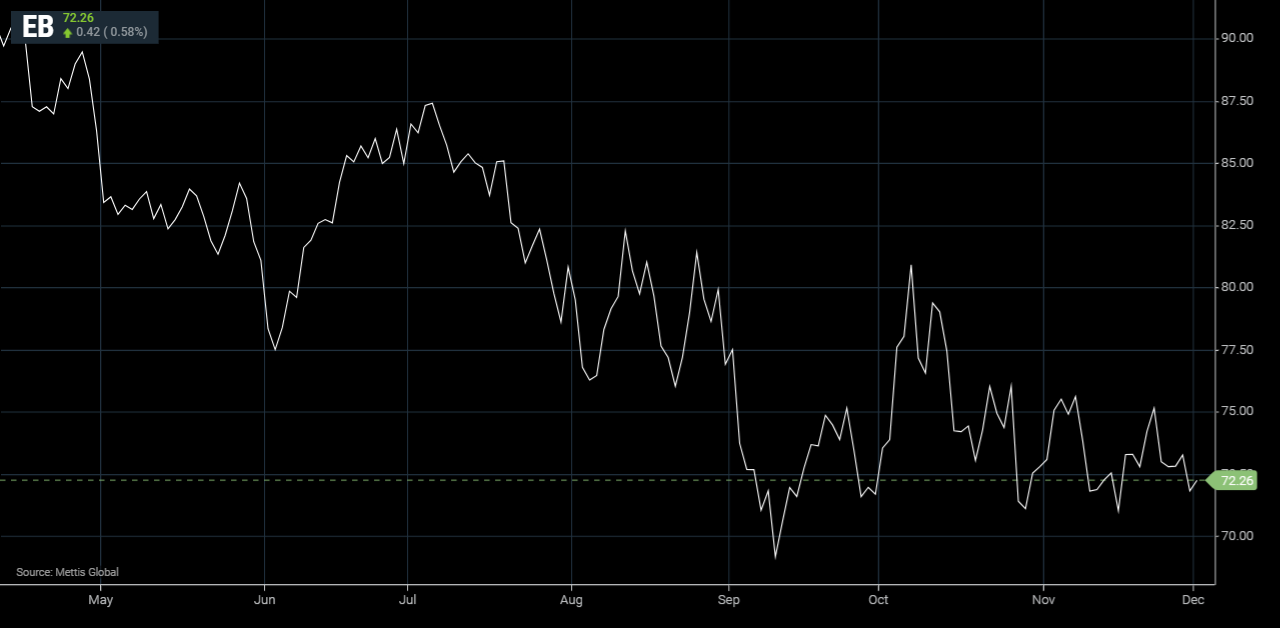

Brent crude traded near $72.26 a barrel, increased 0.58% on the day.

While West Texas Intermediate crude (WTI) was at $68.44 per barrel, up by 0.65%.

Brent crude futures climbed 34 cents, or 0.47%, to $72.18 a barrel by 0452 GMT while U.S.

West Texas Intermediate crude was at $68.32 a barrel, up 32 cents, or 0.47%, according to Reuters.

"Oil prices have managed to stabilise into the new week, with the continued expansion in China's manufacturing activities reflecting some degree of policy success from recent stimulus efforts," said Yeap Jun Rong, market strategist at IG.

This offered some slight relief that oil demand from China may hold for now, he added.

A private-sector survey showed China's factory activity expanded at the fastest pace in five months in November, boosting Chinese firms' optimism just as U.S. President-elect Donald Trump ramps up his trade threats.

Still, traders are eyeing developments in Syria, weighing if they could widen tension across the Middle East, Yeap added.

The Organization of the Petroleum Exporting Countries and their allies, known as OPEC+, postponed its meeting to Dec. 5 and is discussing delaying its oil output hike due to start in January, OPEC+ sources told Reuters last week.

This week's meeting will decide policy for the early months of 2025.

"The extension of output cuts would allow OPEC+ more time to assess the impact of Trump's policy announcements with regards to tariffs and energy and also to see what China's response will be," said Tony Sycamore, IG's Sydney-based market analyst.

Since the group's production hike had been widely expected, the market's focus may be on the extent of delay to sway crude prices, said IG's Yeap.

"An indefinite delay may be the best case for oil prices, given that earlier rounds of delays by a month or so have failed to drive higher oil prices in line with what OPEC+ intended."

Brent is expected to average $74.53 per barrel in 2025 as economic weakness in China clouds the demand picture and ample global supplies outweigh support from an expected delay to a planned OPEC+ output hike, a Reuters monthly oil price poll showed on Friday.

That is the seventh straight downward revision in the 2025 consensus for the global benchmark, which has averaged $80 per barrel so far in 2024.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 173,150.42 424.96M | -0.75% -1303.52 |

| ALLSHR | 104,363.56 708.75M | -0.58% -607.69 |

| KSE30 | 52,816.28 179.58M | -0.72% -382.25 |

| KMI30 | 245,363.66 125.15M | -0.41% -1015.13 |

| KMIALLSHR | 67,373.39 398.72M | -0.35% -233.28 |

| BKTi | 49,278.66 105.95M | -1.36% -677.84 |

| OGTi | 34,757.87 15.47M | 1.78% 609.42 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 66,835.00 | 70,170.00 66,730.00 | -2000.00 -2.91% |

| BRENT CRUDE | 67.46 | 69.04 67.25 | -1.19 -1.73% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -2.25 -2.29% |

| ROTTERDAM COAL MONTHLY | 105.50 | 105.50 105.50 | 0.15 0.14% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 62.52 | 64.14 62.33 | -0.37 -0.59% |

| SUGAR #11 WORLD | 13.61 | 13.86 13.57 | 0.12 0.89% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|