Oil prices slide amid Fed rate cut uncertainty

MG News | July 10, 2024 at 10:45 AM GMT+05:00

July 10, 2024 (MLN): Oil prices edged lower on Wednesday amid concerns about Chinese demand and continued uncertainty over the timeline for Federal Reserve interest-rate cuts.

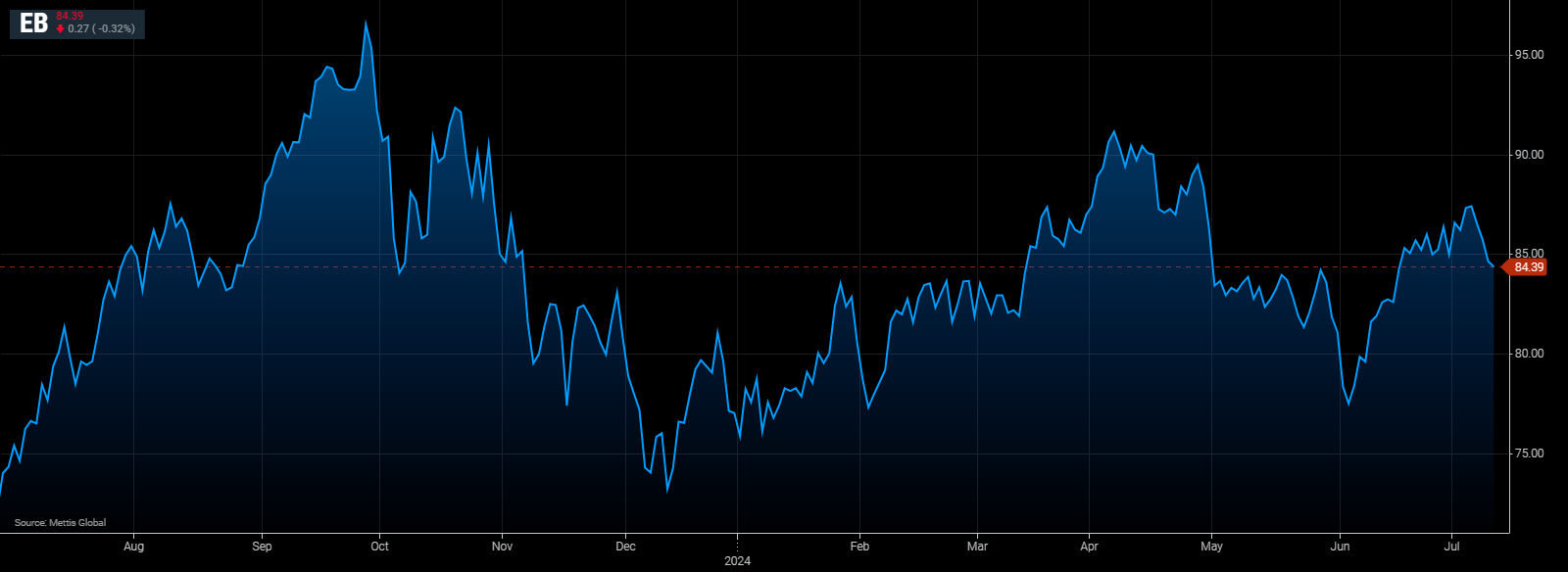

Brent crude traded near $84.39 per barrel, after falling by more than 3% over the last three sessions.

While West Texas Intermediate crude (WTI) was at $81.22 per barrel.

The American Petroleum Institute said crude stockpiles shrank by 1.92 million barrels last week, with a drawdown also logged at the key Cushing, Oklahoma, hub, Bloomberg cited people familiar with the figures as saying.

Total holdings sank more than 12 million barrels the prior week.

Still in China, the world’s largest oil importer, data on Wednesday underscored the nation’s economic challenges, with deflationary pressures persisting as factory-gate prices fell, Bloomberg reported.

That followed a spate of earlier signals that suggest diminished appetite for crude from some of the nation’s refiners.

Oil remains comfortably higher for the year, with gains supported by OPEC+ supply cuts, as well as expectations for looser US monetary policy.

Powell said on Tuesday that while he was watching for signs of labor market weakness, policymakers still wanted to see more evidence that inflation was slowing before reducing borrowing costs.

“Concerns over Chinese oil demand have been growing recently and the latest inflation data will do little to ease these concerns, with it coming in weaker-than-expected,” said Warren Patterson, head of commodities strategy for ING Groep NV.

Meanwhile, Powell’s comments didn’t have too significant a market impact with expectations for a September rate cut little changed, he said.

Crude’s recent listless trading has seen gauges of volatility decline. Brent’s implied volatility — a forecast of likely movement in oil futures that’s tied to options pricing — is near the lowest level in about six years.

Traders will scour a monthly report from the Organization of the Petroleum Exporting Countries later Wednesday for more on the global market outlook.

The International Energy Agency will release its corresponding view a day later.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 135,939.87 307.74M |

-0.41% -562.67 |

| ALLSHR | 84,600.38 877.08M |

-0.56% -479.52 |

| KSE30 | 41,373.68 101.15M |

-0.43% -178.94 |

| KMI30 | 191,069.98 82.45M |

-1.17% -2260.79 |

| KMIALLSHR | 55,738.07 422.01M |

-1.03% -577.24 |

| BKTi | 38,489.75 45.79M |

-0.02% -8.33 |

| OGTi | 27,788.15 6.87M |

-1.24% -350.24 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 117,385.00 | 118,465.00 117,255.00 |

645.00 0.55% |

| BRENT CRUDE | 68.89 | 69.09 68.85 |

0.18 0.26% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 96.50 96.50 |

0.50 0.52% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.25 |

-2.05 -1.92% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.81 | 67.00 66.73 |

0.29 0.44% |

| SUGAR #11 WORLD | 16.56 | 16.61 16.25 |

0.26 1.60% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|