Oil prices set to break 4-Week slide amid impending OPEC+ production cuts

MG News | November 24, 2023 at 10:28 AM GMT+05:00

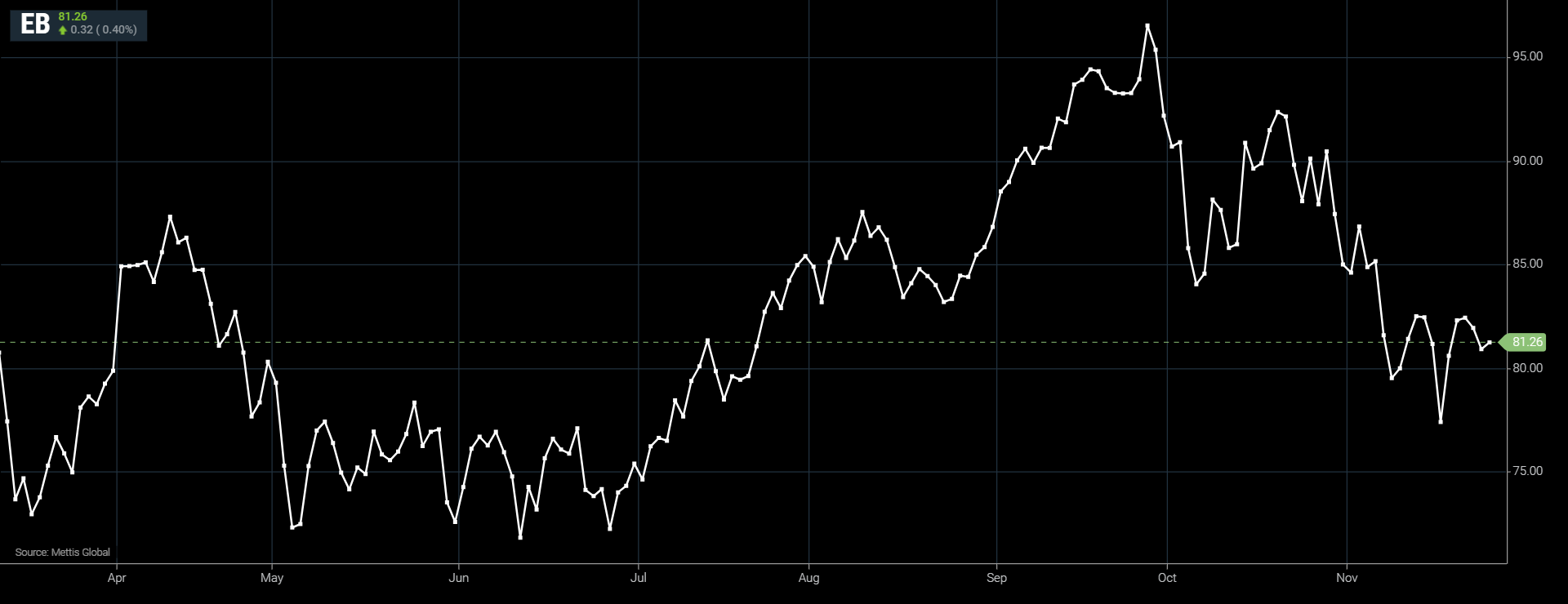

November 24, 2023 (MLN): Global oil prices edged up on Friday, after witnessing two consecutive declines as OPEC+ delayed a ministerial meeting due to production disagreements with members, leading to uncertainty about output cuts.

Brent crude is currently trading at $81.13 per barrel, up by 0.11% on the day.

While West Texas Intermediate crude (WTI) is trading at $76.35 per barrel, up by 0.05% on the day.

Both the benchmarks are on track to snap their four-week-long losing streak supported by expectations that OPEC+ could reduce supply to balance the markets into 2024.

The Organization of Petroleum Exporting Countries and allies, together known as OPEC+, surprised the market with an announcement on Wednesday that it would postpone a ministerial meeting by four days to November 30, after producers struggled to come to a consensus on production levels, as Reuters reported.

"The most likely outcome now appears to be an extension of existing cuts," Tony Sycamore, a Sydney-based market analyst at IG, wrote in a note.

The surprise delay had initially brought Brent futures down by as much as 4% and WTI by as much as 5% in Wednesday's intraday trading.

Trading remained subdued because of the Thanksgiving holiday in the U.S.

The near-term Chinese outlook appeared stronger, supporting market sentiment.

"The recent Chinese data and fresh aid to the indebted properties can be positive for the oil market's near-term trend," said Tina Teng, a market analyst at CMC Markets.

Chinese stocks rose on Thursday amid expectations that China would direct more stimulus to the struggling property sector.

Yet those gains may be capped by higher U.S. crude stockpiles and poor refining margins, leading to weaker crude demand from refineries in the U.S., analysts said.

"Fundamentals developments have been bearish with rising U.S. oil inventories," ANZ analysts said in a note.

China's longer-term outlook is lukewarm. Analysts say oil demand growth could weaken to around 4% in the first half of 2024 from strong post-COVID growth levels in 2023, as the country's property sector crunch weighs on diesel use.

Non-OPEC production growth is set to stay strong with Brazilian state energy firm Petrobras planning to invest $102 billion over the next five years to boost output to 3.2 million barrels of oil equivalent per day (boepd) by 2028 from 2.8m boepd in 2024.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 139,898.70 102.28M | 1.07% 1486.45 |

| ALLSHR | 86,633.46 213.27M | 1.09% 930.50 |

| KSE30 | 42,766.99 60.19M | 1.21% 512.15 |

| KMI30 | 196,990.18 63.71M | 1.48% 2880.59 |

| KMIALLSHR | 57,491.23 111.52M | 1.37% 777.56 |

| BKTi | 38,181.25 7.72M | 0.92% 349.91 |

| OGTi | 28,401.41 30.51M | 3.50% 960.77 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 119,155.00 | 119,430.00 117,905.00 | 1535.00 1.31% |

| BRENT CRUDE | 72.28 | 72.82 72.17 | -0.96 -1.31% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 69.89 | 70.41 69.80 | -0.11 -0.16% |

| SUGAR #11 WORLD | 16.46 | 16.58 16.37 | -0.13 -0.78% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Consumer Confidence Survey

Consumer Confidence Survey