Oil prices rise on expectations of strong demand

MG News | May 15, 2024 at 12:14 PM GMT+05:00

May 15, 2024 (MLN): Global oil prices gained on Tuesday on expectations of a drop in U.S. crude and gasoline inventories and strong demand due to a weaker Dollar.

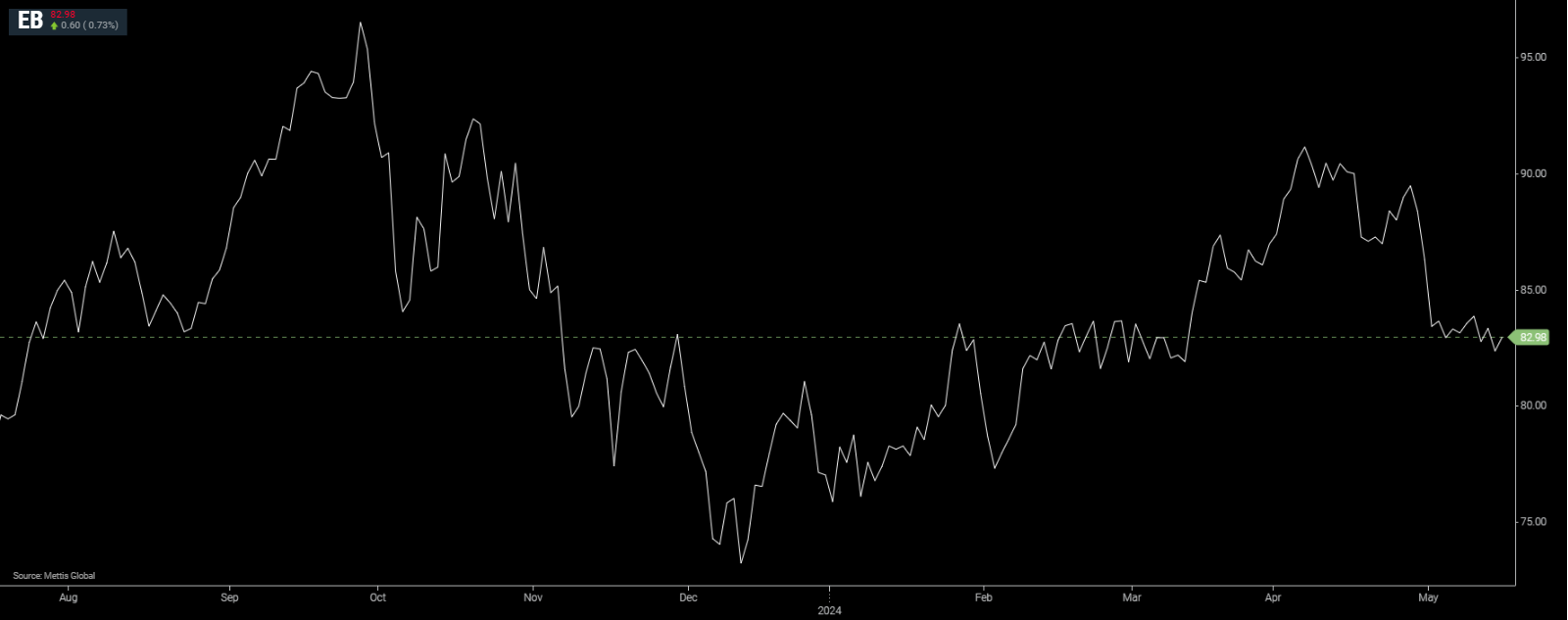

Brent crude is currently trading at $82.63 per barrel, up by 0.30% compared to the previous close.

While West Texas Intermediate crude (WTI) was near $78.13 per barrel.

U.S. crude oil inventories fell 3.104 million barrels in the week ended May 10, according to market sources citing American Petroleum Institute figures on Tuesday. Gasoline inventories fell by 1.269 million barrels and distillates rose by 673,000 barrels, as Reuters reported.

U.S. government inventory data is due later on Wednesday and are likely to also show a drop in crude stockpiles as refineries increase their runs to meet increased fuel demand heading into the peak summer driving season.

"Expectations of another drawdown in U.S. oil inventories should support oil prices," ANZ Research said in a note.

U.S. consumer price index (CPI) data is also due on Wednesday and should give a clearer indication whether the Federal Reserve may cut interest rates later this year, which could spur the economy and boost fuel demand.

Oil prices also found support from a softer U.S. dollar and stimulus measures from China, said independent market analyst Tina Teng, with a weaker greenback making dollar-denominated oil cheaper for investors holding other currencies.

Anglo American has rejected an improved takeover offer from rival miner BHP valued at around $42.7 billion.

Teng was referring to China's plans to raise 1 trillion yuan ($138.39bn) in long-term special treasury bonds this week to raise funds to stimulate key sectors of its flagging economy, which is the world's largest oil importer.

"The U.S. CPI and China's economic data are key to driving oil prices for the rest of the week," she added. China will release economic activity data on Friday.

Prices were also supported by concerns around Canadian oil supply, a key exporter to the U.S.

A large wildfire is approaching Fort McMurray, the hub for Canada's oil sands industry that produces 3.3 million barrels per day of crude, or two-thirds of the country's total output.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 135,939.87 307.74M |

-0.41% -562.67 |

| ALLSHR | 84,600.38 877.08M |

-0.56% -479.52 |

| KSE30 | 41,373.68 101.15M |

-0.43% -178.94 |

| KMI30 | 191,069.98 82.45M |

-1.17% -2260.79 |

| KMIALLSHR | 55,738.07 422.01M |

-1.03% -577.24 |

| BKTi | 38,489.75 45.79M |

-0.02% -8.33 |

| OGTi | 27,788.15 6.87M |

-1.24% -350.24 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 117,530.00 | 118,465.00 117,255.00 |

790.00 0.68% |

| BRENT CRUDE | 68.87 | 69.09 68.85 |

0.16 0.23% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 96.50 96.50 |

0.50 0.52% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.25 |

-2.05 -1.92% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.78 | 67.00 66.73 |

0.26 0.39% |

| SUGAR #11 WORLD | 16.56 | 16.61 16.25 |

0.26 1.60% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|