Oil prices rise after drone attack on Russian pipeline

MG News | February 18, 2025 at 03:07 PM GMT+05:00

February 18, 2025 (MLN): Brent crude oil prices advanced on Tuesday adding to gains in the previous session after a drone attack on an oil pipeline pumping station in Russia reduced flows from Kazakhstan, but gains were capped on the prospects of supply rising soon.

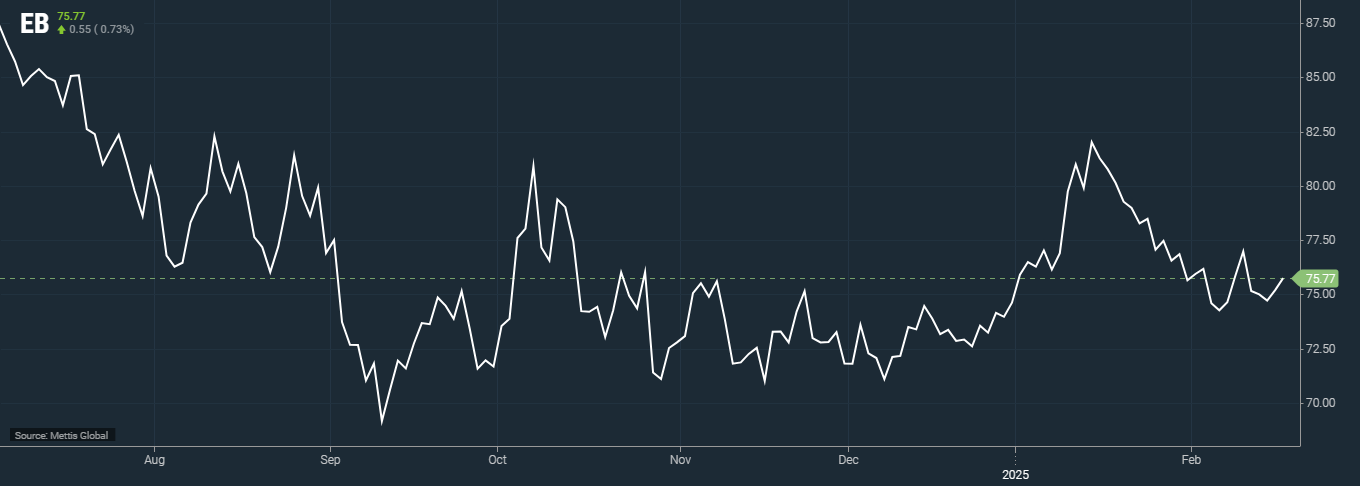

Brent crude futures increased by $0.55, or 0.73%, to $75.77 per barrel.

West Texas Intermediate (WTI) crude futures rose by $0.49, or 0.69%, to $71.82 per barrel by [3:00 pm] PST.

The overriding theme driving oil prices lately has been around supply expectations.

With the weakness in prices over the past weeks, news of a drone strike on Kazakhstan’s export pipeline in Russia has provided the catalyst for some bearish sentiment to unwind, said IG market strategist Yeap Jun Rong in an email.

A senior Russian official said on Tuesday that Ukrainian drones had attacked a pipeline in Russia, which pumps about 1% of global crude supply. He said the strike could disrupt flows to world markets and damage U.S. companies.

Meanwhile, the Black Sea CPC Blend oil loading plan for February would remain unchanged, two sources familiar with the plan told Reuters.

However, longer-term gains are likely to remain capped as the market may anticipate higher supplies from OPEC+ and Russia further down the road.

Meanwhile, the improvement in demand outlook, particularly from China, still remains uncertain, going by recent economic data, IG's Yeap said.

BMI analysts said in a note that they see Brent prices averaging $76 a barrel in 2025, down 5% from the 2024 average, because of market oversupply, tariffs and trade tensions.

OPEC+ producers are not considering delaying a series of monthly oil supply increases scheduled to begin in April, according to a Russian state media report.

In December, OPEC had pushed back a plan to begin raising output to April, due to weak demand and rising supply outside the group.

Markets were also waiting to see if Russia-Ukraine peace talks will bear fruit, as U.S. and Russian officials meet for talks in Saudi Arabia later on Tuesday.

There is seemingly plenty to be bearish about in the crude market, the biggest factor now being the outcome of Ukraine negotiations, as Reuters reported.

Russian oil may partially come back to the legitimate market, though there are of course many permutations as to the end result here, said Sparta Commodities analyst Neil Crosby.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,412.25 167.69M | 0.32% 447.43 |

| ALLSHR | 85,702.96 423.92M | 0.15% 131.52 |

| KSE30 | 42,254.84 82.09M | 0.43% 180.24 |

| KMI30 | 194,109.59 84.37M | 0.15% 281.36 |

| KMIALLSHR | 56,713.67 217.03M | 0.03% 16.37 |

| BKTi | 37,831.34 13.04M | 1.62% 603.62 |

| OGTi | 27,440.63 3.93M | -0.09% -23.70 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 119,025.00 | 119,275.00 117,905.00 | 1405.00 1.19% |

| BRENT CRUDE | 72.40 | 72.82 72.29 | -0.84 -1.15% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 70.00 | 70.41 69.92 | 0.00 0.00% |

| SUGAR #11 WORLD | 16.46 | 16.58 16.37 | -0.13 -0.78% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|