Oil prices jump 5% on market open amid Israel-Palestine conflict

By MG News | Category Commodities | October 09, 2023 at 10:42 AM GMT+05:00

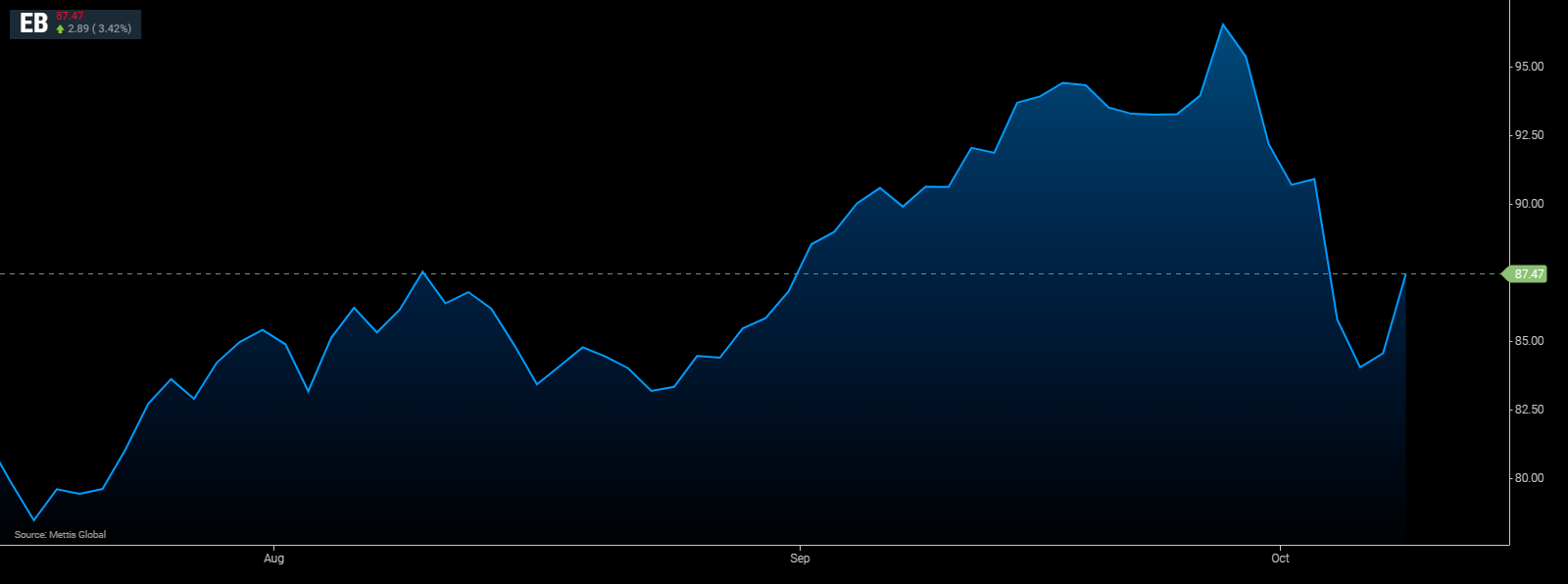

October 09, 2023 (MLN): Oil prices surged as much as 5% on market open, amid the Israel-Palestine conflict that unfolded during the weekend.

Oil prices are now back on track toward their 52-week highs.

Brent crude is currently trading at $87.48 per barrel, up by 3.43% on the day.

While West Texas Intermediate crude (WTI) is trading at $85.87 per barrel, up by 3.72% on the day.

The Wall Street Journal reported that Iranian security officials helped Hamas plan its attack on Israel, which risks triggering a retaliation against Tehran, as Bloomberg reported.

The greenback gained versus the euro and pound, while riskier currencies declined. The yen — another favored refuge for investors — strengthened.

Meanwhile, Australian and New Zealand bonds reversed early declines, and US stock futures extended losses.

“The events over the weekend obviously destabilize the region; investors have a lot to mull over,” said Kyle Rodda, senior market analyst at Capital.com.

“Ultimately, these events tend to have only a short-term impact on financial markets, and it’s probable that this time will be the same.

Investors could be jumpy for a couple of days until the risks of escalation have clearly diminished, though.”

The fallout from the Israel attacks reverberated through Middle East markets on Sunday, sending stocks sliding.

Major equities gauges in the region fell, led by a drop on Israel’s benchmark TA-35 stock index, which posted its biggest loss in more than three years, sliding 6.5%.

Iran is both a major oil producer and supporter of Hamas. Any retaliation against Tehran may endanger the passage of vessels through the Strait of Hormuz, a vital conduit that Iran has previously threatened to close.

Inflation Worries

Rising oil prices could add to already high global inflationary pressures with investors still debating the odds of another rise in interest rates by the Federal Reserve this year.

“Any extension of this to oil-producing countries, Saudi Arabia in the lead, could make the price of crude oil more expensive, with negative inflationary effects for the West, and would mean higher rates for longer,” said Guillermo Santos, head of strategy at Spanish private banking firm iCapital.

Yields on 10-year and 30-year Treasuries calmed on Friday after touching 2007 highs near 4.9% and 5.1%, respectively as global bonds sold off for a fifth straight week.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 121,641.00 407.56M |

-0.13% -157.87 |

| ALLSHR | 75,951.71 854.04M |

-0.10% -76.82 |

| KSE30 | 36,827.89 67.82M |

-0.42% -156.03 |

| KMI30 | 181,199.42 117.76M |

-0.38% -696.40 |

| KMIALLSHR | 52,088.08 592.55M |

-0.27% -143.41 |

| BKTi | 29,808.04 22.21M |

-0.83% -249.97 |

| OGTi | 27,075.99 4.68M |

-0.75% -203.95 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 102,445.00 | 106,555.00 102,020.00 |

-3040.00 -2.88% |

| BRENT CRUDE | 65.34 | 65.85 64.60 |

0.48 0.74% |

| RICHARDS BAY COAL MONTHLY | 90.00 | 90.00 89.50 |

0.25 0.28% |

| ROTTERDAM COAL MONTHLY | 100.65 | 100.65 100.00 |

1.60 1.62% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 63.40 | 63.98 62.50 |

0.55 0.88% |

| SUGAR #11 WORLD | 16.62 | 16.78 16.46 |

-0.13 -0.78% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Central Government Debt

Central Government Debt