Oil prices fall for fourth consecutive session

MG News | November 28, 2024 at 12:56 PM GMT+05:00

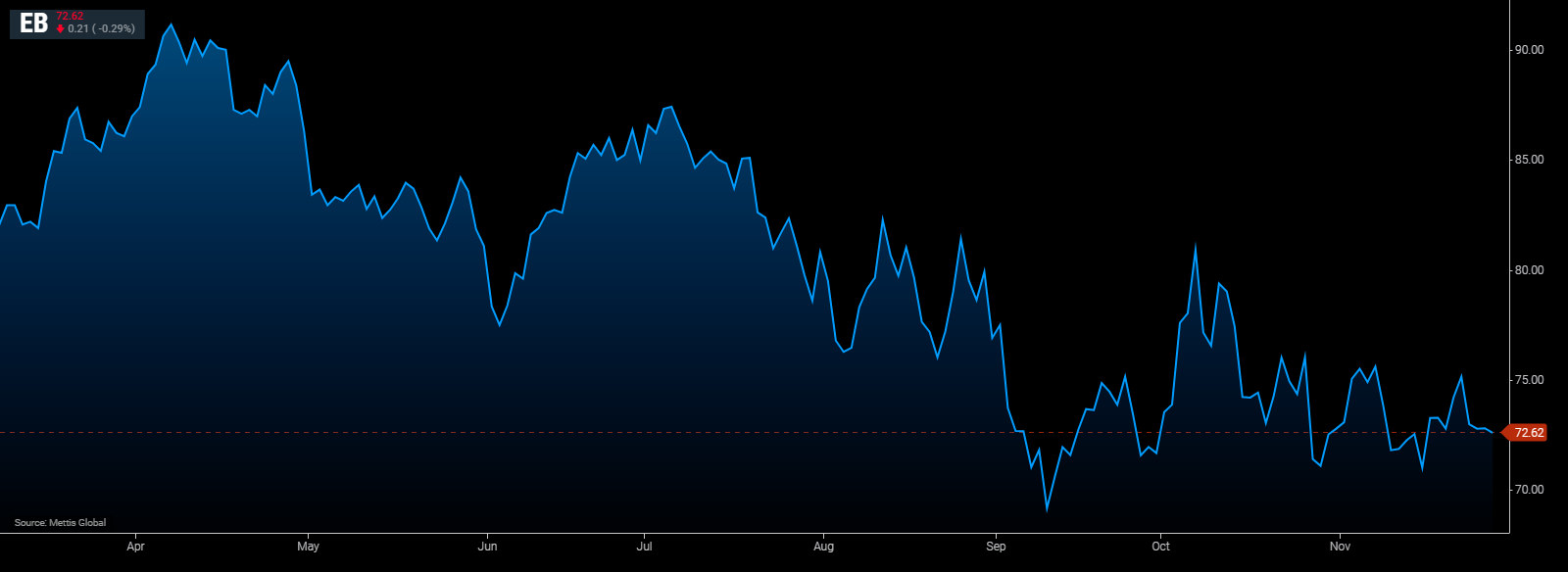

November 28, 2024 (MLN): Global oil prices dropped for the fourth straight session on Thursday after a surprise jump in U.S. gasoline inventories, while investors await this weekend's OPEC+ meeting to discuss oil output policy.

Brent crude traded near $72 a barrel, down 0.29% on the day.

While West Texas Intermediate crude (WTI) was at $68.54 per barrel, down by 0.26%.

Trading is expected to be light due to the U.S. Thanksgiving holidays starting on Thursday, Reuters reported.

Oil is likely to retain its near-term bearish momentum as the risks of supply disruption fade in the Middle East and U.S. gasoline inventories stood higher than expected, said Yeap Jun Rong, a market strategist at IG.

U.S. gasoline stocks rose 3.3 million barrels in the week ending on Nov. 22, the U.S. Energy Information Administration (EIA) said on Wednesday, countering expectations for a small draw in fuel stocks ahead of record holiday travel.

Slowing fuel demand growth in top consumers China and the United States has weighed heavily on oil prices this year, although supply cuts from OPEC+, which groups the Organization of the Petroleum Exporting Countries with Russia and other allies, have limited the losses.

OPEC+, which pumps about half the world's oil, will meet on Sunday. Two sources from the producer group told Reuters on Tuesday that members have been discussing a further delay to a planned oil output hike due to have started in January.

A further deferment, as expected by many in the market, has mostly been factored into oil prices already, said Suvro Sarkar, energy sector team lead at DBS Bank.

"The only question is whether it's a one-month pushback, or three-month, or even longer," he said.

"That would give the oil market some direction. On the other hand, we would be worried about a dip in oil prices if the deferments don't come."

OPEC+ had previously said it would gradually roll back oil production cuts with small increases over many months in 2024 and 2025.

Brent and WTI have lost more than 3% each so far this week, under pressure from Israel's agreement to a ceasefire deal with Lebanon's Hezbollah group. The ceasefire started on Wednesday and helped ease concerns that the conflict could disrupt oil supplies from the Middle East region.

Market participants are uncertain how long the break in fighting will hold, with the broader geopolitical backdrop for oil remaining murky, analysts at ANZ Bank said.

Oil prices are undervalued due to a market deficit, the heads of commodities research at Goldman Sachs and Morgan Stanley warned in recent days.

They also pointed to a potential risk to Iranian supply from sanctions that might be adopted under U.S. President-elect Donald Trump.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 135,939.87 307.74M |

-0.41% -562.67 |

| ALLSHR | 84,600.38 877.08M |

-0.56% -479.52 |

| KSE30 | 41,373.68 101.15M |

-0.43% -178.94 |

| KMI30 | 191,069.98 82.45M |

-1.17% -2260.79 |

| KMIALLSHR | 55,738.07 422.01M |

-1.03% -577.24 |

| BKTi | 38,489.75 45.79M |

-0.02% -8.33 |

| OGTi | 27,788.15 6.87M |

-1.24% -350.24 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 116,735.00 | 120,695.00 116,090.00 |

-3500.00 -2.91% |

| BRENT CRUDE | 68.85 | 69.41 68.60 |

-0.36 -0.52% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 96.50 96.50 |

0.50 0.52% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.25 |

-2.05 -1.92% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.71 | 67.13 66.22 |

-0.27 -0.40% |

| SUGAR #11 WORLD | 16.56 | 16.61 16.25 |

0.26 1.60% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|