Oil prices fall as Trump delays tariffs, expands energy plans

MG News | January 21, 2025 at 03:20 PM GMT+05:00

January 21, 2025 (MLN): Oil prices fell on Tuesday as investors assessed U.S. President Donald Trump's plans to apply new tariffs later than expected while boosting oil and gas production in the United States.

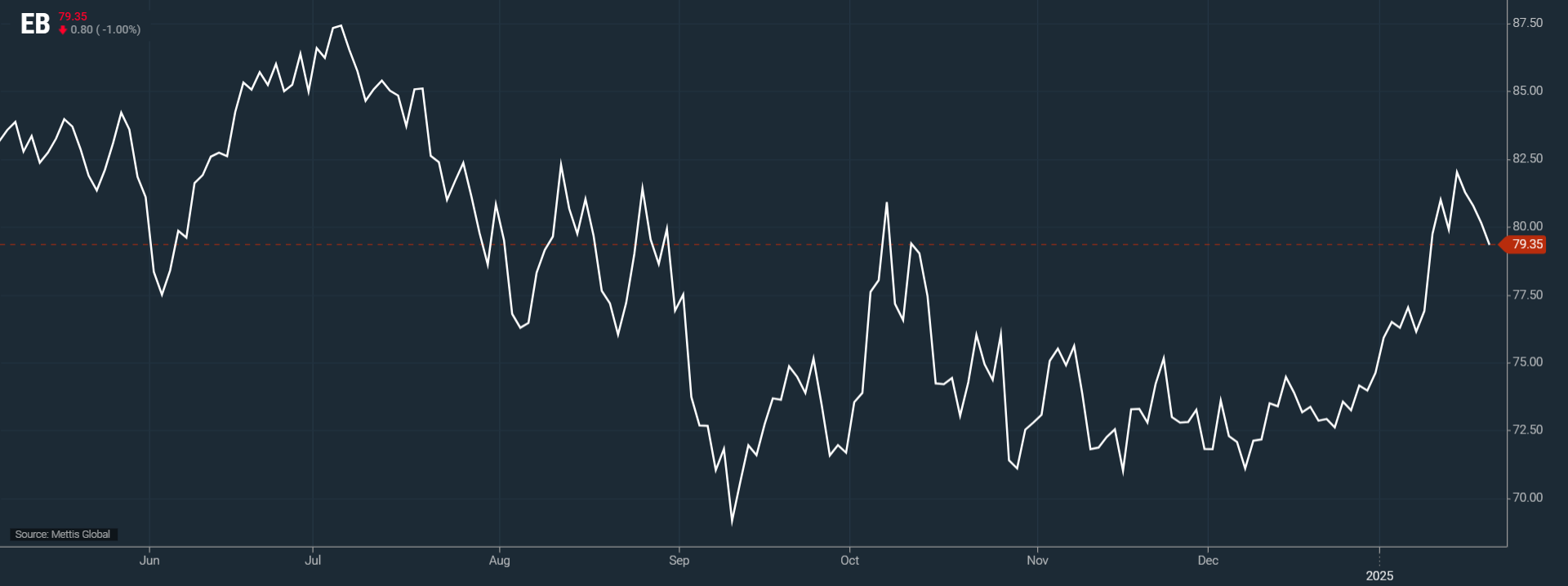

Brent crude futures decreased by $0.80, or 1%, to $79.35 per barrel.

West Texas Intermediate (WTI) crude futures fell by $0.60, or 0.78%, to $75.96 per barrel by [3:10 pm] PST.

The initial sense of relief that trade measures weren't an immediate focus on Trump's 'Day 1' was quickly offset by reports of 25% tariffs on Mexico and Canada as early as February.

This news saw risk sentiments turn, said Yeap Jun Rong, market strategist at IG.

Trump did not impose any sweeping new trade measures right after his inauguration on Monday but told federal agencies to investigate unfair trade practices by other countries, as Reuters reported.

He said he was thinking of imposing 25% tariffs on imports from Canada and Mexico from Feb. 1, rather than on his first day in office as previously promised.

The tariff reprieve initially helped push oil prices down, but duties on Canadian crude could eventually drive the market higher.

Also pressuring prices on Monday, was a stronger U.S. dollar, as its strengthening makes oil more expensive for holders of other currencies.

"The current weakness is most probably Trump and dollar-related," said PVM analyst Tamas Varga.

The dollar rebounded after Trump's comments on imposing tariffs against Mexico and Canada, Varga said, noting that the dollar's strength is negatively impacting oil prices.

Trump on Monday laid out an extensive plan to accelerate oil, gas and power permitting to maximize already record high U.S. energy production.

The U.S. president also said his administration would "probably" stop buying oil from Venezuela.

The U.S. is the second-biggest buyer of Venezuelan oil after China.

Trump also promised to refill strategic reserves, a move that could be bullish for oil prices by boosting demand for U.S. crude oil.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 183,955.92 264.86M | -0.86% -1587.09 |

| ALLSHR | 110,128.14 656.21M | -0.68% -755.81 |

| KSE30 | 56,477.36 103.51M | -0.91% -520.64 |

| KMI30 | 258,596.58 156.48M | -1.10% -2875.60 |

| KMIALLSHR | 70,555.68 332.14M | -0.82% -582.60 |

| BKTi | 53,680.71 31.42M | -0.73% -393.43 |

| OGTi | 35,988.28 10.78M | -0.75% -271.11 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 90,435.00 | 91,855.00 89,825.00 | -670.00 -0.74% |

| BRENT CRUDE | 62.34 | 62.84 62.26 | 0.35 0.56% |

| RICHARDS BAY COAL MONTHLY | 86.75 | 0.00 0.00 | 0.05 0.06% |

| ROTTERDAM COAL MONTHLY | 97.90 | 0.00 0.00 | -0.30 -0.31% |

| USD RBD PALM OLEIN | 1,027.50 | 1,027.50 1,027.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 58.09 | 58.53 57.98 | 0.33 0.57% |

| SUGAR #11 WORLD | 14.80 | 14.99 14.78 | -0.17 -1.14% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction