Oil prices extend drop amid fears of delayed US rate cuts

By MG News | February 26, 2024 at 10:56 AM GMT+05:00

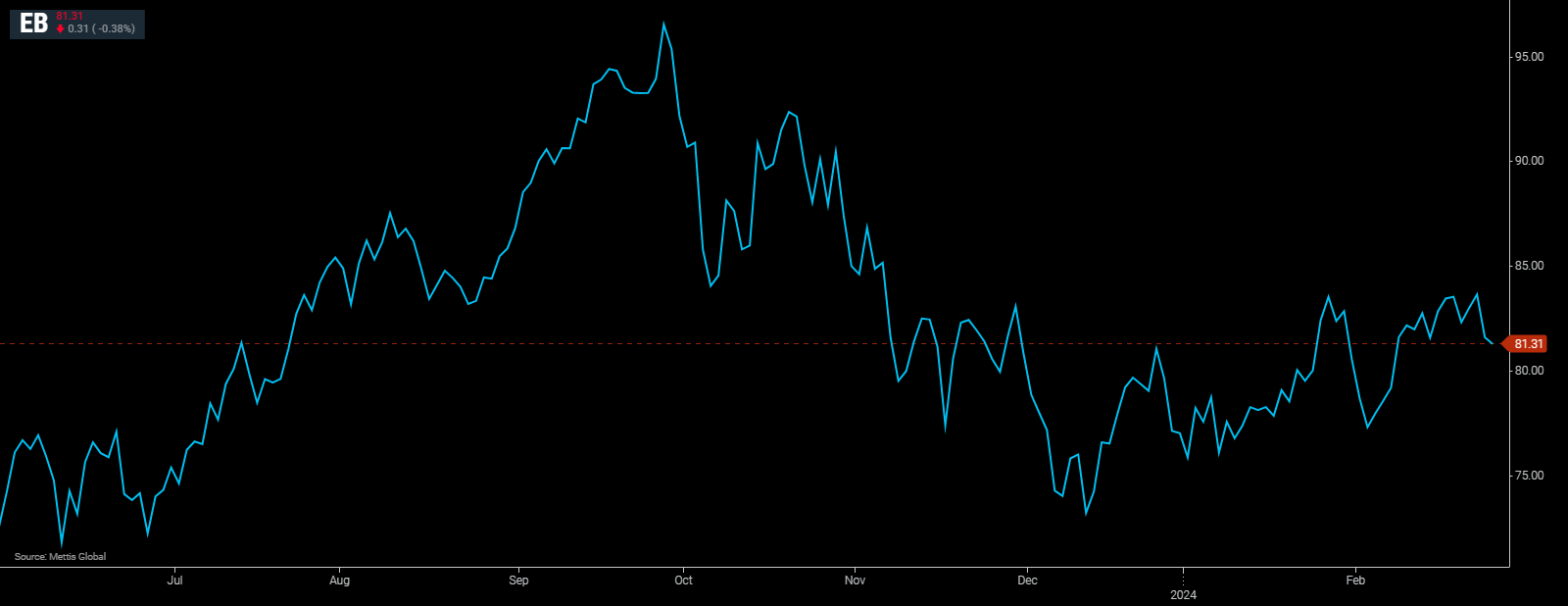

February 26, 2024 (MLN): Oil prices dropped on Monday, continuing the losses incurred in the last trading session of the previous week amid market concerns that higher-than-expected inflation could delay cuts to high U.S. interest rates coupled with a large build in U.S. crude inventories.

Brent crude traded near $80.41 per barrel, down by 0.53% on the day.

While West Texas Intermediate crude (WTI) was at $75.95 per barrel, down 0.57% on the day.

Both benchmarks dropped by 2.22% respectively last week, concluding their two-week winning streak on indications that U.S. interest rate cuts could be delayed by two months due to an uptick in inflation.

"The risk-on sentiment seems to be in a retreat after the Nvidia-led market rally last week as higher-for-longer rate expectations lifted the U.S. dollar, pressuring commodity prices," Auckland-based independent analyst Tina Teng said, as Reuters reported.

Oil prices have been trading between $70 and $90 a barrel since November, as rising supply in the U.S. and concerns of weak demand in China offset OPEC+ supply cuts despite two wars raging.

"Crude oil prices declined for want of fresh drivers," ANZ analysts wrote in a note. "Oil has been caught between bullish factors such as lower OPEC output and elevated geopolitical risks and bearish concerns about weak demand in China."

The geopolitical risk premium from Yemeni Houthis' attacks on ships in the Red Sea remained modest at only a $2 a barrel boost to Brent, Goldman Sachs analysts said in a note.

However, the bank has raised its summer peak price to $87 a barrel, up from $85, as Red Sea disruptions have driven larger-than-expected draws in stocks held by countries that are members of the Organisation for Economic Co-operation and Development (OECD).

Goldman Sachs still expects oil demand to grow by 1.5 million barrels per day (bpd) in 2024 but has cut China's forecast while raising that for the U.S. and India.

"Robust non-OPEC supply growth is likely to nearly keep pace with solid global demand growth," the analysts added.

As the Israel-Hamas conflict continues in the Middle East, White House national security adviser Jake Sullivan told CNN on Sunday that negotiators for the United States, Egypt, Qatar and Israel had agreed on the basic contours of a hostage deal during talks in Paris but are still in negotiations. Israeli Prime Minister Benjamin Netanyahu said it was not clear yet whether a deal would materialise.

Adding to global energy supplies, Qatar will further raise liquefied natural gas production despite a recent steep drop in global prices.

In the U.S., the ANZ analysts anticipated oil stockpiles could start to fall in the coming weeks as refineries return from maintenance, which could offer some support to prices.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 125,627.31 258.99M |

1.00% 1248.25 |

| ALLSHR | 78,584.71 1,142.41M |

1.16% 904.89 |

| KSE30 | 38,153.79 69.25M |

0.63% 238.06 |

| KMI30 | 184,886.50 91.38M |

0.01% 13.72 |

| KMIALLSHR | 53,763.81 554.57M |

0.54% 290.61 |

| BKTi | 31,921.68 33.15M |

1.78% 557.94 |

| OGTi | 27,773.98 9.65M |

-0.40% -112.21 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,055.00 | 109,565.00 107,195.00 |

570.00 0.53% |

| BRENT CRUDE | 66.64 | 67.20 65.92 |

-0.16 -0.24% |

| RICHARDS BAY COAL MONTHLY | 97.00 | 97.00 97.00 |

1.05 1.09% |

| ROTTERDAM COAL MONTHLY | 107.65 | 107.65 105.85 |

1.25 1.17% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 64.97 | 65.82 64.50 |

-0.55 -0.84% |

| SUGAR #11 WORLD | 16.19 | 16.74 16.14 |

-0.52 -3.11% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|