Oil prices edge lower as concerns about US economy mount

MG News | January 03, 2024 at 09:58 AM GMT+05:00

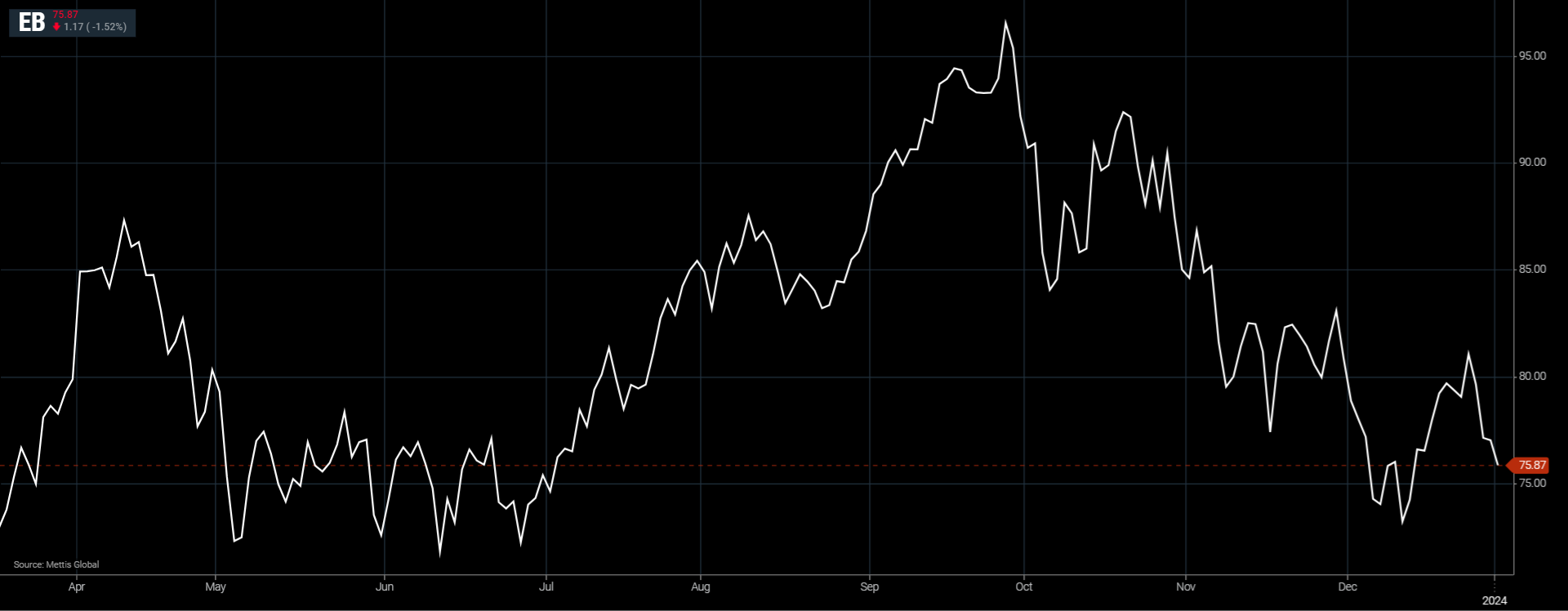

January 03, 2024 (MLN): Global oil prices edged lower on Wednesday as the market weighed economic concerns about the U.S. coupled with potential supply disruptions arising from the ongoing conflicts in the Red Sea.

Brent crude is currently trading at $75.81 per barrel, down by 0.08% on the day.

While West Texas Intermediate crude (WTI) is trading at $70.45 per barrel, down by 0.13% compared to the previous close.

It is crucial to note that oil prices are set to march toward their fifth straight daily loss.

Oil prices had climbed around $2 earlier in the week following attacks on vessels in the Red Sea by Houthi rebels over the weekend and the reported arrival of an Iranian warship on Monday. A wider conflict could close crucial waterways for oil transportation and disrupt trade flows, as Reuters reported.

However, the market fell in the previous session as market optimism about early and aggressive U.S. interest rate cuts ebbed ahead of the release of Federal Reserve minutes and jobs data.

"Energy markets were unable to escape the broader pressure seen on risk assets with equity markets also weaker. The weakness in oil comes despite a ratcheting up in tensions in the Middle East," said ING analysts in a client note.

Expectations of ample supply in the first half of 2024 have kept a lid on prices ahead of OPEC+ plans to hold a meeting of its Joint Ministerial Monitoring Committee (JMMC) in early February. An exact date has not been decided, three sources from the alliance said.

"While the geopolitical situation is a concern for the oil market, a fairly comfortable oil balance over the first half of 2024 does help to ease some of these worries," said ING analysts.

"Given the scale of cuts we are already seeing, it will be increasingly difficult for the group to cut more if needed over the course of 2024," they said, pointing to the fact that recent cuts have been driven by voluntary reductions, rather than group-wide cuts.

Moreover, data from the American Petroleum Institute industry group is due on Wednesday, and data from the Energy Information Administration, the statistical arm of the U.S. Department of Energy, is due on Thursday, delayed by a day due to the New Year's holiday on Monday.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 162,803.16 353.00M | 0.72% 1171.42 |

| ALLSHR | 98,852.42 947.86M | 0.61% 597.68 |

| KSE30 | 49,497.35 204.97M | 0.24% 120.05 |

| KMI30 | 234,519.02 114.11M | 0.78% 1818.74 |

| KMIALLSHR | 64,510.15 338.03M | 0.52% 330.55 |

| BKTi | 45,699.73 99.84M | -1.37% -634.44 |

| OGTi | 31,506.29 9.79M | 0.46% 143.56 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 107,745.00 | 111,290.00 107,470.00 | -2575.00 -2.33% |

| BRENT CRUDE | 64.92 | 65.32 64.51 | 0.15 0.23% |

| RICHARDS BAY COAL MONTHLY | 86.00 | 0.00 0.00 | 0.00 0.00% |

| ROTTERDAM COAL MONTHLY | 96.50 | 98.00 96.15 | -0.20 -0.21% |

| USD RBD PALM OLEIN | 1,082.50 | 1,082.50 1,082.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 61.11 | 61.50 60.70 | 0.13 0.21% |

| SUGAR #11 WORLD | 14.55 | 14.59 14.36 | 0.12 0.83% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|