Oil prices dip after two-day gain

MG News | September 18, 2024 at 11:02 AM GMT+05:00

September 18, 2024 (MLN): Oil fell on Wednesday following a two-day gain as traders assessed indications of higher US crude stockpiles, continued tensions in the Middle East, and the likely course of the Federal Reserve’s rate path.

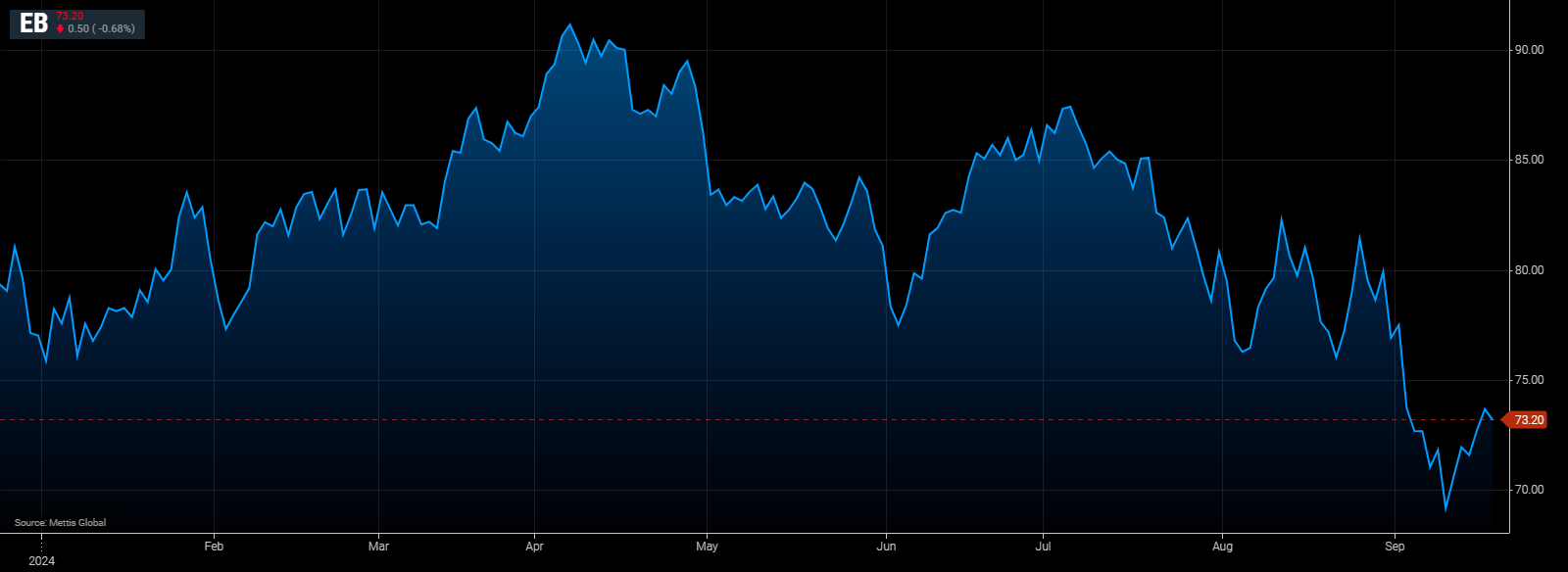

Brent crude fell toward $73.19 per barrel, down 0.69% on the day.

While West Texas Intermediate crude (WTI) was at $69.49 a barrel.

An American Petroleum Institute report showed crude inventories rose by almost 2 million barrels last week, with gasoline and distillates holdings also expanding, Bloomberg reported, citing people familiar with the data.

In the Middle East, Hezbollah accused Israel of orchestrating an attack involving pagers in Lebanon that left a number of people dead and wounded thousands. The incident raised fears of an all-out war in the region, buoying prices on Tuesday.

Although the backdrop is still negative, “extreme bearish sentiments are attempting to unwind,” said Yeap Jun Rong, market strategist at IG Asia Pte in Singapore.

The latest incident in Lebanon has “brought back some uncertainty of a wider conflict,” which could hit oil supply, he said.

Crude remains markedly lower year-to-date, with China’s dour demand outlook and plans for OPEC+ to eventually bring back shuttered supply weighing on prices.

That’s being offset by prospects for US monetary policy, with investors expecting that the Fed will start lowering rates later Wednesday, although there’s no consensus about the size of the cut.

Reflecting the demand weakness, some refineries in Europe have been reducing processing rates as profits drop. In China, the world’s largest oil importing nation, poor margins have led to the bankruptcy of two small plants.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 135,939.87 307.74M |

-0.41% -562.67 |

| ALLSHR | 84,600.38 877.08M |

-0.56% -479.52 |

| KSE30 | 41,373.68 101.15M |

-0.43% -178.94 |

| KMI30 | 191,069.98 82.45M |

-1.17% -2260.79 |

| KMIALLSHR | 55,738.07 422.01M |

-1.03% -577.24 |

| BKTi | 38,489.75 45.79M |

-0.02% -8.33 |

| OGTi | 27,788.15 6.87M |

-1.24% -350.24 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 117,515.00 | 118,465.00 117,255.00 |

775.00 0.66% |

| BRENT CRUDE | 68.89 | 69.09 68.85 |

0.18 0.26% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 96.50 96.50 |

0.50 0.52% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.25 |

-2.05 -1.92% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.81 | 67.00 66.73 |

0.29 0.44% |

| SUGAR #11 WORLD | 16.56 | 16.61 16.25 |

0.26 1.60% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|