Oil prices decline for third day on supply increase, tariff worries

MG News | March 05, 2025 at 11:01 AM GMT+05:00

March 05, 2025 (MLN): Oil prices fell for a third session on Wednesday as plans by major producers to raise output in April combined with concerns U.S. tariffs on Canada, Mexico and China will slow economic and fuel demand growth hammered investor sentiment.

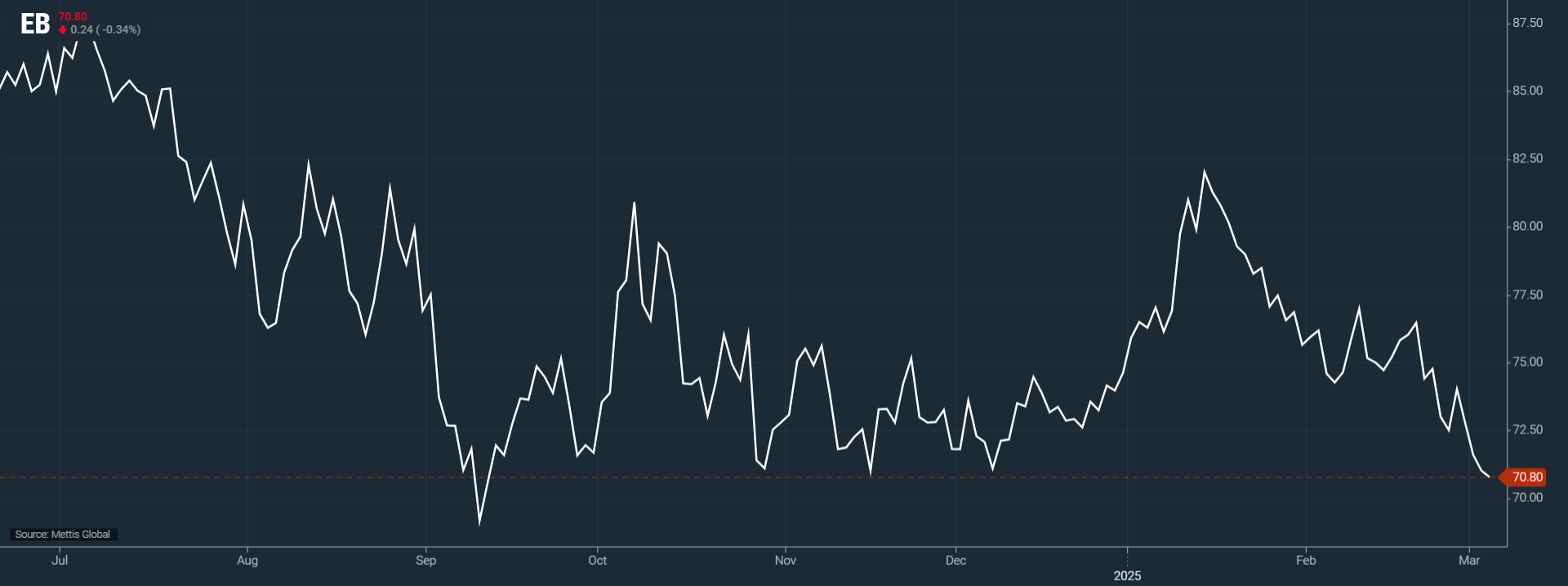

Brent crude futures decreased by $0.24, or 0.34%, to $70.80 per barrel.

West Texas Intermediate (WTI) crude futures fell by $0.59, or 0.86%, to $67.67 per barrel by [10:55 am] PST.

The "OPEC+ decision to start increasing production again is a materially bearish development, loosening markets at a time that U.S. macro data are starting to soften," analysts at Citi said in a note.

The Organization of the Petroleum Exporting Countries and its allies including Russia, a group known as OPEC+, decided on Monday to increase output for the first time since 2022.

The group will make a small increase of 138,000 barrels per day from April, the first step in planned monthly increases to unwind its nearly 6 million bpd of cuts, equal to nearly 6% of global demand.

A 25% tariff on all imports from Mexico, a 10% tariff on Canadian energy and a doubling of duties on Chinese goods to 20% came into effect on Tuesday.

The Trump administration also imposed 25% tariffs on all other Canadian imports, as Reuters reported.

U.S. President Donald Trump's self-declared trade war is seen by economists as a recipe for fewer jobs, slower growth, and higher prices, which could kill demand.

The lower economic growth will likely impact fuel consumption in the world's biggest oil consumer.

U.S. retail gasoline prices are set to climb in the coming weeks as the new tariffs raise the cost of energy imports, according to traders and analysts.

The Trump administration also said on Tuesday it was ending a license that the U.S. has granted to U.S. oil producer Chevron since 2022 to operate in Venezuela and export its oil.

U.S. crude oil stocks fell by 1.46 million barrels in the week ended February 28, market sources said, citing American Petroleum Institute figures on Tuesday.

Investors now await government data on U.S. stockpiles, due on Wednesday.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 140,009.99 119.71M | 1.15% 1597.74 |

| ALLSHR | 86,715.79 244.09M | 1.18% 1012.83 |

| KSE30 | 42,797.13 67.16M | 1.28% 542.29 |

| KMI30 | 197,222.53 70.95M | 1.60% 3112.94 |

| KMIALLSHR | 57,545.91 125.04M | 1.47% 832.24 |

| BKTi | 38,195.75 8.30M | 0.96% 364.41 |

| OGTi | 28,500.56 32.46M | 3.86% 1059.92 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 119,510.00 | 119,530.00 117,905.00 | 1890.00 1.61% |

| BRENT CRUDE | 72.20 | 72.82 72.16 | -1.04 -1.42% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 69.83 | 70.41 69.80 | -0.17 -0.24% |

| SUGAR #11 WORLD | 16.46 | 16.58 16.37 | -0.13 -0.78% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Consumer Confidence Survey

Consumer Confidence Survey