Oil prices climb on strong China manufacturing data

MG News | March 03, 2025 at 10:50 AM GMT+05:00

March 03, 2025 (MLN): Oil rose on Monday as upbeat manufacturing data from China, the world's biggest crude importer, led to renewed optimism for fuel demand, although uncertainty about a Ukraine peace deal and global economic growth from potential U.S. tariffs loomed.

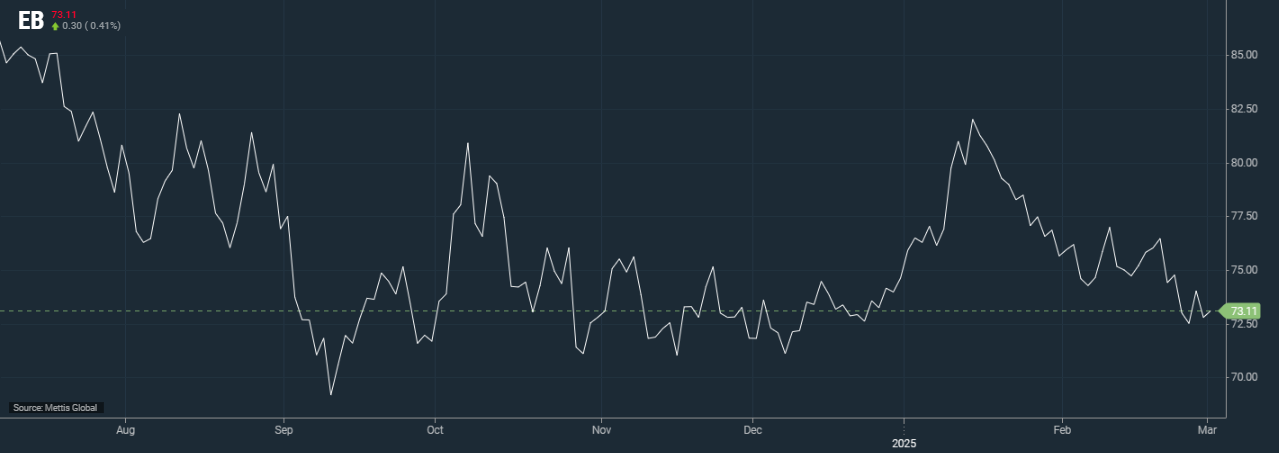

Brent crude futures increased by $0.30, or 0.41%, to $73.11 per barrel.

West Texas Intermediate (WTI) crude futures rose by $0.35, or 0.50%, to $70.11 per barrel by [10:45 am] PST.

Prices rose after official data on Saturday showed that China's manufacturing activity expanded at the fastest pace in three months in February.

New orders and higher purchase volumes led to a solid rise in production, while investors are eyeing China's annual parliamentary meeting on March 5 for further economic support measures.

IG market analyst Tony Sycamore said one of the possible drivers for rising prices was that "the China NBS manufacturing PMI moved back into expansionary territory over the weekend".

However, he cautioned that the country's economic outlook may not be inspiring, with another round of tariffs on exports to the U.S. set to start on March 4.

Analysts from Goldman Sachs were somewhat more positive about the data, stating that it suggests stable to slightly improved economic activity in China in early 2025.

However, they noted that the imposition of the extra 10% U.S. tariff may prompt retaliatory measures, as Reuters reported.

Last month, Brent and WTI posted their first monthly declines in three months as the threat of tariffs from the U.S. and its trade partners shook investors' confidence in global economic growth this year and reduced their appetite for riskier assets.

Overall sentiment improved after a summit on Sunday where European leaders showed strong support for Ukrainian President Volodymyr Zelenskiy and pledged to do more to help his nation.

This came just two days after U.S. President Donald Trump clashed with Zelenskiy, prompting him to cut short his visit to Washington.

Zelenskiy said on Sunday that he believed he could salvage his relationship with Trump but that talks needed to continue behind closed doors.

He added that he remained ready to sign a minerals deal with the United States, and he believed the U.S. would be ready as well.

"It's unclear where the U.S. now stands, making a peace deal seem more distant than a week ago," ING analysts led by Warren Patterson said in a note.

"This is altering energy-market hopes for an easing of sanctions."

In addition, ongoing attacks at Russian refineries have raised concerns about its refined products exports, with another plant in the Russian city of Ufa reportedly on fire.

For 2025, analysts are keeping their oil price forecasts largely steady, with Brent averaging $74.63 a barrel.

They expect any impact from further U.S. sanctions to be balanced by ample supply and a possible peace deal between Russia and Ukraine, a Reuters poll showed.

The U.S. is urging Iraq to resume exports from the semi-autonomous Kurdistan region.

However, eight international oil firms operating there said on Friday they would not restart shipments through Turkey's port of Ceyhan due to a lack of clarity on commercial agreements and guarantees of payment for past and future exports.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 152,445.40 294.06M | 0.31% 472.40 |

| ALLSHR | 91,194.45 524.39M | 0.02% 15.59 |

| KSE30 | 46,786.56 143.25M | 0.99% 460.08 |

| KMI30 | 213,356.24 142.07M | 0.56% 1186.07 |

| KMIALLSHR | 58,265.76 293.87M | -0.20% -116.62 |

| BKTi | 44,993.46 37.82M | 1.55% 687.44 |

| OGTi | 29,112.70 12.63M | 0.02% 5.90 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 66,185.00 | 67,760.00 64,325.00 | -1640.00 -2.42% |

| BRENT CRUDE | 71.88 | 71.96 70.69 | 0.12 0.17% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.50 -3.52% |

| ROTTERDAM COAL MONTHLY | 107.95 | 107.95 107.95 | 0.30 0.28% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.60 | 66.67 65.38 | 0.12 0.18% |

| SUGAR #11 WORLD | 14.05 | 14.10 13.78 | 0.18 1.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Trade Balance

Trade Balance