Oil falls further after yesterday’s slump

By MG News | September 04, 2024 at 11:34 AM GMT+05:00

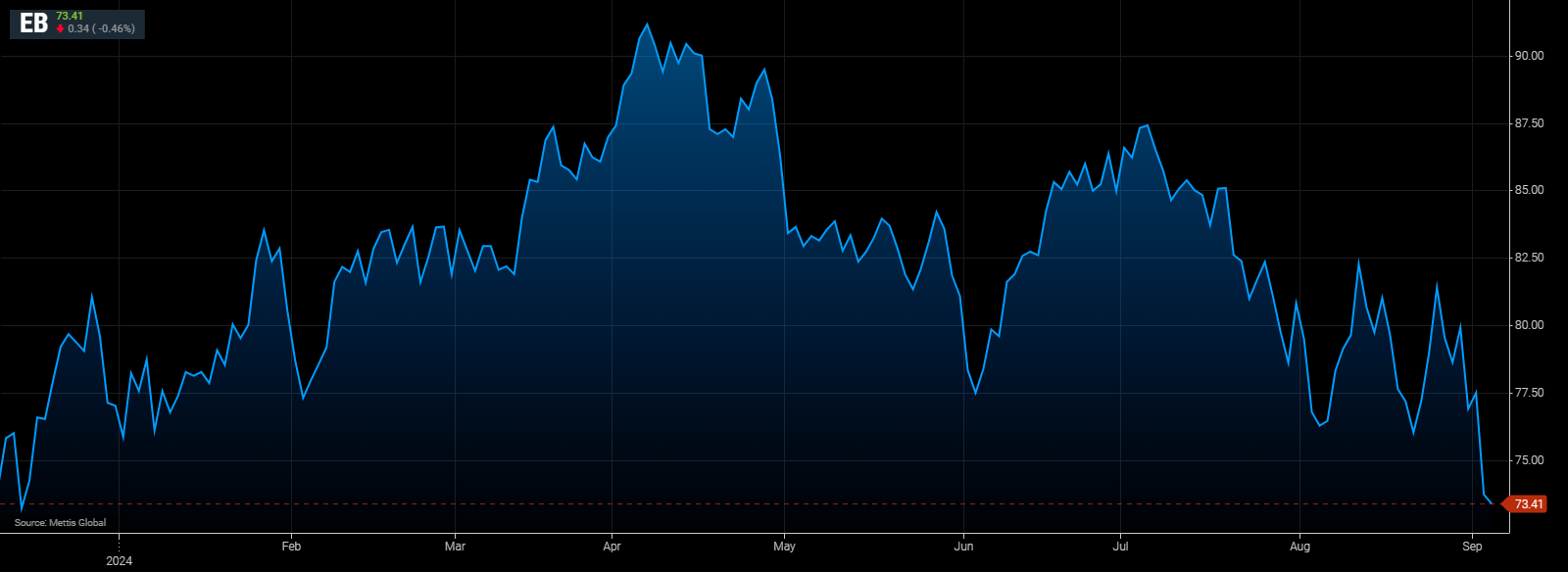

September 04, 2024 (MLN): Oil fell further after plunging almost 5% on Tuesday as the possible easing of political unrest in Libya shifted focus back to OPEC+’s plan to boost production.

Brent fell toward $73 a barrel, while West Texas Intermediate slumped below $70 for the first time since January.

A Libyan central banker said a deal appeared imminent to resolve a dispute between the rival governments in the strife-torn North African nation, which could spur the resumption of oil output, Bloomberg reported.

There was some speculation that the turmoil in Libya could give OPEC+ space to return more barrels from October as planned, but a resolution will likely make it harder for the alliance to boost output without hitting prices.

The group has said previously that it could pause or reverse hikes if necessary.

Oil has now wiped out all of this year’s gains on worries about the economic outlook in China — the world’s biggest crude importer — and ample supply from outside of the Organization of the Petroleum Exporting Countries.

Some of the rout on Tuesday may have been caused by increasingly bearish trend-following algorithmic traders.

Investors are also watching monthly jobs data due Friday that could offer more insight on the Federal Reserve’s path forward on interest-rate cuts.

A report last month showed a rise in the unemployment rate to a level that triggered a popular recession indicator.

“The financial markets seem to be in peak panic mode with a fortnight left for the Fed’s crucial ‘pivot’ policy meeting,” said Vandana Hari, founder of Vanda Insights.

The possible return of Libyan supply and a planned output boost from OPEC+ has presented headwinds for the market, she added.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 125,627.31 258.99M |

1.00% 1248.25 |

| ALLSHR | 78,584.71 1,142.41M |

1.16% 904.89 |

| KSE30 | 38,153.79 69.25M |

0.63% 238.06 |

| KMI30 | 184,886.50 91.38M |

0.01% 13.72 |

| KMIALLSHR | 53,763.81 554.57M |

0.54% 290.61 |

| BKTi | 31,921.68 33.15M |

1.78% 557.94 |

| OGTi | 27,773.98 9.65M |

-0.40% -112.21 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,175.00 | 109,565.00 107,195.00 |

690.00 0.64% |

| BRENT CRUDE | 66.71 | 67.20 65.92 |

-0.09 -0.13% |

| RICHARDS BAY COAL MONTHLY | 97.00 | 97.00 97.00 |

1.05 1.09% |

| ROTTERDAM COAL MONTHLY | 107.65 | 107.65 105.85 |

1.25 1.17% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 65.07 | 65.82 64.50 |

-0.45 -0.69% |

| SUGAR #11 WORLD | 16.19 | 16.74 16.14 |

-0.52 -3.11% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|