Oil falls amid surging dollar, demand concerns

MG News | November 14, 2024 at 01:00 PM GMT+05:00

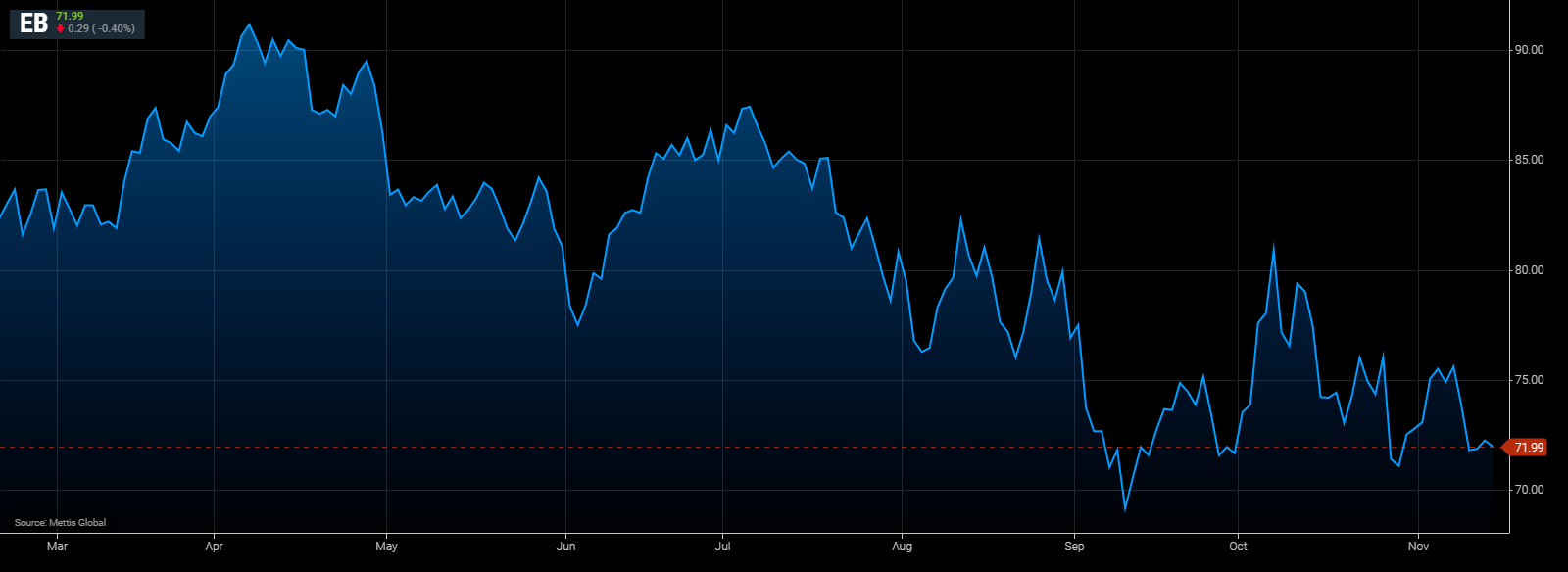

November 14, 2024 (MLN): Oil fell as a surging US dollar and concerns about demand growth weighed on the outlook for prices.

Brent crude traded near $72 a barrel, down 0.4% on the day.

While West Texas Intermediate crude (WTI) was at $68.08 per barrel, down by 0.5%.

The US Dollar has rallied to the highest level in two years in the aftermath of Donald Trump’s election win, Bloomberg reported.

That makes raw materials priced in the greenback more costly for most buyers, and crude’s drop came alongside losses in other commodities including copper.

China’s weakening profile in the global oil market remains a concern, with the US Energy Information Administration saying midweek that India was now the leading source of demand growth in Asia as Chinese consumption falters due to its slowdown and electric-vehicle penetration.

Further analysis will come later Thursday from the International Energy Agency.

Crude has alternated between weekly gains and losses since mid-October, with traders weighing OPEC+ supply moves, US monetary policy, and the risks to oil-demand growth, especially in China.

There’s widespread concern that the global market will flip to a glut next year, with Morgan Stanley trimming its price forecasts this week citing the softening outlook.

“Even as Fed rate-cut bets rise, US economic resilience keeps the dollar strong, weighing on oil,” said Charu Chanana, chief investment strategist at Saxo Capital Markets Pte in Singapore.

Demand concerns remain after OPEC revised its growth forecast lower, and as traders digest what the upcoming Trump presidency could mean for China’s outlook, she said.

The Middle East was also in focus. Israel was rushing to prepare a cease-fire deal on Lebanon as the government adjusted to the prospect of Trump’s White House return, according to a Washington Post report.

In the US, the American Petroleum Institute reported US crude inventories fell 800,000 barrels last week, with levels at the Cushing, Oklahoma, hub shrinking by a larger 1.9 million barrels, Bloomberg reported.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 135,939.87 307.74M |

-0.41% -562.67 |

| ALLSHR | 84,600.38 877.08M |

-0.56% -479.52 |

| KSE30 | 41,373.68 101.15M |

-0.43% -178.94 |

| KMI30 | 191,069.98 82.45M |

-1.17% -2260.79 |

| KMIALLSHR | 55,738.07 422.01M |

-1.03% -577.24 |

| BKTi | 38,489.75 45.79M |

-0.02% -8.33 |

| OGTi | 27,788.15 6.87M |

-1.24% -350.24 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 117,655.00 | 118,465.00 117,255.00 |

915.00 0.78% |

| BRENT CRUDE | 68.91 | 69.09 68.85 |

0.20 0.29% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 96.50 96.50 |

0.50 0.52% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.25 |

-2.05 -1.92% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.83 | 67.00 66.73 |

0.31 0.47% |

| SUGAR #11 WORLD | 16.56 | 16.61 16.25 |

0.26 1.60% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|