NBP affirms to maintain robust CAR after accounting for Rs98bn pension liability

By Rafay Malik | March 01, 2024 at 09:08 PM GMT+05:00

March 01, 2024 (MLN): The National Bank of Pakistan (PSX: NBP) is poised to keep its Capital Adequacy Ratio (CAR) well above the standard limit of 14% after incorporating the financial impact of pension liability that is worth around Rs98 billion, as highlighted by the bank's management during their corporate briefing session held on Thursday.

NBP's CAR as of 2023 stands at 25.5%, and the aforementioned adjustment would just bring it down to 19% approximately, still sound on both a comparative and required basis, as per the management.

The session started with the management addressing the remarkable success of the bank in achieving its highest-ever profit after tax of Rs51.84bn, with a record 70.47% year-on-year growth.

The main driver of this successful financial closure was the massive rise in the bank's both interest and non-interest earnings.

NBP's markup income clocked in at Rs1.02 trillion, which is around 2-fold larger than the interest income recorded in 2022 and comparatively the highest among all the other competitive banks.

However, higher interest rates were not entirely rewarding for the bank as its interest expenses also expanded 2.2x.

As a result, NBP's growth in the net interest income section narrowed to 44.44% YoY in 2023.

According to the management, the monetary tightening in the economy reduced their spreads, however, the growth was driven by the quantity and expanded banking operations during the review year.

NBP’s non-markup income stood at Rs40.61bn in 2023, around 10.69% YoY higher than the inflow recorded in 2022 as the bank made more profitable investments in securities, and the fee and commission income also expanded with improved economic activity.

The bank experienced a significant surge in its customer base, exceeding the 9 million mark, with advances and deposits reaching record levels.

In addition to the tale of the bank's success, the management also revealed that they encountered a significant setback from the national carrier, Pakistan International Airlines (PSX: PIAA), in the last quarter of the review year due to its debt obligations.

To recall, PIA faced fuel supply suspensions due to its failure to settle dues with Pakistan State Oil (PSX: PSO), which, in turn, resulted in the cancellation of several PIA flights.

Consequently, being a significant funder of national companies, NBP had to absorb the shock up to a certain extent.

Later on, the national carrier resumed some of its flight operations after making partial payments to PSO for jet fuel supply.

The corporate briefing forum extended into the Q&A session, during which the bank's shareholders expressed disappointment over the institution's inability to declare any dividends despite experiencing robust profit growth.

In response, the management stated that certain government-funded projects were and still are scheduled due to which a substantial number of resources were directed towards them. Furthermore, they assured shareholders that the bank is actively addressing this situation and will deliver a positive response in the near future.

The management further committed to expand the bank’s network in e-banking and continue to excel in providing advanced agriculture-related services to the economy.

The session concluded with a discussion on the potential impact of IFRS 9, wherein the officials remained optimistic that it would also be advantageous for the bank.

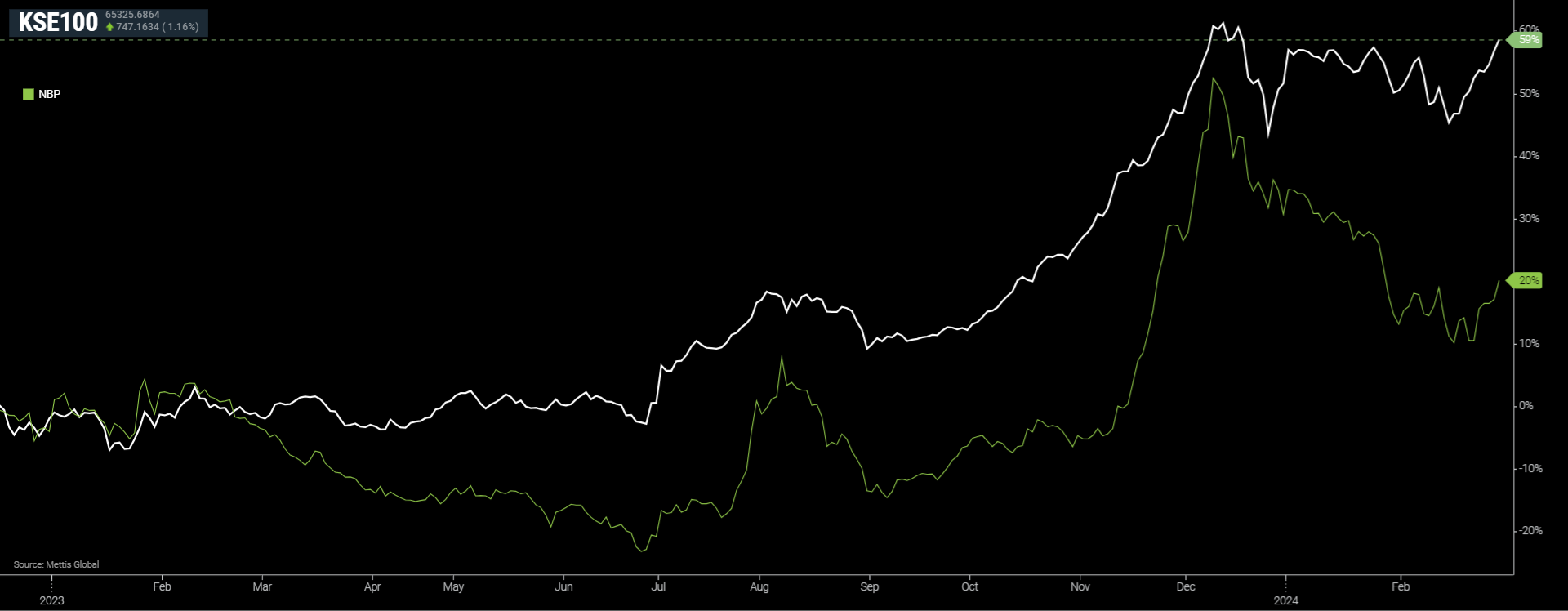

NBP vs KSE-100 chart

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 132,653.56 95.74M |

-0.56% -749.63 |

| ALLSHR | 82,975.88 531.35M |

-0.26% -212.18 |

| KSE30 | 40,370.98 34.57M |

-0.69% -280.48 |

| KMI30 | 190,958.24 38.84M |

-0.59% -1125.68 |

| KMIALLSHR | 55,702.65 271.83M |

-0.26% -145.04 |

| BKTi | 36,200.45 6.07M |

-0.61% -222.43 |

| OGTi | 28,238.42 7.14M |

-0.70% -199.19 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 109,245.00 | 109,545.00 108,625.00 |

30.00 0.03% |

| BRENT CRUDE | 70.09 | 70.10 69.85 |

-0.06 -0.09% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

2.05 2.15% |

| ROTTERDAM COAL MONTHLY | 106.65 | 106.65 106.25 |

0.50 0.47% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.27 | 68.29 67.78 |

-0.06 -0.09% |

| SUGAR #11 WORLD | 16.15 | 16.37 16.10 |

-0.13 -0.80% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.png)