Moody’s sees high govt debt burden in FY20

MG News | April 23, 2020 at 02:01 PM GMT+05:00

April 23, 2020 (MLN): Moody’s Investors Service has further reduced its forecast for Pakistan's GDP growth rate by 0.5% to 2% for FY20 due to the COVID-19 pandemic. Earlier, the IMF projected Pakistan's GDP growth rate to contract by 1.5%.

Moody’s painted a bleak picture for already struggling Pakistan’s economy during these testing times and predicted the country’s first annual recession.

Moody’s highlighted in its research paper on Pakistan that the struggling the financial needs will rise to combat the pandemic and its related socio-economic effects.

The broader parameters of fiscal relief package of Rs 1.2 trillion by the government which provided tax concessions for households and businesses, including the export and healthcare sectors while this stimulus may widen the government deficit to 9.5%-10% of GDP in FY20 from 8.9%, as per research by Moody’s.

Not only the federal stimulus package but also the central bank's cumulative 425-basis-point policy rate cuts since the start of 2020 and facilities to ease the liquidity crunch for businesses and provide cheap loans to the industrial and construction sectors further safeguarded the economic shock related to coronavirus.

In FY21, Moody’s expects the fiscal deficit to narrow down to 8%-8.5% of GDP owing to fiscal consolidation and IMF program. It further sees that govt debt will gradually lessen in subsequent years.

On the revenue front, despite strong revenue growth in the 1HFY20, Moody’s estimates that tax revenue of Pakistan is likely to contract in the second half of FY20 compared with the year-ago period. Pakistan's government revenue in the first half of this year rose almost 40% from a year earlier. Also, nontax revenue increased more than double because of the higher profits of SBP in 1HFY20.

Moody’s sees the high indebtedness and weaker fiscal balances faced by Pakistan. As per Moody’s, government debt will rise to around 87% of GDP by June 2020 from around 83% in June 2019.

On an external front, G20's recent offer of debt relief to low-income countries will also support Pakistan by deferring principal and interest payments on bilateral debt which is due between May and December. The deferrals may be extended and involve other creditors.

Moody’s expects Pakistan GDP growth rate to recover and grow more than 2% in FY21. However, the lockdown to contain the spread of the virus will significantly curtail domestic consumption, which may pose downside risks to economic growth as fiscal deficit may widen.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 139,814.12 53.81M | 1.01% 1401.87 |

| ALLSHR | 86,624.22 119.54M | 1.07% 921.26 |

| KSE30 | 42,719.39 31.34M | 1.10% 464.54 |

| KMI30 | 197,034.63 34.58M | 1.51% 2925.04 |

| KMIALLSHR | 57,493.52 58.34M | 1.38% 779.86 |

| BKTi | 38,040.25 3.03M | 0.55% 208.92 |

| OGTi | 28,332.86 14.98M | 3.25% 892.23 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 119,345.00 | 119,430.00 117,905.00 | 1725.00 1.47% |

| BRENT CRUDE | 72.25 | 72.82 72.19 | -0.99 -1.35% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 69.86 | 70.41 69.83 | -0.14 -0.20% |

| SUGAR #11 WORLD | 16.46 | 16.58 16.37 | -0.13 -0.78% |

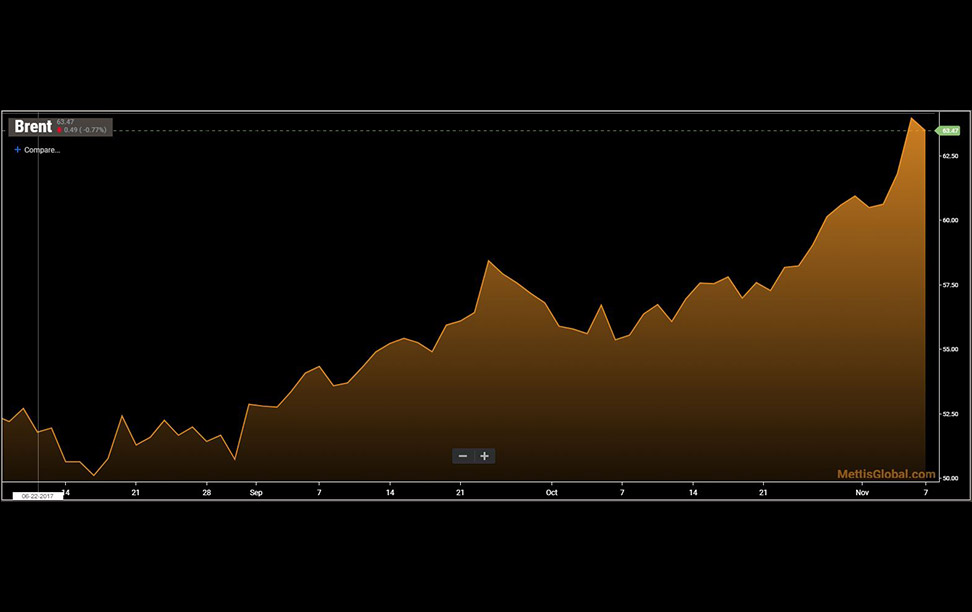

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|