Intraday Report: KSE-100 jumps over 1,000pts

MG News | October 24, 2024 at 12:52 PM GMT+05:00

October 24, 2024 (MLN): Pakistan stocks' rally powered ahead on Thursday as improving macroeconomic indicators continued to boost sentiment.

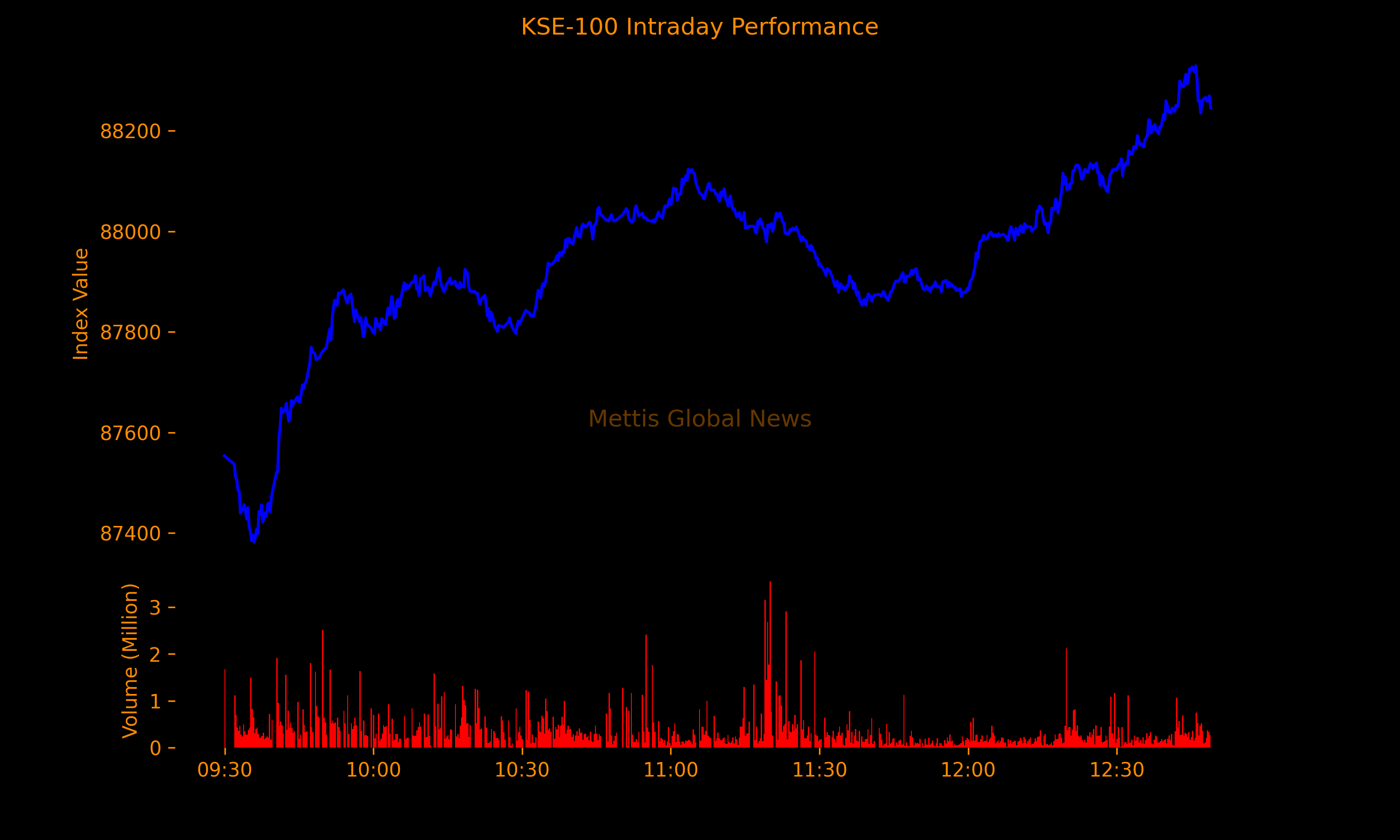

The benchmark KSE-100 Index topped 88,000 for the first time and is on its way to notching its 43rd record close this year. The index rose 1,042 points or 1.2% to 88,236 as of 12:50pm.

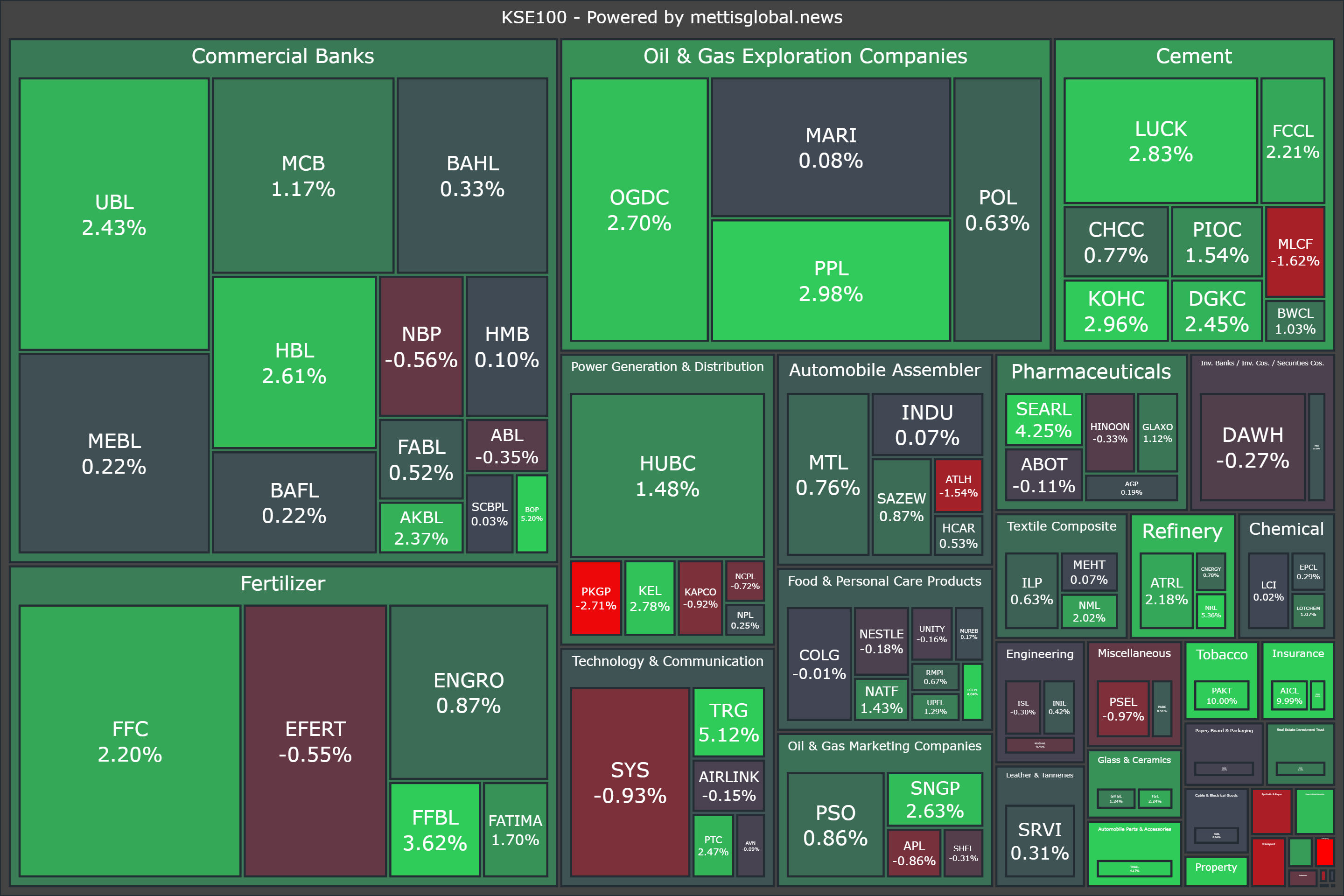

The rally was broad-based, with 70 of the 100 index companies trading in green.

Top gainers during the day were PAKT (+10.00%), AICL (+9.99%), JVDC (+5.82%), NRL (+5.36%), and BOP (+5.20%).

On the other hand, top losers were KOSM (-3.01%), PKGP (-2.71%), PIBTL (-1.85%), IBFL (-1.68%), and MLCF (-1.62%).

In terms of index-point contributions, companies that propped up the index were FFC (+126.79pts), UBL (+112.37pts), OGDC (+94.68pts), PPL (+83.87pts), and LUCK (+69.06pts).

Sector-wise, KSE-100 Index was supported by Commercial Banks (+255.56pts), Oil & Gas Exploration Companies (+195.61pts), Fertilizer (+170.13pts), Cement (+131.19pts), and Power Generation & Distribution (+44.41pts).

In the broader market, the All-Share Index was at 56,788.95 with a net gain of 709.27 points or 1.26%.

Key reports on Monday showed the economy continues to move toward stability.

The country's current account posted a second straight monthly surplus amid a surge in home remittances. In the first three months of current fiscal year, the deficit narrowed by 92% to $98m from $1.24 billion in 3MFY24.

Moreover, the cash-strapped nation attracted $385m foreign direct investment (FDI) in September, up a significant 81% compared to the same period last year (SPLY).

To note, the KSE-100 has gained 9,791 points or 12.48% during the fiscal year, whereas the ongoing calendar year has witnessed a cumulative increase of 25,785 points, equivalent to 41.29%.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 172,400.73 346.40M | 0.92% 1570.51 |

| ALLSHR | 103,483.96 796.97M | 0.55% 561.58 |

| KSE30 | 52,734.06 184.56M | 1.08% 564.57 |

| KMI30 | 245,565.33 110.97M | 1.07% 2605.02 |

| KMIALLSHR | 67,233.70 319.67M | 0.68% 453.28 |

| BKTi | 47,898.10 95.85M | 0.98% 462.51 |

| OGTi | 33,838.49 13.78M | 1.39% 464.88 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 87,825.00 | 90,115.00 86,915.00 | 75.00 0.09% |

| BRENT CRUDE | 60.80 | 62.67 60.56 | -1.44 -2.31% |

| RICHARDS BAY COAL MONTHLY | 87.50 | 0.00 0.00 | 1.05 1.21% |

| ROTTERDAM COAL MONTHLY | 94.50 | 0.00 0.00 | -0.70 -0.74% |

| USD RBD PALM OLEIN | 1,027.50 | 1,027.50 1,027.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 56.93 | 58.88 56.65 | -1.42 -2.43% |

| SUGAR #11 WORLD | 15.17 | 15.28 15.08 | -0.12 -0.78% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction